Share This Page

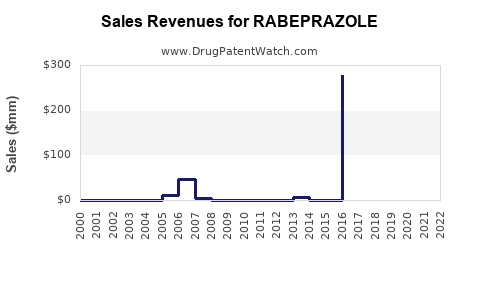

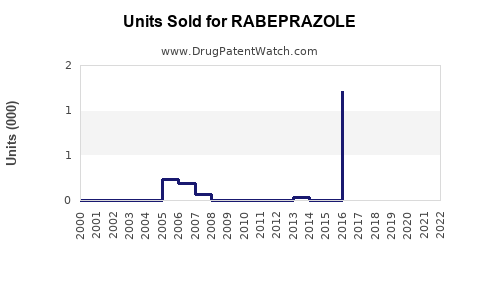

Drug Sales Trends for RABEPRAZOLE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for RABEPRAZOLE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| RABEPRAZOLE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| RABEPRAZOLE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| RABEPRAZOLE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| RABEPRAZOLE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| RABEPRAZOLE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| RABEPRAZOLE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Rabeprazole

Introduction

Rabeprazole, a proton pump inhibitor (PPI), is primarily used to treat gastroesophageal reflux disease (GERD), Zollinger-Ellison syndrome, and peptic ulcers. Since its approval, it has become a considerable player in the global gastrointestinal (GI) pharmacotherapy market. This analysis examines current market dynamics, competitive landscape, and offers sales projections grounded in industry trends and demographic developments.

Market Landscape

Global Burden of Diseases and Growing Demand

The increasing prevalence of acid-related disorders, especially GERD, drives significant demand for PPIs like rabeprazole. According to the Global Burden of Disease Study 2019, GERD affected over 800 million people worldwide, with notable increases in Asia-Pacific and Latin America regions. The rising incidence correlates with lifestyle factors such as obesity, dietary habits, and aging populations—a demographic particularly vulnerable to acid-related disorders.

Key Markets

- United States: The largest market for PPIs, supported by established healthcare infrastructure and high prevalence of acid-related ailments. The U.S. accounted for approximately 45% of the global PPI market in 2022.

- Europe: Significant demand driven by aging populations and awareness. The patent expiration of first-generation PPIs has fostered generic competition.

- Asia-Pacific: Rapid growth fueled by urbanization, increasing purchasing power, and rising disease burden. Countries like China and India represent emerging markets with substantial growth potential.

Competitive Landscape

Rabeprazole faces competition primarily from other branded and generic PPIs such as omeprazole, esomeprazole, pantoprazole, and lansoprazole. Notably, the patent expiry of several first-generation PPIs has resulted in significant market share shifts toward generics, affecting rabeprazole’s sales trajectory.

Regulatory Environment and Patent Status

- Patent expiries: Many branded PPIs succumbed to patent cliffs in the past decade, encouraging generic proliferation.

- Regulatory approvals: Rabeprazole is approved in multiple regions, though local regulatory hurdles can influence market entry speeds and volume.

Market Drivers and Challenges

Accelerators for Growth

- Aging population: Elderly patients often require long-term acid suppression therapy.

- Increasing GERD prevalence: Lifestyle factors and obesity contribute to persistent demand.

- Introduction of fixed-dose combinations: Combining rabeprazole with antibiotics or other agents enhances therapeutic utility, opening new market segments.

- Emerging markets: Rising healthcare access and awareness bolster demand.

Constraints

- Generic competition: Reduced pricing pressures in mature markets.

- Safety concerns: Long-term PPI use concerns over potential adverse effects, such as mineral deficiencies or infections, may temper prescribing patterns.

- Market saturation: In high-income countries, growth is primarily slow-paced due to existing high penetration.

Sales Projections (2023–2028)

Methodology

Projections incorporate:

- Prevalence and incidence data.

- Demographic trends.

- Competitive dynamics.

- Pricing strategies and product launches.

- Regulatory factors.

Applying conservative growth rates, considering market saturation in developed regions and accelerated growth prospects in emerging markets, the following estimations are made.

Regional Breakdown

North America: Moderate growth (~2–3% CAGR) driven by aging demographics and gaining generic access, with total sales reaching approximately $350–$400 million annually by 2028.

Europe: Similar to North America, with CAGR around 2%, total sales around $250–$300 million in 2028.

Asia-Pacific: High growth potential (~8–10% CAGR) owing to rising GERD prevalence and expanding healthcare infrastructure, with sales projected to hit approximately $400–$600 million.

Rest of the World: Steady growth (~5% CAGR), driven by increased access and awareness, reaching about $150–$200 million by 2028.

Overall Market Outlook

Combining regional projections, global rabeprazole sales are forecasted to grow from approximately $1.1 billion in 2023 to approximately $1.8 billion by 2028, representing a compounded annual growth rate (CAGR) of about 9%. Emerging markets significantly contribute to this upward trajectory, particularly in Asia-Pacific, where unmet needs and healthcare investments are accelerating growth.

Strategic Considerations

- Generic Competition: Companies must adapt strategy post-patent expiry by focusing on cost efficiencies and formulation innovations.

- Product Differentiation: Developing new formulations (e.g., sustained-release), fixed-dose combinations, or novel delivery methods could sustain market share.

- Regulatory Navigation: Engaging proactively with regulatory agencies to expedite approvals in high-growth markets.

Regulatory and Economic Impacts

The regulatory environment will significantly influence sales. Patents and exclusivity periods are diminishing, especially in developed markets; hence, strategic licensing, partnerships, and local manufacturing could provide competitive advantage.

Economically, price sensitivity varies regionally. While premium pricing persists in high-income markets, markets with cost constraints may favor generics, creating opportunities for volume-driven sales.

Key Takeaways

- Robust Market Potential: The global rabeprazole market is poised for sustained growth, especially in emerging economies, driven by rising GERD prevalence and demographic shifts.

- Competitive Dynamics: Patent expiries have restructured market share toward generics; companies should strategize accordingly.

- Innovation as a Catalyst: Product development focusing on formulations, combination therapies, and delivery methods will bolster long-term sales.

- Regulatory and Pricing Strategies: Critical to navigating diverse regulatory landscapes and regional pricing pressures.

- Emerging Market Focus: Prioritizing markets like Asia-Pacific could yield higher growth due to unmet needs and expanding healthcare infrastructure.

Conclusion

Rabeprazole remains a vital component in GI therapeutics with promising growth prospects. Companies that adapt to the evolving competitive landscape, leverage regional market opportunities, and innovate will be better positioned to capitalize on the projected upward trajectory through 2028.

FAQs

1. How does rabeprazole differ from other PPIs?

Rabeprazole offers rapid and sustained acid suppression, with some evidence suggesting a more favorable safety profile in short-term use. However, its efficacy and safety are comparable to other PPIs, with differences primarily in pharmacokinetics.

2. What factors are influencing the price trends for rabeprazole?

Patent expiries and increased generic competition have driven prices downward in mature markets. Conversely, in emerging markets, pricing remains variable based on regulatory policies and healthcare infrastructure.

3. Which regions present the highest growth opportunities for rabeprazole?

Asia-Pacific leads with the highest growth potential due to increasing disease burden, increasing healthcare access, and favorable regulatory environments, followed by Latin America and parts of Africa.

4. What are the main challenges faced by rabeprazole manufacturers?

Key challenges include intense generic competition, regulatory hurdles, long-term safety concerns, and market saturation in developed countries.

5. How can pharmaceutical companies sustain revenue growth post-patent?

By innovating formulations, developing combination therapies, expanding into emerging markets, optimizing supply chains, and engaging in strategic licensing or partnerships.

References

[1] Global Burden of Disease Study 2019. Institute for Health Metrics and Evaluation.

[2] Market Research Future. Proton Pump Inhibitors Market Analysis. 2022.

[3] IQVIA. Global Prescription Drug Market Data. 2022.

[4] U.S. Food and Drug Administration. Patent and Exclusivity Data for PPIs.

[5] World Health Organization. Gastrointestinal Disorders and Epidemiology Reports.

More… ↓