Last updated: July 29, 2025

Introduction

PULMICORT (budesonide inhalation suspension) is a corticosteroid administered via nebulizer for the treatment of persistent asthma, particularly in pediatric populations. Since its approval, it has established a significant footprint within respiratory therapeutics. Understanding its market dynamics and projecting future sales are essential for stakeholders, including pharmaceutical companies, investors, healthcare providers, and policymakers, seeking to optimize strategic decisions.

Market Overview

The global asthma therapeutics market, driven by rising prevalence rates, improved awareness, and advances in inhaler technology, is projected to grow at a compound annual growth rate (CAGR) of approximately 5-6% over the next five years [1]. PULMICORT occupies a niche within this sector, primarily focusing on pediatric patients with persistent asthma.

The drug's competitive landscape encompasses other corticosteroid formulations, including inhaled corticosteroids (ICS) like Fluticasone and Beclomethasone, as well as combination therapies incorporating long-acting beta-agonists (LABAs). PULMICORT's distinct advantage lies in its nebulized delivery form, offering an alternative for young children or patients unable to use dry powder inhalers effectively [2].

Market Drivers

- High Prevalence of Pediatric Asthma: According to the CDC, approximately 8.4% of children in the U.S. suffer from asthma [3]. The rising diagnosis rate enhances demand for suitable inhalers.

- Preference for Nebulized Therapies: Pediatrics and elderly populations often prefer nebulized medications due to ease of use, fueling PULMICORT's utilization.

- Awareness and Diagnosis: Increased clinician awareness and proactive screening contribute to higher prescribing rates.

Market Constraints

- Competitive Alternatives: Widespread availability of inhalers with similar efficacy can limit PULMICORT's market share.

- Cost Considerations: Healthcare systems and patients may prefer more cost-effective options.

- Regulatory and Formulary Dynamics: Insurance policies and formulary preferences influence drug accessibility.

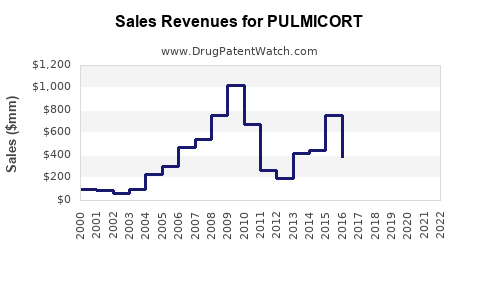

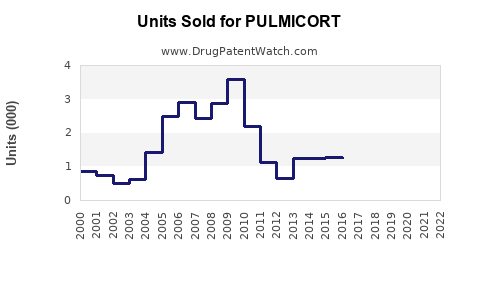

Current Market Penetration and Sales Performance

PULMICORT is marketed primarily in North America, Europe, and select Asian countries. Its revenue generation hinges on factors such as baseline prevalence, prescribing patterns, and formulary inclusion.

In the United States, PULMICORT's sales are estimated at approximately $250 million annually, representing a modest but significant share of the pediatric asthma therapeutics market [4]. Its sales performance aligns with the overall rise in pediatric asthma diagnoses but has plateaued slightly owing to increasing competition and product consolidation.

International markets exhibit varying adoption levels, with notable growth projected in emerging economies where asthma prevalence is rising and nebulized therapy access improves.

Sales Projections

Short-term (Next 1-2 Years)

- Market Stability & Incremental Growth: PULMICORT will likely maintain steady revenues, driven by ongoing pediatric diagnoses and incremental adoption in developed markets.

- Impact of Pandemics & Economic Factors: COVID-19 initially disrupted respiratory care services; however, as healthcare services normalize, demand may rebound [5].

Medium to Long-term (3-5 Years)

-

Projected Compound Annual Growth Rate: 3-5%, assuming steady market expansion, increased awareness, and stable competition.

-

Factors Enhancing Growth:

- Expanded approvals for new pediatric indications.

- Introduction into emerging markets facilitated by partnerships and generic options.

- Integration into combination inhalers or novel delivery devices.

-

Factors Hindering Growth:

- Competitive erosion by newer biologics or alternative therapies.

- Pricing pressures and healthcare reforms.

- Patent expirations or biosimilar entries affecting market pricing dynamics.

Forecast Summary

| Year |

Estimated Global Sales (USD million) |

Growth Rate (%) |

| 2023 |

250 |

— |

| 2024 |

260–270 |

4–8% |

| 2025 |

270–290 |

3–7% |

| 2026 |

280–310 |

3–8% |

| 2027 |

290–330 |

3–7% |

Note: These estimates incorporate potential market expansion, competition, and macroeconomic factors.

Strategic Opportunities

- Market Expansion: Penetrating emerging markets (e.g., Southeast Asia, Latin America) can enhance sales. Partnering with local distributors and adapting to regional regulatory frameworks are critical.

- Formulation Innovations: Developing new delivery systems or combination therapies could rejuvenate interest.

- Regulatory Approvals: Securing or expanding pediatric indications can increase utilization.

- Patient Compliance & Education: Marketing campaigns emphasizing ease of use and safety might further improve adherence.

Risks & Challenges

- Generic Competition: The expiration of patents can introduce generics, reducing market share and pricing.

- Regulatory Shifts: Stringent healthcare policies and reimbursement models may impact profitability.

- Market Saturation: In mature markets, growth may plateau without significant innovation or expansion.

Conclusion

PULMICORT maintains a vital position in pediatric asthma management, bolstered by its nebulized delivery advantage. Its sales are projected to grow modestly in the coming years, contingent upon continued demand, strategic expansion, and innovation. Stakeholders should focus on expanding access through international markets, pursuing formulation advancements, and navigating competitive pressures to sustain growth.

Key Takeaways

- The global pediatric asthma market is expanding, with PULMICORT positioned as a key player within nebulized corticosteroid therapies.

- Short-term sales growth is stable, but medium to long-term projections depend on market penetration and competitive dynamics.

- Opportunities exist in emerging markets and through formulation innovations, though patent expirations pose risks.

- Strategic investments in awareness, education, and partnerships can enhance market share.

- Regulatory and reimbursement landscapes remain critical factors influencing future sales performance.

FAQs

1. How does PULMICORT compare with other corticosteroids in pediatric asthma?

PULMICORT's nebulized form offers advantages in young children or patients unable to manage inhaler techniques, providing effective relief with ease of administration. However, inhaler-based corticosteroids like Fluticasone may dominate adult markets due to convenience and cost considerations [2].

2. What are the primary drivers for increased demand for PULMICORT?

Rising pediatric asthma prevalence, improved diagnosis, preference for nebulized therapy in children, and expanding access in developing markets drive demand.

3. How will patent expirations affect PULMICORT’s future sales?

Patent expirations could lead to generic manufacturing, potentially reducing prices and sales volume. However, market share may be sustained through brand loyalty, formulary positioning, and new indications.

4. Are there any recent innovations in PULMICORT formulations?

While current formulations focus on nebulized delivery, ongoing research explores improved nebulizer compatibility, combination therapies, and smart delivery devices to boost adherence and efficacy.

5. Which markets are most promising for PULMICORT’s expansion?

Emerging economies in Asia, Latin America, and parts of Africa hold significant growth potential due to increasing asthma rates and improving healthcare infrastructure.

Sources:

[1] Grand View Research. "Asthma Therapeutics Market Size, Share & Trends Analysis Report." 2022.

[2] Pulmicort Official Prescribing Information. AstraZeneca, 2022.

[3] CDC. "Asthma in Children." 2021.

[4] IQVIA Pharmaceutical Market Reports. 2022.

[5] World Health Organization. "Impact of COVID-19 on Respiratory Care." 2021.