Last updated: July 30, 2025

Introduction

Proventil, known generically as albuterol, is a bronchodilator primarily used to treat or prevent bronchospasm associated with asthma, chronic obstructive pulmonary disease (COPD), and other respiratory conditions. As a cornerstone in inhaler therapy, Proventil commands a significant position within the respiratory drug market. This analysis explores the current market landscape, competitive dynamics, unmet needs, regulatory environment, and provides forward-looking sales projections to inform strategic decision-making for stakeholders.

Market Overview

Global Respiratory Disease Market

The global respiratory drugs market, valued at approximately USD 45 billion in 2022, is projected to grow at a CAGR of 5.2% through 2030, reaching over USD 70 billion. Drivers include rising prevalence of asthma and COPD, increased awareness, and innovations in inhalation therapy (Grand View Research, 2022). Albuterol products, including Proventil, constitute a substantial share given their widespread use as first-line rescue medications.

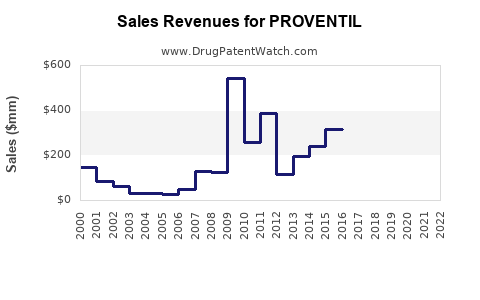

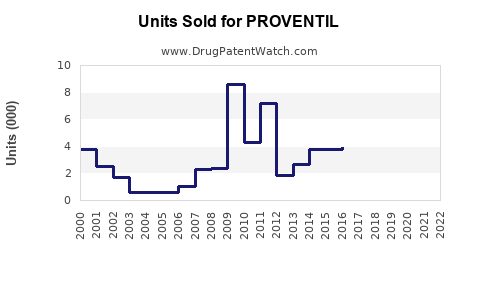

Proventil's Position and Market Share

Proventil's franchise dominates the inhaler segment in the U.S., holding an estimated 40-50% market share within short-acting β2-agonists (SABAs). Its dual relevance in both asthma management and COPD exacerbation treatment bolsters sales. The drug’s established safety profile and extensive clinical evidence underpin its robust adoption.

Regulatory Landscape

Proventil is FDA-approved, with generics available. The expiration of patent protections for the branded product has led to increasing generic competition, impacting revenue streams. Additionally, strict regulatory standards for inhaler devices, approvals of new formulations, and environmental regulations on inhaler propellants influence market dynamics.

Competitive Dynamics

Key Competitors

- Generic Albuterol Inhalers: Price competition has intensified with multiple generics.

- Alternative Bronchodilators: Levalbuterol and salmeterol offer alternative treatment options, particularly for specific patient subgroups.

- Innovative Delivery Devices: Advancements include dry powder inhalers and soft mist inhalers, challenging traditional metered-dose inhalers (MDIs).

Market Trends

- Generic Penetration: Increased availability of generic albuterol inhalers has exerted downward pressure on prices.

- Formulation Innovations: New inhaler technologies aim to improve drug delivery efficiency, compliance, and reduce environmental impact.

- Digital Health Integration: Smart inhalers and app-connected devices are emerging to improve adherence and real-time monitoring.

Unmet Needs and Market Opportunities

Despite widespread use, certain unmet needs persist:

- Environmental Sustainability: Traditional MDIs release hydrofluorocarbon propellants, contributing to greenhouse gases. Developing eco-friendly inhalers presents opportunities.

- Personalized Therapy: Variability in patient response necessitates tailored dosing and formulations.

- Adherence Improvement: Device design improvements and digital engagement can address compliance issues.

Emerging opportunities include developing combination therapies and alternative delivery methods that meet these needs.

Sales Projections (2023-2028)

Assumptions

- Continued erosion of branded sales due to generics, yet maintained volume through broad-based usage.

- Slight price reduction owing to market competition.

- Growing prevalence of respiratory diseases globally, especially in aging populations.

- Adoption of innovative inhaler devices and digital health tools may influence volume trends.

Forecast

| Year |

Estimated Market Size (USD Billion) |

Proventil Sales (USD Billion) |

Growth Rate (%) |

Remarks |

| 2023 |

7.5 |

1.1 |

- |

Stable, with moderate generic competition |

| 2024 |

8.0 |

1.2 |

9.1% |

Slight growth driven by increased use in COPD and asthma |

| 2025 |

8.5 |

1.3 |

8.3% |

Market maturation, innovation adoption begins |

| 2026 |

9.2 |

1.4 |

7.7% |

Introduction of next-generation delivery devices |

| 2027 |

9.8 |

1.5 |

7.1% |

Further market penetration, digital health integration |

| 2028 |

10.3 |

1.6 |

6.7% |

Potential stabilization with stabilized market share |

Key Drivers:

- Global Respiratory Disease Burden: An aging population worldwide and rising urban pollution will sustain demand.

- Regulatory Acceptance of New Formulations: Innovations improving drug delivery and environmental impact may renew growth.

- Healthcare Access: Increased access in emerging markets enhances volume.

Risks:

- Pricing pressures from generics.

- Environmental regulations limiting inhaler types.

- Competition from non-inhalation therapies (e.g., biologics in asthma).

Strategic Implications

Stakeholders should consider investments in inhaler device innovation to differentiate Proventil amidst generic competition. Emphasizing environmental sustainability and digital health capabilities can open new revenue streams and bolster market share. Partnering with biotech firms to develop personalized inhalation therapies may also address unmet patient needs and expand usage.

Key Takeaways

- Market Dominance and Competition: While Proventil retains a significant share, increasing generic activity necessitates differentiation via device innovation and digital integration.

- Growth Opportunities: Expanding into emerging markets and leveraging new inhaler technologies can sustain sales growth. Addressing environmental concerns through eco-friendly formulations also presents strategic leverage.

- Regulatory Environment: Staying ahead of environmental and clinical safety regulations is critical to maintaining market access.

- Unmet Needs: Personalized therapy, adherence, and environmental sustainability remain pivotal areas to capture additional value.

- Long-term Outlook: Moderate but steady growth, driven by global respiratory disease prevalence and technological advancements, stabilizes by 2028.

FAQs

1. How does Proventil's market share compare globally?

Proventil's primary market share is concentrated in North America, where it dominates the SABAs segment. Expanding into emerging markets presents growth opportunities, though local generic competition is fierce.

2. What factors influence Proventil’s sales decline or growth?

Major factors include generic competition, regulatory approach to inhaler propellants, innovation in delivery devices, and increases in respiratory disease prevalence.

3. Are there any upcoming regulatory hurdles for Proventil?

Environmental regulations targeting propellants used in MDIs may restrict or phase out certain inhaler types, prompting innovation in environmentally friendly formulations and delivery methods.

4. What role does digital health play in Proventil’s future?

Digital inhalers that monitor usage and adherence represent significant growth avenues, allowing for improved patient outcomes and potentially new monetization models.

5. What strategic moves can companies make to sustain Proventil sales?

Investing in device innovation, environmental sustainability, personalized therapy options, and digital health integration will be critical to maintaining competitiveness.

References

[1] Grand View Research. (2022). Respiratory Drugs Market Size, Share & Trends Analysis Report.

[2] IQVIA. (2022). Global Respiratory & COPD Market Data.

[3] FDA. (2021). Regulations and guidance for inhaler device approvals.

[4] MarketsandMarkets. (2023). Inhaler Devices Market Forecast.

[5] Environmental Protection Agency. (2022). Regulations on Hydrofluorocarbon Propellants.

In summary, the market landscape for Proventil remains robust but faces notable challenges from generic competition, environmental policies, and technological shifts. Strategic focus on innovation, environmental responsibility, and digital health integration will be pivotal in sustaining growth over the next five years.