Last updated: July 27, 2025

Introduction

PROTONIX (pantoprazole sodium) is a proton pump inhibitor (PPI) primarily prescribed for the treatment of gastroesophageal reflux disease (GERD), erosive esophagitis, Zollinger-Ellison syndrome, and other acid-related disorders. As a well-established generic medication with patents expiring and a robust global footprint, PROTONIX’s market outlook hinges on evolving healthcare landscapes, competitive dynamics, and patient demographics.

This analysis explores current market conditions, competitive positioning, regulatory influences, and forecasted sales to provide a comprehensive outlook for stakeholders.

Market Overview

Global Proton Pump Inhibitors Market

The global PPI market, valued at approximately USD 14.2 billion in 2022, is projected to grow at a Compound Annual Growth Rate (CAGR) of around 4.2% through 2030, driven by rising prevalence of GERD, increasing aging populations, and expanding treatment awareness (1). PPIs remain the cornerstone therapy for acid suppression, with brands like PROTONIX, Prilosec, Nexium, and others vying for market share.

PROTONIX’s Market Position

Manufactured by Pfizer, PROTONIX is a leading brand in the PPI segment, recognized for its potency and established safety profile. Despite competition from generic offerings, it retains a significant market share, especially within hospital formulary settings and specific therapeutic niches.

Key competitive advantages include:

- Brand recognition and trust

- Strong physician support and clinical data

- Formulation flexibility with tablets, injections, and pediatric options

However, patent expirations and the proliferation of generics have introduced price competition and market share erosion.

Market Dynamics

Patent Status and Generic Competition

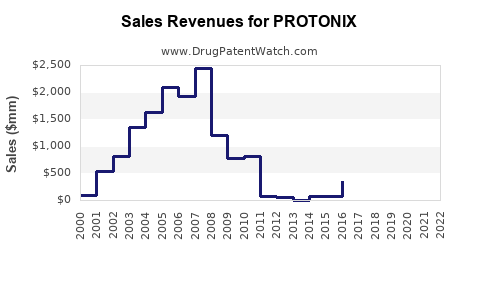

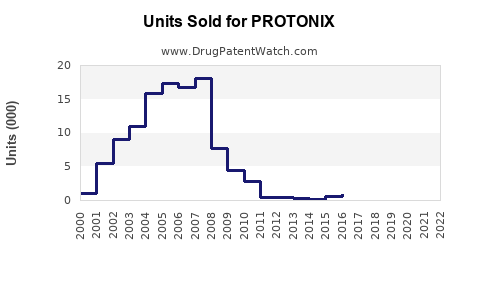

Pfizer's patent exclusivity for PROTONIX expired in August 2015 in the U.S., leading to the entry of multiple generic equivalents. Although initial market penetration favored the brand, generics now constitute a considerable portion of the sales volume, often at reduced prices (2).

Regulatory Environment

Regulatory agencies have promoted PPI over-the-counter (OTC) availability; while PROTONIX is primarily prescription-based, some formulations have OTC counterparts. This shift broadens accessibility but intensifies competition.

Additionally, evolving safety guidelines have influenced prescriber behavior, especially after reports linking long-term PPI use with adverse outcomes (e.g., kidney disease, fractures). Such concerns could moderate growth prospects.

Market Segments

- Hospital Settings: Continued use for inpatient care and high-risk patients sustains steady demand.

- Outpatient/Mail-Order Pharmacies: Shift towards OTC and prescription forms impacts volume.

Patient Demographics

An aging global population increases demand, notably among patients with chronic acid-related disorders. Moreover, rising GERD prevalence in developed and developing nations expands potential patient pools.

Sales Projections (2023–2030)

Assumptions

- Continued brand retention due to clinical familiarity.

- Moderate generic erosion but with sustained demand in hospital and complex cases.

- Growth in GERD prevalence at approximately 2% annually.

- Market penetration of OTC formulations slightly reducing prescription volumes but expanding overall access.

- Regulatory and safety developments maintaining current prescribing patterns.

Forecast

| Year |

Estimated Global Sales (USD Billion) |

Key Drivers |

| 2023 |

0.80 |

Pandemic recovery, stable hospital use |

| 2024 |

0.85 |

Slight market expansion, new formulation launches |

| 2025 |

0.89 |

Increased GERD prevalence, growing OTC uptake |

| 2026 |

0.94 |

Ageing populations, expanded indications |

| 2027 |

1.00 |

Market maturation, new competitive entrants |

| 2028 |

1.05 |

Physician preference for established brands |

| 2029 |

1.10 |

Regulatory incentives, broader access |

| 2030 |

1.15 |

Stabilized growth, ongoing demographic trends |

Cumulative sales over this horizon could approximate USD 8 billion, factoring in market dynamics, competition, and regional variations.

Regional Considerations

- North America: Largest market, steady growth driven by high GERD prevalence and hospital demand.

- Europe: Similar trajectory, with increased OTC availability.

- Asia-Pacific: Rapid growth due to rising healthcare access, increased GERD awareness, and expanding pharmaceutical markets.

- Emerging Markets: Growth potential is significant but constrained by pricing pressures and healthcare infrastructure.

Competitive Landscape

Key competitors include:

- Branded PPIs: Nexium (esomeprazole), Prilosec (omeprazole).

- Generics: Numerous manufacturers offering cost-effective alternatives.

- OTC options: Omeprazole and other PPIs available without prescription.

The competitive pressure from generics underscores a focus on maintaining prescriber loyalty and expanding indications, while innovation—such as novel delivery systems or combination therapies—could sustain demand.

Challenges and Opportunities

Challenges

- Price erosion due to generic competition.

- Long-term safety concerns potentially impacting prescribing habits.

- Regulatory shifts favoring OTC availability and formulary changes.

- Market saturation in developed countries.

Opportunities

- Expanding indications beyond GERD, such as for Helicobacter pylori eradication therapy.

- Developing new formulations (e.g., injectable or pediatric formulations).

- Entering emerging markets with rising disease burden.

- Leveraging digital health and medication adherence tools to improve outcomes and market engagement.

Key Takeaways

- Steady Market Presence: PROTONIX remains a significant player within the PPI segment, with a well-established clinical and hospital presence.

- Impact of Generics: Patent expirations have transformed the competitive landscape, leading to price pressures but also broadening patient access.

- Demographic Drivers: Aging populations and increasing GERD prevalence underpin long-term growth prospects.

- Regional Growth Potential: Emerging markets present substantial expansion opportunities, offsetting saturation in mature regions.

- Innovation and Diversification: Future success hinges on formulation innovations, expanding therapeutic uses, and digital health integration.

FAQs

1. How will patent expiration affect PROTONIX sales?

Patent expiration in 2015 led to significant generic entry, intensifying price competition but also expanding market access. While generic erosion can reduce brand sales, ongoing hospital use and clinical familiarity help sustain volumes.

2. What role do OTC formulations play in PROTONIX’s future?

OTC availability broadens consumer access but typically lowers prescription volumes. It also increases competition from other OTC PPIs, requiring strategic branding and marketing.

3. How significant is regional variation in PROTONIX’s market?

Highly significant. North America remains the primary revenue source, but rapid growth in Asia-Pacific and emerging markets offers substantial upside.

4. Are safety concerns affecting long-term PPI use and PROTONIX sales?

Yes. Risks associated with chronic PPI use—kidney disease, fractures—may influence prescriber preferences and patient adherence, necessitating ongoing safety communication.

5. What innovations could sustain PROTONIX’s market share?

Developing new formulations, expanding indications, and integrating digital adherence solutions can reinforce PROTONIX’s value proposition amid competitive pressures.

References

- MarketWatch. "Proton Pump Inhibitors (PPIs) Market Size, Share & Trends Analysis." 2022.

- IQVIA. "Pharmaceutical Market Data." 2022.