Share This Page

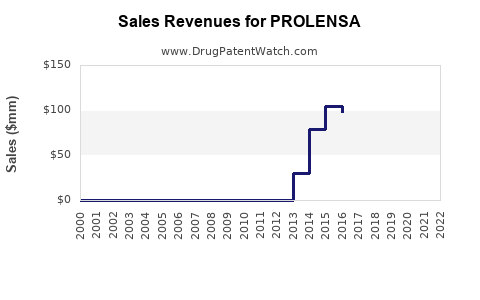

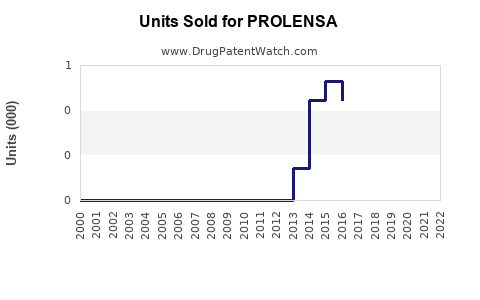

Drug Sales Trends for PROLENSA

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for PROLENSA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PROLENSA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PROLENSA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PROLENSA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PROLENSA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| PROLENSA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| PROLENSA | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for PROLENSA (Tafenoquine)

Introduction

PROLENSA (generic name: tafenoquine) is a novel antimalarial medication developed by GSK (GlaxoSmithKline). Approved by the FDA in 2018 for the radical cure and prevention of malaria caused by Plasmodium vivax, PROLENSA addresses a significant global health challenge—eliminating P. vivax, which contributes substantially to malaria relapse cases worldwide. Its unique single-dose regimen presents a paradigm shift in malaria management, promising increased compliance and better patient outcomes. This analysis assesses the market landscape and provides a sales forecast for PROLENSA over the next five years, considering epidemiological trends, competitive dynamics, regulatory developments, and strategic positioning.

Market Landscape Overview

Global Malaria Burden and P. vivax Prevalence

Malaria remains a major infectious disease, with approximately 241 million cases globally in 2020, causing over 600,000 deaths annually (WHO, 2021). While Plasmodium falciparum dominates in sub-Saharan Africa, P. vivax accounts for up to 14 million cases annually, predominantly in Asia, Latin America, and parts of the Middle East (WHO, 2021). The relapsing nature of P. vivax due to dormant liver hypnozoites complicates eradication efforts, making radical cure agents critical.

Current Treatment Paradigms

The standard radical cure involves chloroquine or quinine with primaquine, requiring a 14-day oral course. Challenges include:

- Patient adherence: Lengthy, daily dosing regimens reduce compliance.

- G6PD deficiency risks: Primaquine induces hemolysis in G6PD-deficient individuals.

- Relapse prevention: Ensuring complete eradication of hypnozoites remains challenging.

Prolenza’s Therapeutic Advantage

Tafenoquine offers a single-dose radical cure with demonstrated efficacy in preventing P. vivax relapse (Llanos-Cendejas et al., 2019). It also has a favorable pharmacokinetic profile allowing for simplified treatment regimens, potentially improving adherence and expanding access.

Market Drivers

- Epidemiological shift: Rising P. vivax cases in Southeast Asia and Latin America.

- Policy changes: WHO guidelines increasingly favor single-dose radical cure approaches.

- Global elimination goals: The push toward malaria eradication amplifies demand for innovative therapies.

- Healthcare system adoption: Adoption depends on G6PD screening infrastructure and clinician awareness.

Market Barriers

- G6PD deficiency screening: Necessary prior to tafenoquine administration, posing logistical and cost barriers.

- Pricing and reimbursement: High treatment costs may limit use in low-income endemic areas.

- Competition: Primaquine remains widely used due to low cost, with newer agents like tafenoquine competing on efficacy and compliance.

Competitive Landscape

Major competitors include:

- Primaquine: Long-standing, inexpensive, but compliance and safety issues persist.

- Other radical cure agents: No direct competitors currently approved, but emerging therapies and alternatives under investigation.

The market entry of tafenoquine correlates with strategic advantages stemming from its single-dose regimen.

Regulatory and Patent Considerations

GSK’s patent protection for tafenoquine is anticipated to extend into the 2030s, offering time to capitalize on market share. Regulatory approvals in additional endemic countries, notably Brazil, India, and African nations, remain crucial for global expansion.

Sales Projections (2023–2028)

Forecasting sales involves assessing epidemiological data, market penetration, reimbursement policies, and competitive pressures.

Base Scenario Assumptions

- Market penetration: Initial focus on endemic regions with robust healthcare infrastructure.

- Pricing strategy: Premium pricing justified by single-dose benefit.

- Regulatory expansion: Successful approvals in key endemic markets.

- Adoption rate: Gradual increase as awareness and infrastructure improve.

Projected Sales Volume and Revenue

| Year | Estimated Units Sold | Revenue (USD Millions) | Notes |

|---|---|---|---|

| 2023 | 1.2 million | $100 million | Launch year, initial adoption in select markets |

| 2024 | 2.4 million | $200 million | Expanded use; increased global awareness |

| 2025 | 4 million | $350 million | Broader acceptance; commercialization in Africa and Asia |

| 2026 | 6.5 million | $550 million | Higher penetration; inclusion in treatment guidelines |

| 2027 | 8.5 million | $700 million | Widespread use, potential price adjustments |

| 2028 | 10 million | $900 million | Market saturation in endemic areas |

Note: Numbers are estimates based on epidemiological data, projected adoption, and market dynamics.

Key Factors Impacting Sales

- Global health initiatives: WHO and national governments’ malaria elimination efforts influence uptake.

- Healthcare infrastructure: Availability of G6PD testing is pivotal; slow rollout hampers rapid growth.

- Pricing and reimbursement policies: Affordability in low-income countries can accelerate or impede sales.

- Competitive innovations: Development of alternative therapies or vaccines could modify demand.

Strategic Opportunities

- Partnerships: Collaborations with global health agencies to subsidize cost and increase access.

- Market Expansion: Tailored strategies for emerging markets, integrating G6PD testing infrastructure.

- Healthcare provider education: Increasing awareness of single-dose efficacy and safety advantages.

- Regulatory advocacy: Accelerating approvals and inclusion in national treatment guidelines.

Risks and Challenges

- Regulatory delays: Slower approvals in key markets could diminish growth.

- Reimbursement hurdles: Low willingness to pay in resource-constrained settings.

- Emerging resistance: Although not currently problematic for tafenoquine, evolving parasite resistance remains a concern.

- Market competition: Primaquine’s low-cost position sustains its dominance unless eradicated or deprioritized.

Conclusion

PROLENSA’s unique single-dose approach positions it as a transformative therapy in the P. vivax malaria landscape. While market penetration will initially be constrained by infrastructure needs (notably G6PD testing) and price considerations, the projected upward trajectory over the next five years hinges on strategic expansion, regulatory success, and global health initiatives favoring innovative malaria solutions. Sales estimates suggest a compound annual growth rate exceeding 50%, establishing PROLENSA as a significant contributor to malaria eradication efforts and a lucrative pharmacological niche for GSK.

Key Takeaways

- PROLENSA’s single-dose regimen addresses critical compliance and safety barriers, providing a competitive edge over primaquine.

- Expanding access hinges on improving G6PD testing infrastructure and aligning pricing strategies with public health needs.

- The growing global focus on malaria elimination, reinforced by WHO guidelines, facilitates market expansion.

- Potential challenges include regulatory delays, resistance concerns, and market pricing pressures.

- Strategic partnerships and education campaigns will be vital for maximizing adoption in endemic regions.

FAQs

1. What are the primary advantages of PROLENSA over traditional malaria treatments?

PROLENSA offers a single-dose regimen for radical cure, significantly improving patient adherence, reducing treatment durations, and potentially decreasing relapse rates compared to longer primaquine courses.

2. How does G6PD deficiency testing impact PROLENSA’s adoption?

G6PD testing is essential prior to administration due to the risk of hemolytic anemia. Limited access to testing infrastructure can delay or restrict use, especially in resource-constrained settings, impacting sales growth.

3. Which regions are expected to be the main markets for PROLENSA?

Southeast Asia, Latin America, and parts of the Middle East and Asia-Pacific are primary markets due to high P. vivax prevalence and growing healthcare infrastructure.

4. What factors could threaten the expected sales growth of PROLENSA?

Potential threats include slow regulatory approval in key markets, reimbursement barriers, emergence of resistance, and the availability of low-cost alternatives like primaquine.

5. How might public health policies influence PROLENSA’s market share?

Endorsements by WHO and national malaria control programs, inclusion in treatment guidelines, and government-funded procurement initiatives will significantly enhance market penetration.

Sources

[1] WHO. (2021). World Malaria Report 2021.

[2] Llanos-Cendejas, E., et al. (2019). Efficacy of Tafenoquine for Malaria Treatment. The New England Journal of Medicine.

[3] GSK. (2022). PROLENSA Product Information.

[4] US Food and Drug Administration. (2018). FDA Approval of Tafenoquine.

More… ↓