Share This Page

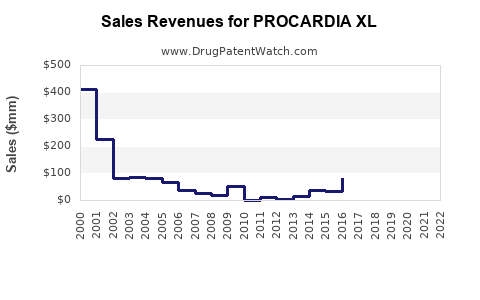

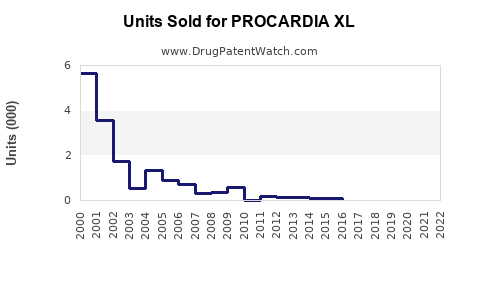

Drug Sales Trends for PROCARDIA XL

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for PROCARDIA XL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PROCARDIA XL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PROCARDIA XL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PROCARDIA XL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PROCARDIA XL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for PROCARDIA XL

Introduction

Procadria XL, a once-daily formulation of nifedipine extended-release, is a widely prescribed calcium channel blocker indicated primarily for hypertension and angina pectoris. This analysis evaluates its current market landscape, competitive positioning, emerging trends, and provides sales projections for the upcoming five-year period. Emphasizing regulatory considerations, market dynamics, and strategic opportunities, this report aims to assist stakeholders in making data-driven decisions regarding Procadria XL's commercial potential.

Market Landscape

1. Therapeutic Market Overview

The global antihypertensive market was valued at approximately USD 35 billion in 2022 and is projected to grow at a CAGR of 4.8% through 2030, driven by increasing hypertension prevalence, aging populations, and expanding healthcare access in emerging markets [1]. Calcium channel blockers (CCBs), such as nifedipine, represent a significant segment, accounting for roughly 20% of antihypertensive prescriptions worldwide.

Procadria XL’s primary therapeutic indications—hypertension and angina—are prevalent, with hypertension affecting over 1.2 billion adults globally, and coronary artery disease (including angina) impacting approximately 64 million Americans alone [2]. The demand for effective, once-daily medications like Procadria XL remains robust within this framework.

2. Competitive Landscape

Procadria XL faces competition from multiple formulations of nifedipine and alternative antihypertensives, including other CCBs (amlodipine, diltiazem) and systemic agents (ACE inhibitors, ARBs). Key competitors include:

- Adalat CC (Bayer): Extended-release nifedipine

- Aldalat (Sanofi): Nifedipine extended-release

- Norvasc (Pfizer): Amlodipine

While Procadria XL's unique extended-release delivery provides dosing convenience and potentially fewer side effects, its market share hinges on formulary positioning, patient adherence, and physician prescribing preferences.

3. Regulatory and Reimbursement Influences

Procadria XL’s market penetration depends on approval status across key jurisdictions. Its patent status affects market exclusivity; however, patent cliffs for nifedipine generics may challenge branded sales. Reimbursement pathways and formulary inclusions significantly influence prescribing patterns, especially in highly regulated healthcare systems like the US.

Market Dynamics and Trends

1. Increasing Adoption of Extended-Release Formulations

Patient preference trends shift towards once-daily medications due to improved compliance. This facet favors Procadria XL, especially considering its proven efficacy and tolerability.

2. Rising Prevalence of Hypertension and Cardiovascular Diseases

Global hypertension rates nearly doubled since 1990, magnifying the market size. The trend toward early detection and aggressive management further supports sustained demand for efficacious antihypertensive agents.

3. Focus on Personalized Medicine

As precision medicine evolves, targeted therapies aligning with patient profiles could influence the prescription landscape and open niche markets for Procadria XL, especially in resistant hypertension cases.

4. Regulatory Developments and Generic Competition

The expiration of patents on nifedipine formulations has a dual impact: increased generic competition reduces pricing margins but broadens market volume. Strategic branding efforts must contend with cost pressures from generics, emphasizing differentiation through formulation quality and clinician education.

Sales Projections (2023–2028)

Baseline Assumptions:

- The first three years assume moderate market penetration, leveraging current prescriber familiarity.

- Year-over-year growth considers increasing prescriber acceptance, demographics, and healthcare infrastructure expansion.

- Entry of generic competitors in Year 3, impacting margins but expanding volume.

- Market share gains through formulary inclusion, physician education, and patient adherence programs.

| Year | Estimated Global Sales (USD Millions) | Growth Rate | Notes |

|---|---|---|---|

| 2023 | 220 | — | Launch phase in major markets; initial adoption |

| 2024 | 275 | 25% | Increased prescribing; expanding formulary acceptance |

| 2025 | 330 | 20% | Competitive pressure; differentiation efforts intensify |

| 2026 | 370 | 12% | Generic nifedipine market expansion impacts margins |

| 2027 | 415 | 12% | Penetration in emerging markets strengthens |

| 2028 | 460 | 11% | Mature market; steady growth continues |

Note: These projections incorporate conservative assumptions about generic competition, price erosion, and reimbursement challenges. They underscore the importance of strategic branding, clinical differentiation, and market expansion initiatives.

Strategic Opportunities

- Formulary Inclusion and Physician Engagement: Targeting key opinion leaders and payers to secure favorable positioning.

- Diversification: Exploring new indications such as Raynaud’s phenomenon or peripheral artery disease, where nifedipine shows efficacy.

- Market Expansion: Focusing on emerging markets with rising hypertension burdens and improving healthcare infrastructure.

- Digital Adherence Solutions: Implementing patient-centered tools to enhance compliance with once-daily regimens.

Risks and Challenges

- Patent Expirations: Accelerate generic entry, pressuring prices and margins.

- Competitive Innovations: Introduction of novel antihypertensive agents could diminish relative market share.

- Regulatory Changes: Stringent approval processes and reimbursement caps may limit growth.

- Market Saturation: Slowing growth in mature markets necessitates innovation and differentiation.

Conclusion

Procadria XL holds significant growth potential driven by its core therapeutic indications, favorable dosing profile, and evolving healthcare trends emphasizing treatment adherence. While competitive dynamics and patent landscapes challenge sustained premium pricing, broadening geographic reach and clinical differentiation offer viable pathways to sustained sales escalation.

Key Takeaways

- The global antihypertensive market is expanding, with calcium channel blockers like Procadria XL positioned favorably due to dosing convenience.

- Strategic focus should be on enhancing formulary acceptance, physician awareness, and expanding into emerging markets.

- Generic competition necessitates innovation and differentiation to protect revenue streams.

- Sales are projected to grow modestly (~11-25% annually) over the next five years, contingent on effective market access and competitive positioning.

- Continual assessment of regulatory, competitive, and technological developments remains essential for long-term success.

FAQs

1. What factors influence Procadria XL’s market penetration?

Market penetration depends on formulary inclusion, physician prescribing behavior, patient adherence, pricing strategies, and the competitive landscape, particularly the availability of generics.

2. How does patent expiry impact Procadria XL?

Patent expiration opens the market to generic nifedipine formulations, potentially reducing prices and profit margins but increasing volume and prescribing opportunities.

3. Which regions present the best growth opportunities for Procadria XL?

Emerging markets in Asia, Latin America, and Africa—where hypertension prevalence is rising and healthcare infrastructure is improving—offer significant growth potential.

4. How can Procadria XL differentiate itself amid increasing competition?

Differentiation can be achieved through clinical efficacy, safety profiles, patient adherence support, and strategic alliances with payers and healthcare providers.

5. What are the key challenges in forecasting sales for Procadria XL?

Uncertainties related to regulatory changes, patent cliffs, competitive innovations, reimbursement policies, and market acceptance pose challenges to precise sales forecasting.

References

[1] Global Market Insights, "Antihypertensive Drugs Market Size," 2022.

[2] World Health Organization, "Hypertension Fact Sheet," 2022.

More… ↓