Last updated: July 28, 2025

Introduction

PROAIR HFA (albuterol sulfate inhalation aerosol) is a widely prescribed bronchodilator used primarily for the treatment of bronchospasm associated with conditions such as asthma and chronic obstructive pulmonary disease (COPD). As a leading inhaler in emergency and maintenance respiratory care, PROAIR HFA’s market performance hinges on factors including global respiratory disease prevalence, competitive landscape, regulatory environment, and innovation trajectories. This report offers a comprehensive market analysis and sales projection, synthesizing current data and future growth drivers to assist stakeholders in strategic decision-making.

Market Overview

Global Respiratory Disease Landscape

Respiratory diseases represent a significant global health burden, with asthma affecting approximately 262 million individuals and COPD more than 384 million globally, according to the Global Initiative for Asthma (GINA) and the World Health Organization (WHO) [1][2]. The rising prevalence correlates with increased environmental pollution, urbanization, smoking, and aging populations, underpinning the sustained demand for inhalation therapeutics such as PROAIR HFA.

Product Profile and Therapeutic Indication

PROAIR HFA contains albuterol sulfate, a short-acting beta-2 adrenergic agonist (SABA) that offers rapid relief of bronchospasm symptoms. It serves both as a rescue inhaler and in some cases as a prophylactic treatment, especially in acute episodes. The device’s inhalation aerosol format ensures quick onset, simplicity, and portability, making it a preferred choice among clinicians and patients.

Market Segments and Key Regional Markets

The main markets for PROAIR HFA include:

- North America: Dominant due to high asthma/COPD prevalence, advanced healthcare infrastructure, and insurance coverage.

- Europe: Significant adoption driven by regulatory approval and the burden of respiratory diseases.

- Asia-Pacific: Rapidly expanding due to urbanization, increasing disease burden, and improving healthcare access.

- Rest of the World: Emerging markets with rising respiratory disease cases and growing pharmaceutical investments.

Competitive Landscape

PROAIR HFA faces competition from other inhalers containing albuterol or other SABAs, including:

- Ventolin HFA (GlaxoSmithKline): A leading competitor with a similar formulation.

- Proventil HFA: Another albuterol-based inhaler.

- Generic equivalents: Increasing market penetration as patent exclusivity diminishes.

- Innovative inhalers and combination therapies: Emerging treatments combining SABAs with steroids or long-acting bronchodilators.

Despite intensifying competition, PROAIR HFA holds a prominent position owing to brand recognition, safety profile, and established prescriber trust.

Market Drivers

Rising Prevalence of Respiratory Conditions

Continuous increases in asthma and COPD prevalence reinforce steady demand. Epidemiologic studies indicate that urbanized regions exhibit higher disease rates, aligning with environmental pollution levels. Moreover, aging populations in developed countries are likely to sustain demand for inhaled therapies.

Enhanced Awareness and Diagnosis

Public health initiatives and improved diagnostic tools lead to earlier detection and treatment initiation, amplifying the need for effective inhalers like PROAIR HFA.

Regulatory Approvals and Reimbursement Policies

Stringent regulatory standards ensure product safety and efficacy, fostering physician confidence. Reimbursement policies further influence patient access and adherence.

Product Differentiation and Patient Preference

Portable, easy-to-use inhalers with rapid onset remain preferred, especially for emergency use, solidifying PROAIR HFA’s market position.

Market Challenges

Generic Competition and Price Pressures

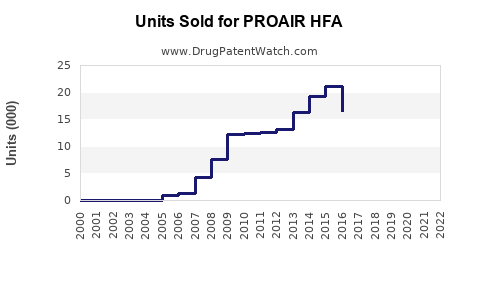

Patent expirations and entry of generics diminish pricing power and volume, challenging revenue streams.

Environmental Concerns

Hydrofluorocarbon (HFA) propellants used in inhalers are phased out or restricted in certain jurisdictions due to environmental impact, prompting reformulation efforts and potential product transformations.

Innovation Lag

Lack of novel formulations or delivery mechanisms may impact long-term growth prospects compared to emerging inhaler technologies, such as dry powder inhalers (DPI).

Regulatory and Reimbursement Uncertainty

Changes in healthcare policies or approval pathways could impact market access and sales.

Sales Projections

Methodology Overview

Sales forecasts integrate epidemiologic trends, market penetration rates, competitive dynamics, and regulatory factors. Both qualitative and quantitative analyses underpin these projections, supported by industry reports, prescription data, and market surveys.

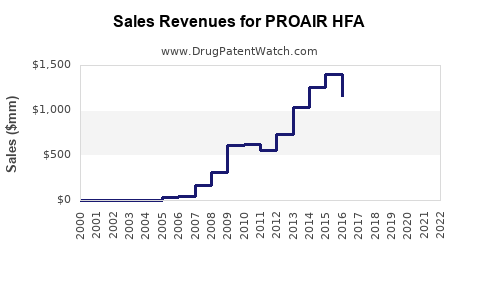

Short-term Outlook (2023-2025)

- Growth Rate: Anticipated Compound Annual Growth Rate (CAGR) of approximately 3-5%.

- Market Size: Estimated global sales in 2023 at $1.2 billion to $1.4 billion.

- Drivers: Steady demand in key markets, increased awareness, and the impact of COVID-19 on respiratory health awareness.

Medium-term Outlook (2026-2030)

- Growth Rate: Moderate CAGR of 2-4%, reflecting market maturity and competitive pressures.

- Market Size: Projected to reach $1.6 billion to $1.8 billion by 2030.

- Drivers: Population growth, expansion into emerging markets, and incremental improvements in delivery devices.

Long-term Outlook (2031 and beyond)

- Growth may stabilize or decline marginally owing to patent expirations, biosimilar entries, and regulatory shifts. Innovations—such as smart inhalers and combination therapies—may either augment or cannibalize existing sales.

Emerging Trends Influencing Future Sales

- Technological Integration: Smart inhalers improving adherence, real-time data, and remote monitoring.

- Regulatory Advances: Favorable approvals for new formulations or delivery systems.

- Environmental Regulations: Transition toward low-GWP (Global Warming Potential) propellants may delay or reshape product formulation.

- Market Expansion: Increased healthcare access and rising disposable incomes in Asia-Pacific and Africa open new markets.

Conclusion

PROAIR HFA’s market remains robust, reinforced by the persistent global burden of asthma and COPD. While short-term growth prospects appear stable, long-term success hinges on innovation, strategic positioning against generic competition, and adaptation to environmental regulation changes. Companies investing in next-generation inhaler technologies and expanding access in emerging markets are better positioned for sustainable revenue streams.

Key Takeaways

- The global respiratory market, driven by asthma and COPD prevalence, sustains high demand for inhalers like PROAIR HFA.

- North America remains the dominant market, but Asia-Pacific shows notable growth potential fueled by rising disease burden and improved healthcare infrastructure.

- Competitive pressures from generics and evolving environmental regulations pose challenges, necessitating innovation and strategic adaptation.

- Sales are projected to grow modestly at a CAGR of 3-5% over the next three years, reaching approximately $1.4 billion, with long-term growth contingent on market and regulatory developments.

- Adoption of digital inhaler technologies and formulary shifts toward combination therapies will influence future sales trajectories.

FAQs

1. What factors could impact the future sales growth of PROAIR HFA?

Key influences include patent expirations leading to generic competition, regulatory changes (environmental and safety standards), technological innovations in inhaler devices, and evolving treatment guidelines that favor alternative or combination therapies.

2. How is environmental regulation affecting inhaler formulations?

Restrictions on HFA propellants due to environmental concerns prompt manufacturers to develop low-GWP alternatives or reformulate products, potentially affecting production costs and supply chains.

3. What is the competitive advantage of PROAIR HFA over its rivals?

Its long-standing clinical efficacy, well-understood safety profile, wide availability, and physician familiarity confer competitive stability; however, innovation in delivery devices and digital health integration are necessary for sustained advantage.

4. Which emerging markets are vital for expanding PROAIR HFA's global footprint?

India, China, Southeast Asia, and Latin America present significant growth opportunities driven by increasing respiratory disease prevalence and improving healthcare infrastructure.

5. How might digital health advancements influence PROAIR HFA’s sales?

Smart inhalers and remote monitoring can enhance adherence and clinical outcomes, potentially increasing prescription volume and patient retention. Incorporating such technologies could also open new revenue streams and market differentiation.

References

[1] Global Initiative for Asthma (GINA). 2022 GINA Report, Global Strategy for Asthma Management and Prevention.

[2] World Health Organization. The Global Burden of Disease Study 2019.

[3] Market Research Future. Inhalers Market Overview, 2022.

[4] IMS Health. Prescription Data and Market Share Analysis, 2022.

[5] Environmental Protection Agency. Hydrofluorocarbon (HFC) Phase-down Regulations, 2022.