Share This Page

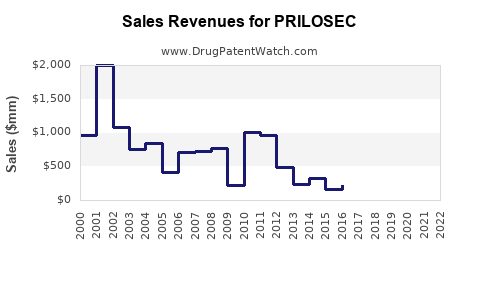

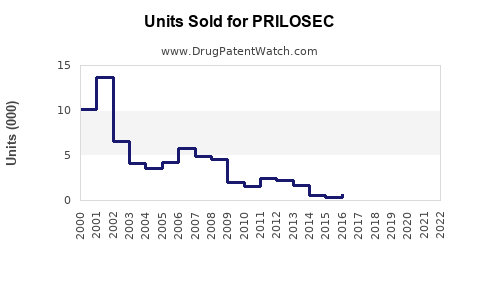

Drug Sales Trends for PRILOSEC

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for PRILOSEC

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PRILOSEC | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PRILOSEC | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PRILOSEC | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PRILOSEC | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| PRILOSEC | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| PRILOSEC | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| PRILOSEC | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for PRILOSEC (Omeprazole)

Introduction

PRILOSEC, a leading proton pump inhibitor (PPI), is widely prescribed to treat conditions such as gastroesophageal reflux disease (GERD), peptic ulcers, and Zollinger-Ellison syndrome. Since its introduction, PRILOSEC has established itself as a dominant player in the gastrointestinal (GI) pharmacotherapy market. This analysis examines the current market landscape for PRILOSEC, evaluates competitive dynamics, and projects future sales trajectories integrating recent trends and patent statuses.

Market Overview

Global Market Size

The global proton pump inhibitors market was valued at approximately USD 14.8 billion in 2022, with a compound annual growth rate (CAGR) of around 4.5% projected through 2030 (source: Grand View Research). PRILOSEC, branded as omeprazole, accounts for a significant share, given its first-to-market advantage and widespread prescription practices.

Key Therapeutic Indications

PRILOSEC addresses high-incidence GI conditions:

- GERD: Affecting an estimated 20-30% of adults in North America and Europe.

- Peptic Ulcers: Estimated worldwide prevalence of 4-10%, often requiring PPI therapy.

- Zollinger-Ellison Syndrome: A rare condition, constituting a smaller segment but vital for niche markets.

Market Drivers

- Increasing prevalence of GERD linked to obesity and lifestyle changes.

- Growing aging population vulnerable to acid-related disorders.

- Rising awareness and physician endorsement of PPIs for ulcer prevention and management.

Market Challenges

- Patent expiration leading to generic competition.

- Safety concerns related to long-term PPI use (e.g., potential for osteoporosis, kidney disease).

- Competition from other PPIs (e.g., lansoprazole, pantoprazole) and emerging therapies like H2 receptor antagonists.

Competitive Landscape

Generic and Brand Competition

Since PRILOSEC’s patent expired in 2004, generic omeprazole formulations dominate, reducing branded sales prices significantly. Market share now shifts toward generics, but branded PRILOSEC retains some loyalty due to sustained physician preference and formulary positioning.

Emerging Therapies

Newer drugs such as vonoprazan (a potassium-competitive acid blocker) challenge traditional PPIs by offering faster onset and longer-lasting acid suppression.

Strategic Positioning

Pfizer, the original manufacturer, has maintained market relevance through:

- Formulation innovations for patient compliance.

- Expansion into combination therapies.

- Focused marketing to healthcare providers.

Sales Projections (2023-2030)

Baseline Scenario

In 2022, PRILOSEC’s global sales were estimated at USD 600 million. Post-patent expiration, sales have declined steadily but remain significant due to brand loyalty and specific indications (e.g., Zollinger-Ellison).

Assuming:

- U.S. market share remains stable at around 15-20%, with sales driven by national prescription trends.

- Increasing adoption in emerging markets driven by expanding healthcare infrastructure.

- Continued prescription for specialty indications with less generic competition.

Forecast (USD Millions)

| Year | Sales Projection | Key Assumptions |

|---|---|---|

| 2023 | USD 450-500 million | Market stabilization; competition intensifies; generic prevalence increases. |

| 2024-2025 | USD 400-450 million | Growth in emerging markets; slight decline in mature markets due to generics. |

| 2026-2028 | USD 350-400 million | Market saturation; advent of competition from novel therapies. |

| 2029-2030 | USD 300-350 million | Continued erosion; focus on niche indications, strategic repositioning. |

Factors Influencing Sales

- Patent and Exclusivity: Since key patents expired, generic proliferation dominates, pressuring prices.

- Market Penetration Strategies: Pfizer’s focus on specialty uses and formulations could sustain higher prices in niche segments.

- Regulatory Environment: Increased scrutiny on long-term PPI safety may influence prescribing habits.

- Emerging Markets: Growth potential remains significant due to increased access to healthcare and growing disease prevalence.

Strategic Opportunities

- Formulation Innovation: Developing novel delivery mechanisms or combination formulations can differentiate PRILOSEC.

- Niche Indications: Targeting rare conditions with high unmet needs (e.g., Zollinger-Ellison) could sustain revenue.

- Partnerships and Licensing: Collaboration with local pharmaceutical firms in emerging markets can expand reach.

Risks and Mitigation

- Market Deterioration from Generics: Diversification into complementary markets and branded formulations can mitigate erosion.

- Safety Concerns and Regulatory Constraints: Transparent safety profiling and post-market surveillance help maintain customer trust.

- Competitive Therapies: Continual R&D investments in next-generation acid suppression technologies secure future relevance.

Key Takeaways

- PRILOSEC remains a pivotal drug within the GI therapeutic landscape, with sales primarily challenged by generics but supported via niche applications and emerging markets.

- The global proton pump inhibitor market persists with moderate growth, heavily influenced by healthcare infrastructure and disease prevalence patterns.

- Future sales will hinge on strategic diversification, formulation innovation, and positioning in specialized indications.

- Patent expiration has transitioned PRILOSEC from a branded blockbuster to a competitive, niche product with stable but declining revenue streams.

- Collaboration, ongoing R&D, and market expansion are essential to sustain PRILOSEC’s commercial viability amid evolving therapeutic and regulatory landscapes.

FAQs

1. How has patent expiration affected PRILOSEC's market share?

Patent expiration in 2004 led to a surge in generic omeprazole products, significantly reducing branded sales. Despite this, PRILOSEC retains a degree of market share through physician preference and specific indications, especially in niche segments.

2. What are the primary drivers of growth in the proton pump inhibitor market?

Key drivers include rising prevalence of acid-related GI disorders driven by lifestyle changes, aging populations, and increased awareness. Expansion into emerging markets also presents growth opportunities.

3. What are the main challenges facing PRILOSEC’s continued revenue stream?

Generic competition, safety concerns over long-term use, emergence of new drug classes like potassium-competitive acid blockers, and regulatory scrutiny pose significant challenges.

4. Are there any innovative formulations or uses in development for PRILOSEC?

Pfizer and other stakeholders are exploring combination therapies, sustained-release formulations, and targeted treatments for rare indications to extend the drug's relevance.

5. How do emerging therapies impact PRILOSEC sales projections?

New therapies such as vonoprazan and other novel acid suppressants offer improved efficacy and safety profiles, potentially limiting PRILOSEC’s market share unless adaptations and new indications are pursued.

Sources:

[1] Grand View Research. Proton Pump Inhibitors Market Size & Trends | industry analysis report. 2022.

[2] Pfizer Annual Reports and Press Releases. 2022-2023.

[3] EvaluatePharma. World Preview 2023.

[4] American Gastroenterological Association. GERD prevalence statistics.

[5] MarketWatch. Pharma industry press and market news briefs.

More… ↓