Last updated: July 31, 2025

Introduction

Pravastatin sodium, marketed under brand names like Pravachol, is a widely prescribed HMG-CoA reductase inhibitor (statin) used primarily for hyperlipidemia and cardiovascular risk reduction. As a stalwart in the lipid-lowering therapeutic class, pravastatin's market dynamics are influenced by evolving healthcare policies, patent statuses, competing pharmaceuticals, and demographic shifts. This analysis offers a comprehensive assessment of pravastatin sodium’s market landscape, growth drivers, challenges, and forecasted sales trajectories.

Market Overview

Global Market Size and Trends

The global statins market was valued at approximately USD 11.02 billion in 2022 and is projected to grow at a CAGR of around 2.8% through 2030, reaching approximately USD 14.27 billion. Statins, including pravastatin, account for a significant share of lipid-lowering drug sales due to their established efficacy, safety profile, and broad acceptance in cardiovascular disease (CVD) prevention.

Pravastatin holds an estimated 8-10% market share within the statin segment, primarily owing to its favorable safety profile and the availability of generic formulations. While newer drugs like atorvastatin and rosuvastatin have gained market dominance, pravastatin maintains a steady presence especially in specific patient subsets requiring statins with fewer drug-drug interactions or muscle-related side effects.

Geographic Market Dynamics

- North America: The dominant market, due to high prevalence of hyperlipidemia, extensive healthcare infrastructure, and widespread statin prescription practices.

- Europe: Significant growth driven by aging populations and proactive CVD management policies.

- Asia-Pacific: Rapid growth prospects, propelled by increasing urbanization, lifestyle changes, and expanding healthcare access.

- Latin America & Middle East & Africa: Emerging markets with increasing adoption but hindered by affordability and regulatory hurdles.

Market Drivers

Aging Population and Rising CVD Prevalence

The global aging demographic—over 1 billion people aged 60 and above—fuels the prevalence of hyperlipidemia and related cardiovascular comorbidities. According to WHO, cardiovascular diseases remain the leading cause of death worldwide, creating sustained demand for lipid-lowering therapies like pravastatin.

Clinical Guidelines and Prescribing Practices

Guidelines from the American College of Cardiology/American Heart Association (ACC/AHA) and European Society of Cardiology (ESC) endorse early management of hyperlipidemia with statins, incentivizing physicians to prescribe pravastatin especially in patients intolerant to other statins.

Cost-Effectiveness and Generic Competition

Patent expirations have introduced generics, making pravastatin more affordable and accessible. The low-cost profile sustains its use in emerging markets and healthcare systems emphasizing value-based care.

Safety Profile and Patient Preference

Pravastatin's comparatively lower risk of muscle-related side effects enhances its desirability, particularly in elderly or polypharmacy patients.

Market Challenges

Competition from Newer and More Potent Statins

Atorvastatin and rosuvastatin have surpassed pravastatin in potency, often prescribed for patients with significantly elevated LDL-C levels or high-risk individuals. This limits pravastatin's share in aggressive lipid management.

Shifts Toward Non-Statin Therapies

Emerging therapies such as PCSK9 inhibitors (e.g., evolocumab, alirocumab) and ezetimibe have gained popularity for resistant hyperlipidemia, potentially reducing pravastatin’s growth in certain segments.

Regulatory and Patent Dynamics

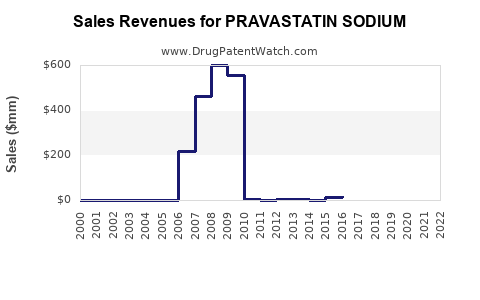

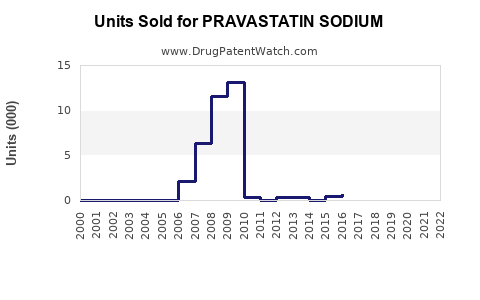

While patent protections for pravastatin have long expired (patent expiry around 2004-2005), market entry barriers may persist in some regions due to regulatory delays for generics or formulary preferences favoring newer agents.

Patient and Physician Preferences

Preference for higher potency, once-daily dosing, and combination medications may restrict pravastatin’s usage in specific clinical scenarios.

Sales Projections (2023–2030)

Baseline Scenario

Given current market conditions, pravastatin's global sales are expected to trend steadily with modest annual growth. From a 2022 estimated USD 880 million (including global sales of pravastatin sodium), projected revenues are anticipated to grow at a CAGR of approximately 2-3% over the next decade, reaching roughly USD 1.2 billion by 2030.

Regional Variations

- North America: Growth remains steady (~2% CAGR), supported by aging demographics and healthcare policy stability.

- Europe: Slightly higher growth (~2.5%) driven by increased awareness and guideline implementation.

- Asia-Pacific: Faster growth (~4%), reflecting rising healthcare access and disease burden.

- Emerging Markets: Potential for exponential growth if affordability and regulatory barriers diminish.

Factors Influencing Sales Growth

- Intensified focus on primary and secondary prevention of CVD.

- Expansion into newly regulated markets.

- Introduction of fixed-dose combination therapies involving pravastatin.

- Potential market contraction due to the ascendancy of alternative therapies.

Competitive Landscape

Major generic manufacturers, including Teva, Mylan, and Sandoz, dominate pravastatin sodium supply. Patent expirations have facilitated intense price competition, maintaining low per-unit costs. Patent renewal opportunities are unlikely, but regulatory exclusivities (e.g., process patents, formulations) in some jurisdictions could influence market dynamics.

New entrants focus less on pravastatin and more on innovative lipid-lowering agents, which constrains pravastatin's innovative growth but preserves its role as an established, low-cost option.

Regulatory and Market Access Considerations

Regulatory agencies continually evaluate statin safety profiles, influencing prescribing habits. Leaning on extensive clinical trial data, pravastatin benefits from a well-established safety record, facilitating favorable market access in regions with rigorous drug approval standards. Government initiatives promoting generic drug use further solidify its market position.

Key Market Segments and Opportunities

- Hospital and Primary Care Settings: Dominant channels for pravastatin distribution.

- Chronic Disease Management: Ongoing therapy for hyperlipidemia in high-risk populations.

- Combination," Formulation Opportunities: Fixed-dose combinations with other cardiovascular drugs for improved adherence.

- Emerging Markets: Price-sensitive regions offer growth potential for low-cost pravastatin formulations.

Conclusion

Pravastatin sodium remains a cornerstone in lipid management, especially valued for its safety and affordability. While facing stiff competition from more potent statins and novel therapies, its entrenched position in the global healthcare landscape ensures sustained, albeit modest, growth over the coming years. Strategic focus on emerging markets, combination therapies, and adherence to evolving guidelines will be critical for maximizing sales potential.

Key Takeaways

- The global pravastatin sodium market is projected to grow modestly (~2-3% CAGR) through 2030, driven primarily by aging populations and rising CVD prevalence.

- Generic competition stabilizes prices and expands access, especially in cost-sensitive regions.

- The drug’s strong safety profile supports its use in vulnerable populations and in long-term management.

- Rising competition from potent statins and non-statin therapies presents a challenge; market share growth requires strategic positioning.

- Opportunities lie in emerging markets, combination therapies, and targeted marketing aligned with clinical guidelines.

FAQs

1. How does pravastatin sodium compare to newer statins regarding efficacy?

Pravastatin generally has lower LDL-C lowering potency compared to atorvastatin and rosuvastatin, but it remains effective for moderate LDL-C reduction and primary prevention, with a superior safety profile.

2. What factors influence pravastatin’s market growth in emerging economies?

Cost advantages from generic formulations, increasing awareness of CVD, expanding healthcare infrastructure, and supportive regulatory policies drive growth in these regions.

3. Are there upcoming patent expirations that could impact pravastatin sales?

Given the patent expirations that occurred around 2004–2005, no significant patent barriers remain, facilitating broad generic competition and stable pricing.

4. How has the advent of non-statin therapies affected pravastatin's sales?

While PCSK9 inhibitors and ezetimibe are effective for resistant hyperlipidemia, they are more expensive and targeted at specific populations, thus limiting their impact on pravastatin’s overall sales but representing a competitive niche.

5. What strategic recommendations exist for maximizing pravastatin’s market share?

Focus on expanding access in emerging markets, developing fixed-dose combination products, emphasizing its safety profile, and aligning marketing with clinical guideline updates.

References

[1] Grand View Research. “Statins Market Size, Share & Trends Analysis Report by Product (Atorvastatin, Simvastatin, Lovastatin), By Application, By Region, And Segment Forecasts, 2022–2030.”

[2] World Health Organization. “Cardiovascular Diseases (CVDs).”

[3] American College of Cardiology. “2018 AHA/ACC Guideline on the Management of Blood Cholesterol.”

[4] MarketWatch. “Global Lipid-Lowering Drugs Market Forecast & Trends 2022.”