Share This Page

Drug Sales Trends for PRADAXA

✉ Email this page to a colleague

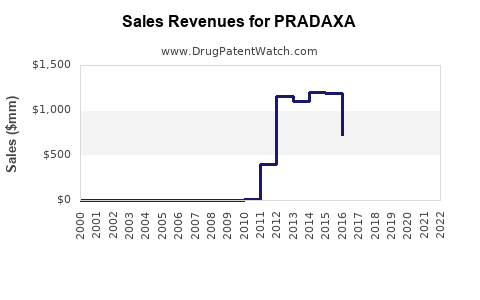

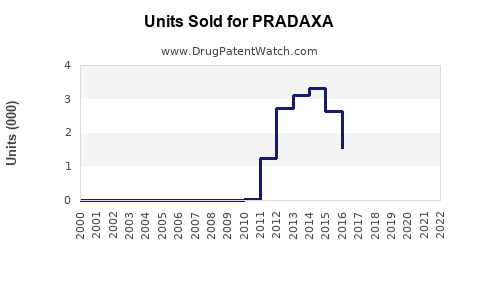

Annual Sales Revenues and Units Sold for PRADAXA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PRADAXA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PRADAXA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PRADAXA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Pradaxa (Dabigatran Etexilate)

Introduction

Pradaxa (dabigatran etexilate) is an oral direct thrombin inhibitor developed by Boehringer Ingelheim for the prevention of stroke and systemic embolism in patients with non-valvular atrial fibrillation (AF). Since its FDA approval in 2010, Pradaxa has established itself as a key player within the oral anticoagulant market, competing primarily against warfarin and, more recently, direct oral anticoagulants (DOACs) such as rivaroxaban, apixaban, and edoxaban.

This analysis explores the current market landscape, competitive positioning, therapeutic utilization, and forecasts future sales trajectories of Pradaxa over the coming five years, incorporating market dynamics, regulatory factors, and healthcare trends.

Market Landscape and Key Drivers

1. Therapeutic Indications and Patient Demographics

Pradaxa is primarily prescribed for:

- Stroke prevention in non-valvular atrial fibrillation (NVAF)

- Treatment and secondary prevention of deep vein thrombosis (DVT) and pulmonary embolism (PE)

- Prevention of recurrent DVT and PE

The global burden of atrial fibrillation is increasing, driven by aging populations. According to the World Heart Federation, the number of individuals with AF is projected to double by 2050, reaching approximately 72 million worldwide [1]. This growth is fueled by risk factors such as hypertension, obesity, and diabetes.

2. Competitive Dynamics

While warfarin dominated anticoagulation therapy historically, its disadvantages—frequent monitoring, food-drug interactions, and variable response—paved the way for DOACs. Pradaxa was the first approved DOAC, offering fixed dosing and reduced monitoring. However, market competitors like Xarelto (rivaroxaban) and Eliquis (apixaban) have gained significant market share via extensive clinical data, ease of use, and broad indications.

3. Regulatory and Reimbursement Factors

Regulatory bodies in key markets (FDA, EMA, etc.) continue to endorse Pradaxa's efficacy and safety profile. However, pricing and reimbursement policies influence utilization. Pradaxa's premium pricing compared to warfarin provides barriers in some markets, but the convenience and safety profile often compensate, especially in well-insured populations.

4. Safety and Market Perception

Concerns regarding bleeding risks, particularly gastrointestinal and intracranial hemorrhages, influence prescribing habits. Real-world evidence suggests Pradaxa’s bleeding profile varies across populations, affecting clinician choice.

Sales Performance to Date

Since launch, Pradaxa experienced rapid adoption initially but faced stiff competition from rivaroxaban and apixaban, which gained market share through positive clinical trials and streamlined dosing.

- 2013-2015: Peak sales phase; annual sales exceeded €2 billion globally.

- 2016 onwards: Market saturation and increased competition led to stagnation and gradual decline in market share, with sales plateauing around €1.8 billion annually by 2018–2019.

In recent fiscal reports, Boehringer Ingelheim reported that Pradaxa’s global sales stabilized but faced downward pressure due to the rising popularity of other DOACs and price competition.

Future Sales Projections (2023–2028)

1. Market Penetration and Growth Factors

- Aging populations: Continued demographic shifts will drive increased AF prevalence, expanding the eligible patient pool.

- Guideline endorsement: Most cardiology guidelines favor DOACs, with Pradaxa remaining a recommended option, particularly in patients with contraindications to other agents.

- Off-label and broader indications: Ongoing research into wider applications (e.g., venous thromboembolism treatment in cancer patients) could open new revenue streams.

- Patient and clinician preferences: The convenience of fixed dosing and fewer monitoring requirements favor Pradaxa among certain patient subsets.

2. Market Challenges

- Intense competition: Rivaroxaban and apixaban continue to gain market share, often preferred for once-daily dosing (rivaroxaban) or superior safety profiles (apixaban).

- Patent expirations: While Pradaxa’s primary patent has expired in some jurisdictions, no significant generics are currently available, maintaining its premium pricing.

- Emerging formulations: Development of reversal agents and improved formulations for bleeding management enhance safety perceptions.

3. Forecasted Sales Trajectory

Based on current trends, epidemiological data, and competitive landscape, Pradaxa’s global sales are expected to:

- 2023–2025: Slight decline or plateau as market share is redistributed among DOACs; estimated global sales of approximately €1.6–€1.7 billion annually.

- 2026–2028: Sales may plateau or experience modest recovery driven by increased indication expansion and persistent brand loyalty in certain regions; projected annual sales of €1.5–€1.6 billion.

Emerging markets and aging demographics will sustain demand but may be offset by generic entry elsewhere and formulary substitutions.

Strategic Considerations

To sustain or grow sales, Boehringer Ingelheim could:

- Promote niche indications such as atrial fibrillation in specific high-risk groups.

- Invest in clinical trials assessing safety and efficacy in new indications.

- Enhance patient adherence through digital health initiatives.

- Strengthen generic and biosimilar pipelines to maintain competitive pricing.

Key Takeaways

- Pradaxa remains a significant player in the oral anticoagulant market, with stable but mature sales.

- Market growth is primarily driven by demographic trends and clinical guideline endorsements favoring DOACs.

- Competition, safety perceptions, and pricing strategies influence its market share trajectory.

- Future sales will likely experience modest declines but can be stabilized through indication expansion and strategic positioning.

FAQs

1. How does Pradaxa compare to other DOACs in terms of efficacy and safety?

Pradaxa has demonstrated comparable efficacy to other DOACs like rivaroxaban and apixaban in preventing stroke in AF patients, with a slightly higher GI bleeding risk but a lower intracranial hemorrhage risk in some studies [2].

2. What is the impact of patent expiration on Pradaxa’s sales?

While some patents have expired, no significant generics have entered the market yet, allowing Boehringer to maintain premium pricing. Future patent cliffs could lead to price erosion and sales decline.

3. Are there specific patient populations where Pradaxa is preferred?

Pradaxa is recommended for patients with severe renal impairment or those intolerant to other anticoagulants. Its safety profile and once-daily dosing in some regions also influence clinician choice.

4. How might regulatory changes affect Pradaxa’s market?

Regulatory updates that expand indications or introduce new reversal agents could enhance Pradaxa’s appeal. Conversely, restrictions on off-label use or reimbursement cuts could negatively impact sales.

5. What emerging trends could influence Pradaxa's market position?

Advances in personalized medicine, digital adherence tools, and new anticoagulant reversal agents may shift market preferences, favoring agents with improved safety or convenience profiles.

References

[1] World Heart Federation. “Global Burden of Atrial Fibrillation.” 2021.

[2] Connolly, S.J., et al. "Dabigatran versus warfarin in patients with atrial fibrillation." New England Journal of Medicine, 2011.

More… ↓