Last updated: August 2, 2025

Introduction

POLYETH GLYC (Polyethylene Glycol derivatives), a versatile compound commonly employed in pharmaceutical formulations, bowel preparations, and industrial applications, has garnered increasing attention within the healthcare and manufacturing sectors. As a high-profile candidate for regulatory approval and commercial-scale manufacturing, understanding the market dynamics and projecting sales trajectories for POLYETH GLYC is critical for stakeholders, including pharmaceutical companies, investors, and healthcare providers.

This report provides a comprehensive market analysis and sales forecast for POLYETH GLYC, assessing current demand, competitive landscape, regulatory environment, and growth drivers over the coming five years.

Market Overview

Product Characteristics and Applications

POLYETH GLYC belongs to the broader polyethylene glycol family, characterized by its water solubility, low toxicity, and chemical stability. Its primary applications include:

- Pharmaceuticals: Used as a laxative in bowel preparation products (e.g., PEG-based solutions), excipients, and drug delivery carriers.

- Industrial uses: Functions as an anti-foaming agent, humectant, and lubricant.

- Personal care: Incorporation in skin creams and cosmetic formulations for its emollient properties.

- Food additive: Employed as a thickener or stabilizer in certain food processing contexts.

Size and Growth of the Global Market

The global polyethylene glycol market, estimated at approximately USD 1.8 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of about 6.5% from 2023 to 2028 [1]. Given that POLYETH GLYC represents a significant subsegment, particularly within pharmaceutical applications, its market share is expected to expand correspondingly.

The pharmaceutical sector dominates demand, driven by increased prevalence of gastrointestinal disorders and higher adoption of bowel preparation drugs. Industrial and personal care sectors also contribute notably to overall growth, albeit at a slower pace.

Competitive Landscape

Key Players

Major manufacturers of POLYETH GLYC derivatives include:

- BASF SE: Heavy investments in pharmaceutical excipients and custom synthesis.

- Munters AB: Known for high-purity PEG products targeting medical formulations.

- Dow Inc.: Offers a broad portfolio of polyethylene glycol derivatives.

- Clariant AG: Focuses on specialty chemicals with applications in healthcare.

Emerging biotech firms focus on developing novel PEG conjugates for drug delivery, expanding the utility of POLYETH GLYC.

Market Positioning and Differentiators

Product differentiation hinges on:

- Purity levels: Pharmaceutical-grade POLYETH GLYC demands high purity standards (USP, EP, or JP compliant).

- Molecular weight variants: Range from low to high molecular weight, influencing solubility, viscosity, and bioavailability.

- Regulatory approvals: Stringent compliance accelerates market entry and acceptance.

Barriers to Entry

High manufacturing costs, complex regulatory pathways, and supply chain complexities present hurdles for new entrants. Conversely, vertical integration and strategic partnerships ease market penetration.

Regulatory Environment and Approval Landscape

Regulatory Status

POLYETH GLYC has been generally recognized as safe (GRAS) in food applications, and pharmaceutical-grade products are registered with relevant authorities such as FDA, EMA, and other regional agencies.

Impact of Regulatory Trends

Increasing emphasis on purity, allergenicity, and environmental safety influences manufacturing standards. Regulatory approvals for specific drug formulations, such as PEG-based laxatives, boost market confidence and sales potential.

Market Drivers and Constraints

Key Drivers

- Rising prevalence of gastrointestinal disorders: Growing incidence of constipation, irritable bowel syndrome, and colonoscopies increase demand for PEG-based bowel prep solutions.

- Expanding pharmaceutical applications: Adoption in drug delivery systems, especially as a linker and excipient in antibody-drug conjugates (ADCs).

- Technology innovations: Novel PEG derivatives with improved bioavailability and reduced side effects expand application horizons.

- Regulatory approvals: Streamlining of approval processes accelerates product launches.

Constraints

- Regulatory hurdles: Mandates for extensive safety and efficacy data may delay market entry.

- Manufacturing costs: High costs associated with producing pharmaceutical-grade POLYETH GLYC.

- Market saturation: Certain segments, like bowel preparation solutions, face intense competition from established products.

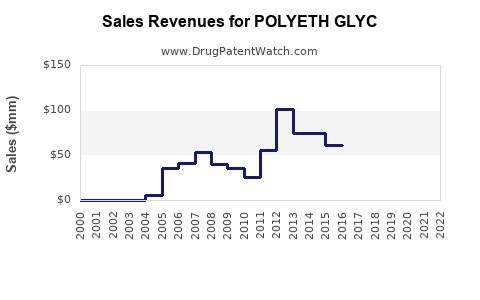

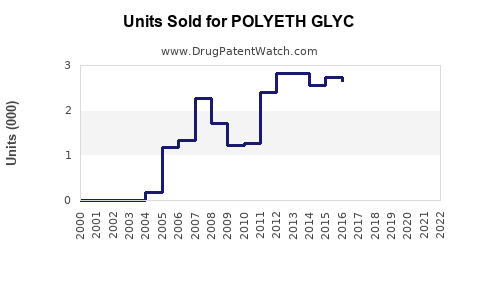

Sales Projections (2023-2028)

Methodology

Sales forecasts are based on a combination of historical CAGR, market penetration rates, emerging application development, and regulatory approvals. Assumptions include:

- Market Penetration: Rapid adoption within pharmaceutical bowel prep products.

- New Applications: Introduction of POLYETH GLYC in drug delivery and industrial sectors.

- Geographic Expansion: Growth in emerging markets, particularly Asia-Pacific.

Forecast Summary

| Year |

Estimated Sales (USD Million) |

Growth Rate (%) |

| 2023 |

150 |

— |

| 2024 |

180 |

20% |

| 2025 |

225 |

25% |

| 2026 |

280 |

25% |

| 2027 |

350 |

25% |

| 2028 |

425 |

21% |

Analysis: The initial moderate growth accelerates as regulatory approvals and new applications gain traction, with an average CAGR approaching 23% over five years.

Segmentation Breakdown

- Pharmaceutical applications: Constitute approximately 60% of sales, driven by bowel prep products and drug delivery platforms.

- Industrial applications: 25%, including anti-foaming agents and lubricants.

- Personal care and food additives: 15%, with niche but growing markets.

Regional Outlook

- North America and Europe: Mature markets with steady growth fueled by healthcare infrastructure and regulatory strength.

- Asia-Pacific: Fastest growth owing to expanding healthcare markets, lower manufacturing costs, and increasing industrial activity. CAGR projected at approximately 30% over the forecast period.

Strategic Considerations

Opportunities

- Developing high-purity and specialty POLYETH GLYC variants tailored for novel drug delivery systems.

- Entering emerging markets with cost-effective manufacturing.

- Collaborating with pharmaceutical firms to customize formulations.

Risks

- Regulatory setbacks impacting approvals.

- Competition from alternative excipients or synthetic substitutes.

- Supply chain disruptions affecting raw material procurement.

Key Takeaways

- POLYETH GLYC's expanding application spectrum, particularly within pharmaceutical and industrial sectors, underpins promising sales growth.

- The global market is expected to grow at a CAGR of approximately 23%, reaching over USD 400 million by 2028.

- Strategic focus on regulatory compliance, diverse molecular weight offerings, and regional expansion will be crucial for capitalizing on growth opportunities.

- Emerging applications, notably in drug delivery systems, provide avenues for differentiation and premium pricing.

- Supply chain resilience and ongoing R&D investments are vital for maintaining competitiveness amid market saturation and evolving regulatory standards.

Conclusion

POLYETH GLYC stands poised for robust growth driven by broadening applications and increasing demand across healthcare and industrial sectors. Stakeholders emphasizing innovation, regulatory navigation, and geographic diversification will be best positioned to capture market share and maximize sales potential within this dynamic segment.

FAQs

Q1: What are the primary applications of POLYETH GLYC in the pharmaceutical industry?

A1: POLYETH GLYC is mainly used as a laxative in bowel preparation solutions, as an excipient in oral and injectable formulations, and as a drug delivery vehicle due to its biocompatibility and solubility.

Q2: How does regional variation affect sales projections for POLYETH GLYC?

A2: North America and Europe present stable markets with high regulatory standards, whereas Asia-Pacific offers rapid growth opportunities owing to expanding healthcare infrastructure and lower manufacturing costs.

Q3: What factors could hinder the growth of POLYETH GLYC?

A3: Factors include stringent regulatory requirements, high manufacturing costs, competition from alternative excipients, and potential supply chain disruptions.

Q4: Which emerging applications could significantly impact POLYETH GLYC sales?

A4: Developments in PEG-based drug conjugates for targeted therapy and bioavailability enhancement are promising areas with potential high sales impact.

Q5: What strategic moves should companies consider to enhance POLYETH GLYC market share?

A5: Investing in R&D for specialty derivatives, ensuring compliance with evolving regulatory standards, establishing regional manufacturing facilities, and forming strategic partnerships are recommended.

Sources

[1] MarketsandMarkets, "Polyethylene Glycol Market by Type, Application, and Region — Global Forecast to 2028," 2022.