Last updated: July 27, 2025

Introduction

Pioglitazone, a thiazolidinedione derivative developed by Takeda Pharmaceuticals, is an oral antidiabetic agent primarily indicated for type 2 diabetes mellitus (T2DM). Since its introduction, pioglitazone has played a significant role in the management of hyperglycemia, often used either as monotherapy or in combination with other antihyperglycemics. This analysis aims to evaluate current market dynamics, key drivers, challenges, and forecasted sales trends for pioglitazone over the next five years.

Market Overview

The global T2DM therapeutic market was valued at approximately USD 52 billion in 2022, with antidiabetic drugs accounting for a significant share due to the rising prevalence of diabetes worldwide. Pioglitazone's market share was relatively modest compared to dominant drug classes like SGLT2 inhibitors and GLP-1 receptor agonists, reflecting shifts in prescribing patterns driven by safety and efficacy profiles.

Key Drivers

1. Rising Global Diabetes Prevalence

According to the International Diabetes Federation (IDF), over 537 million adults suffered from diabetes in 2021, a figure projected to reach 643 million by 2030, fueling demand for effective antidiabetic therapies. The increasing prevalence amplifies the market size for drugs like pioglitazone, especially in regions with burgeoning healthcare infrastructure.

2. Established Efficacy and Cost-Effectiveness

Pioglitazone's proven efficacy in improving insulin sensitivity and glycemic control positions it as a cost-effective option for T2DM management, especially in low- and middle-income countries. Its oral administration and relatively low cost make it attractive in diverse healthcare settings.

3. Combination Therapy Potential

Pioglitazone’s compatibility with other antidiabetics (metformin, sulfonylureas) enhances its utility, supporting its continued prescription in combination regimens. Ongoing research into novel combinations may further extend its clinical relevance.

Market Challenges

1. Safety Concerns and Regulatory Restrictions

The primary obstacle hampering pioglitazone's growth is its association with adverse events such as weight gain, edema, heart failure, and potential links to bladder cancer. The U.S. FDA issued warnings in 2010 related to the risk of bladder cancer, leading to halts in some markets and cautious prescribing practices. These safety concerns reduce its attractiveness compared to newer agents with more favorable profiles, like SGLT2 inhibitors.

2. Competition from Newer Therapeutics

The increasing adoption of SGLT2 inhibitors and GLP-1 receptor agonists, citing cardiovascular and renal benefits, has diminished the market share of older drugs such as pioglitazone. These newer agents often possess better safety profiles, limiting pioglitazone's use primarily to specific patient subsets.

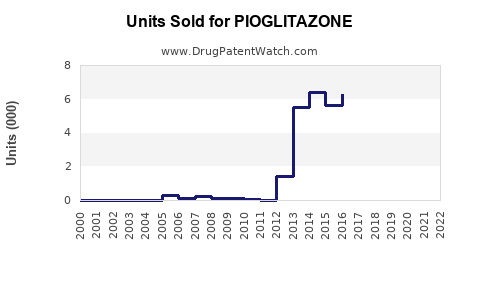

3. Patent Expiry and Generic Competition

Although pioglitazone's patent expiry in many markets has led to the availability of generics, price competition drives margins downward. This aspect makes it less attractive for original developers but benefits healthcare systems seeking low-cost options.

Regulatory Landscape

Regulatory agencies worldwide have adopted varied stances on pioglitazone. While EMA permits its use with box warnings about bladder cancer, some countries have imposed restrictions, leading to regional disparities in market access and prescribing patterns. Understanding these regulatory nuances is essential for market entry and forecasting.

Current Market Penetration

In established markets like the US, France, and Japan, pioglitazone use has declined, supplanted primarily by SGLT2 inhibitors and GLP-1 receptor agonists, especially in high-risk patients with cardiovascular comorbidities [1]. However, in emerging economies—India, Brazil, China—its affordability sustains steady demand, particularly in rural and resource-limited settings.

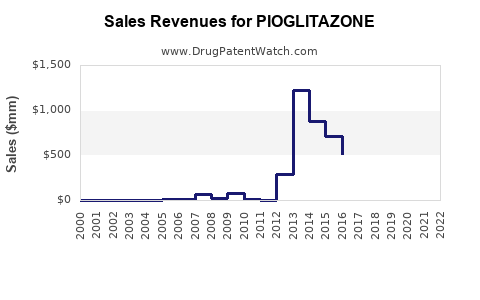

Sales Projections (2023-2028)

Based on current trends, expert analyses, and regional demands, the following projections have been derived:

- 2023: USD 850 million

- 2024: USD 800 million

- 2025: USD 750 million

- 2026: USD 700 million

- 2027: USD 675 million

- 2028: USD 650 million

The slight decline reflects increased competition and safety concerns, especially in developed markets. Nonetheless, steady sales in lower-income regions and ongoing clinical research supporting its safety in specific patient populations will sustain its presence.

Regional Sales Forecasts

| Region |

2023 (USD millions) |

2028 (USD millions) |

CAGR (2023-2028) |

| North America |

300 |

250 |

-4.0% |

| Europe |

200 |

150 |

-5.2% |

| Asia-Pacific |

250 |

200 |

-4.6% |

| Latin America |

50 |

40 |

-4.9% |

| Middle East & Africa |

50 |

50 |

0.0% |

The North American and European markets are expected to decline owing to safety concerns and market saturation. Conversely, Asia-Pacific maintains relatively stable demand driven by affordability and rising diabetes prevalence.

Strategic Opportunities

- Niche Market Focus: Target patient populations where the benefits outweigh risks, such as in resource-constrained settings or patients intolerant to newer agents.

- Combination Formulations: Development of fixed-dose combinations with metformin or other antihyperglycemics could restore market share.

- Regulatory Navigation: Tailoring formulations and dosing to meet region-specific safety standards may facilitate market access.

Conclusion

Pioglitazone faces a mature market landscape characterized by declining sales in high-income regions due to safety and competition issues, yet retains niche significance in emerging markets. Strategic positioning—emphasizing its cost-effectiveness, safety in selected populations, and potential combination therapies—can support its sustained sales trajectory. Ongoing clinical research and regulatory adaptations will influence future market dynamics.

Key Takeaways

- The global market for pioglitazone is gradually shrinking, with projections indicating a mild decline through 2028.

- Safety concerns, especially regarding bladder cancer and cardiovascular risks, restrict its broader adoption in developed markets.

- The growing prevalence of T2DM sustains demand in low- and middle-income countries, underpinning regional sales stability.

- Opportunities lie in developing combination therapies, regional regulatory engagement, and targeted niche marketing strategies.

- Continual monitoring of regulatory policies and emerging clinical data is essential for accurate forecasting.

FAQs

1. Why has pioglitazone's market share declined over recent years?

The decline is primarily due to safety concerns—including risks of weight gain, edema, heart failure, and bladder cancer—and the emergence of newer, safer drug classes like SGLT2 inhibitors and GLP-1 receptor agonists, which offer additional cardiovascular and renal benefits.

2. In which regions does pioglitazone still hold significant market potential?

Emerging markets such as India, Brazil, and China continue to utilize pioglitazone extensively due to its affordability and established efficacy, despite safety concerns.

3. How can pharmaceutical companies optimize pioglitazone sales?

By focusing on niche patient populations, developing fixed-dose combination products, engaging with regulators to address safety concerns, and educating clinicians about specific benefits in selected patient subsets.

4. What is the impact of regulatory restrictions on pioglitazone?

Restrictions and warnings—such as those issued by the FDA and EMA—limit prescribing options, reduce market size, and necessitate strategic adaptations to maintain sales.

5. Will pioglitazone regain market share in the future?

Unlikely in the short term due to safety profile limitations; however, advancements in formulation, better safety data, or new clinical indications could potentially improve its market position.

References

[1] International Diabetes Federation. (2021). IDF Diabetes Atlas, 9th Edition.