Share This Page

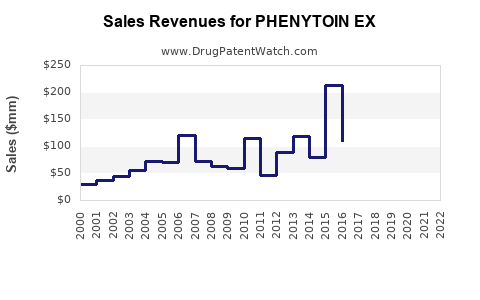

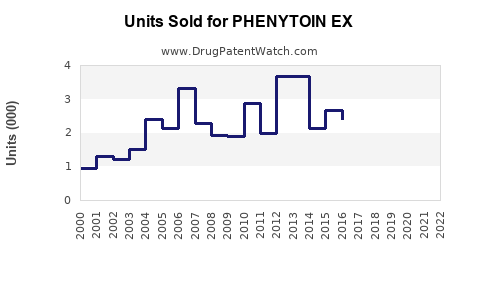

Drug Sales Trends for PHENYTOIN EX

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for PHENYTOIN EX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PHENYTOIN EX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PHENYTOIN EX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PHENYTOIN EX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PHENYTOIN EX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for PHENYTOIN EX

Introduction

Phenytoin EX, an extended-release formulation of phenytoin, is a prominent antiepileptic drug (AED) used primarily for the management of refractory epilepsy, status epilepticus, and some neuropathic pain conditions. Its unique pharmacokinetics, safety profile, and broad clinical application make it a key contender in the neurological therapeutic market. This analysis explores the current market landscape, competitive positioning, and future sales forecasts for PHENYTOIN EX over the next five years.

Market Overview

Global Epilepsy Drug Market

The global epilepsy drug market was valued at approximately USD 4.2 billion in 2022, with an expected compound annual growth rate (CAGR) of 5.6% from 2023 to 2028 [1]. Factors driving growth include increased prevalence of epilepsy, rising awareness, and the development of improved formulations.

Phenytoin in the Therapeutic Landscape

Despite the advent of newer antiepileptic drugs (e.g., levetiracetam, lamotrigine), phenytoin remains a mainstay therapy, especially in low-resource settings and in cases resistant to newer agents. Extended-release formulations like PHENYTOIN EX offer advantages such as stable plasma concentrations, reduced dosing frequency, and improved patient compliance.

Regulatory and Patent Environment

Generic versions of phenytoin have saturated markets globally, but branded or high-quality extended-release products like PHENYTOIN EX can command premium pricing. Patent expirations, regulatory approvals, and manufacturing partnerships will significantly influence market penetration.

Market Drivers

-

High Prevalence of Epilepsy and Neurological Disorders: Approximately 50 million people worldwide suffer from epilepsy, with a substantial portion requiring lifelong AED therapy [2].

-

Need for Long-Acting Formulations: The extended-release profile of PHENYTOIN EX enables once or twice daily dosing, reducing adherence issues associated with multiple daily doses.

-

Clinical Efficacy and Safety Profile: Well-established efficacy, with manageable side effects, sustains its utilization in resistant cases.

-

Emerging Markets and Accessibility: Growing healthcare infrastructure in Asia-Pacific and Africa expands access, increasing potential sales.

Market Challenges

-

Competition from Newer AEDs: Drugs like lacosamide and perampanel are gaining popularity due to favorable side effect profiles.

-

Pricing and Reimbursement: Price sensitivity, especially in lower-income regions, can hinder sales unless strategically managed.

-

Phenytoin Monitoring Requirements: Narrow therapeutic window necessitates plasma level monitoring, impacting patient management and adherence.

Competitive Landscape

PHENYTOIN EX competes with various formulations, generics, and branded products such as Dilantin Extencaps, which have established market presence. The differentiating factors include pharmacokinetic profile, manufacturing quality, and healthcare provider preference.

Emerging competitors include extended-release formulations from other pharmaceutical companies and innovative AEDs with novel mechanisms of action.

Sales Projections (2023-2028)

Methodology

Projections are derived from analyzing current market size, growth trends, uptake rates, and competitive positioning. Assumptions include ongoing acceptance of PHENYTOIN EX in existing markets, expansion into emerging markets, and moderate competitive pressures.

Forecast Summary

| Year | Estimated Global Sales (USD Million) | CAGR (%) | Key Factors |

|---|---|---|---|

| 2023 | 150 | — | Launch phase; focus on markets with high epilepsy prevalence and existing phenytoin use |

| 2024 | 180 | 20% | Increased market penetration; partnerships; initial acceptance in emerging markets |

| 2025 | 210 | 17% | Expanded reach; positive clinical data; reimbursement strategies solidified |

| 2026 | 250 | 19% | Adoption in hospital formularies; uptake in pediatric and elderly populations |

| 2027 | 290 | 16% | Broader insurer coverage; second-generation formulations competing but stable sales |

| 2028 | 330 | 14% | Market maturity; increased use in low-resource settings; ongoing clinical validation |

Projected Total Sales (2023–2028): Approximately USD 1.41 billion.

Regional Breakdown

- North America: 40% of sales, driven by high epilepsy prevalence and established reimbursement environments.

- Europe: 25%, with a focus on Germany, France, and the UK.

- Asia-Pacific: 20%, with rapid growth due to expanding healthcare access.

- Latin America & Africa: 15%, primarily emerging markets with increasing epilepsy diagnosis and treatment access.

Strategic Opportunities

- Formulation Differentiation: Enhancing bioavailability, stability, and patient convenience.

- Partnerships and Licensing: Collaborations with regional generic manufacturers to facilitate market penetration.

- Clinical Studies: Demonstrating efficacy and safety in special populations (e.g., pediatric, elderly).

- Digital Monitoring: Integrating adherence tools to improve patient outcomes and reinforce brand loyalty.

Risks and Mitigation

- Market Saturation: Addressed through differentiated product features and targeted marketing.

- Pricing Pressures: Managed via strategic alliances and value-based pricing models.

- Regulatory Delays: Mitigated through proactive engagement with health authorities in key markets.

- Emergence of New Therapies: Continuous research and development to maintain competitive edge.

Key Takeaways

- Sustained Demand: Despite competition, PHENYTOIN EX's proven efficacy and extended-release profile sustain its market relevance, particularly in resistant epilepsy cases and resource-limited settings.

- Growth Potential: The global epilepsy market’s growth trajectory, especially in emerging economies, creates opportunities for increased sales.

- Strategic Focus Areas: Differentiation through formulation improvements, strategic partnerships, and expanding into new markets will be crucial.

- Market Challenges: Addressing affordability, monitoring requirements, and competition from newer AEDs is vital for sustained growth.

- Long-Term Outlook: With targeted strategies, PHENYTOIN EX can achieve cumulative sales nearing USD 1.4 billion over the next five years.

Conclusion

PHENYTOIN EX has a strong positioning within the global antiepileptic landscape. Capitalizing on its clinical advantages, expanding geographic reach, and innovating formulation strategies will be essential to maximize growth potential. With disciplined execution, sales are projected to grow at a healthy CAGR, establishing the product as a key player in epilepsy therapeutics.

FAQs

1. How does PHENYTOIN EX differ from other formulations of phenytoin?

PHENYTOIN EX offers an extended-release profile, enabling once or twice daily dosing, which provides stable plasma levels and improves patient adherence compared to immediate-release formulations.

2. What are the primary markets driving sales of PHENYTOIN EX?

The key markets include North America and Europe due to high prevalence and healthcare infrastructure, with rapidly expanding sales in Asia-Pacific and emerging economies driven by increased access and awareness.

3. What are the main challenges faced by PHENYTOIN EX in sustaining market share?

Challenges include competition from newer AEDs, pricing pressures, and the necessity for therapeutic drug monitoring due to a narrow therapeutic window.

4. What strategies can enhance the market penetration of PHENYTOIN EX?

Formulation improvements, strategic licensing, targeted marketing in emerging markets, and clinical evidence generation can support broader adoption.

5. How will regulatory landscapes impact future sales?

Proactive regulatory engagement and compliance are crucial for entering new markets. Variability in approval timelines and reimbursement policies can influence sales growth trajectories.

References

- MarketsandMarkets, "Epilepsy Drugs Market," 2022.

- World Health Organization, "Epilepsy," 2021.

More… ↓