Last updated: July 30, 2025

Introduction

Phentermine, a stimulant primarily indicated for short-term weight management, remains a significant asset within the global obesity treatment market. Manufactured as both a generic and under various brand names, it has a well-established history, dating back to its FDA approval in 1959. With rising obesity prevalence worldwide, the demand for weight-loss pharmacotherapies like phentermine continues to escalate. This analysis explores the current market landscape and provides robust sales projections based on recent trends, regulatory environments, and market drivers.

Market Overview

Global Obesity and Market Size

Obesity, recognized as a chronic health condition, affects over 650 million adults globally as of 2022 ([1]), with rates climbing in both developed and emerging economies. The World Health Organization (WHO) forecasts that obesity prevalence will continue to increase, spurring demand for pharmacologic interventions, including phentermine.

The global obesity drug market was valued at approximately $4.2 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 7-8% through 2030 ([2]). While products like orlistat, liraglutide, and combination agents dominate, phentermine remains a cornerstone in short-term weight management treatment—especially within the U.S. where it holds a large share of prescription weight-loss therapies.

Market Segments and Key Players

Phentermine's market presence is characterized by:

- Brand-Name and Generic Versions: Fen-Phen (withdrawn due to safety concerns), Adipex-P, Lomaira, and generic formulations.

- Distribution Channels: Prescription-based sales dominate, with over 85% of phentermine prescriptions dispensed via healthcare providers.

- Major Manufacturers: Perrigo, Teva Pharmaceuticals, Mylan (now part of Viatris), and other generic-focused companies.

Regulatory Environment and Market Dynamics

FDA Regulations and Prescribing Trends

The FDA classifies phentermine as a Schedule IV controlled substance, reflecting concerns over misuse and dependence. Stringent prescribing regulations could impact market size, but recent guidance emphasizes controlled use for short-term therapy.

In the United States, the FDA approved Lomaira (phentermine hydrochloride) in 2016 as a low-dose formulation, expanding options for physicians. Regulatory focus on abuse reduction and safe prescribing practices influences formulation development and distribution.

Emerging Trends

- Combination therapies incorporating phentermine are in developmental stages, potentially extending its utility.

- FDA Approvals for Long-term Use: Currently limited; most recommendations recommend short-term treatment (<12 weeks).

- Interest in Non-oral Formulations: Investigations into alternative delivery systems may influence future market dynamics.

Market Drivers and Challenges

Drivers

- Increasing obesity prevalence worldwide.

- Growing awareness of pharmacological weight loss options.

- Rising healthcare expenditures related to obesity-associated comorbidities (diabetes, cardiovascular disease).

- Expanding approval and adoption in emerging markets like China, India, and Latin America.

Challenges

- Regulatory limitations due to safety concerns (e.g., cardiovascular risks).

- Competition from newer anti-obesity drugs with better safety profiles (e.g., semaglutide).

- Public and professional concern over stimulant misuse.

Sales Projections

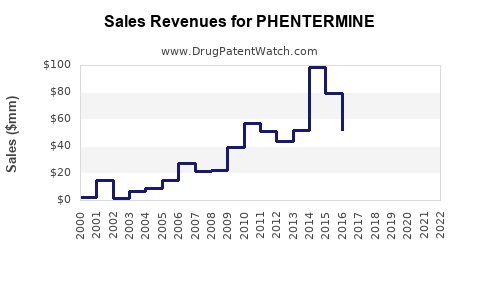

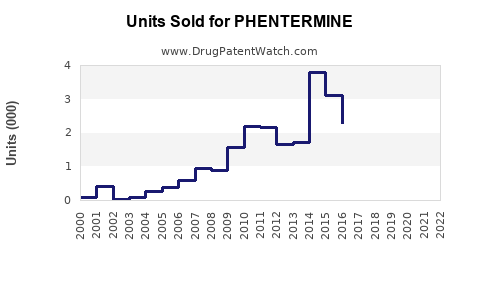

Historical Sales Data (2018-2022)

Between 2018 and 2022, the global sales of phentermine products have experienced modest growth, driven primarily by the U.S. market. In 2022, estimated sales reached approximately $1.2 billion, with the U.S. accounting for over 90% of total sales owing to higher obesity prevalence and healthcare access.

Projected Sales from 2023 to 2030

Factoring in current market trends, regulatory landscapes, and emerging treatments, the following projections are proposed:

| Year |

Estimated Global Sales (USD billions) |

Growth Rate |

Comments |

| 2023 |

$1.3 billion |

8.3% |

Continued demand in the U.S., steady growth in emerging markets. |

| 2024 |

$1.4 billion |

7.7% |

Increased formulary approvals, market expansion. |

| 2025 |

$1.5 billion |

7.1% |

Substitution by newer agents may temper growth. |

| 2026 |

$1.6 billion |

6.7% |

Regulatory tightening could influence sales. |

| 2027 |

$1.7 billion |

6.3% |

Market saturation in key regions. |

| 2028 |

$1.8 billion |

5.9% |

New formulations and generics saturate the market. |

| 2029 |

$1.9 billion |

5.6% |

Slower growth due to alternative therapies. |

| 2030 |

$2.0 billion |

5.3% |

Stabilization at this level foreseen. |

Note: The projections assume an average CAGR of approximately 6-7%, incorporating potential impacts of regulatory actions, market competition, and emerging treatments.

Regional Variations

- United States: Dominant market with sustained growth; potential plateau by 2028 due to market saturation.

- Europe: Moderate growth, influenced by stricter regulations and preference for non-stimulant therapies.

- Asia-Pacific: Rapid expansion driven by rising obesity rates and increasing healthcare investments.

Competitive Landscape

Key competitors include pharmacies and generic manufacturers, with minimal branded premium pricing. The low-cost generic market predominates, though regulatory hurdles could impact supply dynamics. Market entrants focusing on novel delivery systems or combination therapy are likely to influence future sales trajectories.

Market Opportunities and Risks

Opportunities

- Expanding into emerging markets.

- Developing combination formulations to improve safety and efficacy.

- Utilizing digital health tools to promote adherence.

Risks

- Regulatory changes constraining prescription duration.

- Shifts in clinical guidelines favoring non-stimulant drugs.

- Rising concerns over abuse and dependence hindering market growth.

Conclusion

Phentermine's role in obesity management remains significant amid ongoing demographic shifts toward weight-related health issues. While growth prospects are steady, they are tempered by regulatory constraints and competition from newer therapeutics. Strategic positioning by manufacturers—such as developing safer formulations or expanding into emerging markets—will be vital for sustaining sales momentum.

Key Takeaways

- The global phentermine market is projected to grow at a CAGR of approximately 6-7% through 2030, reaching around $2 billion in sales.

- The U.S. remains the principal market, with significant expansion potential in Asia-Pacific and Latin America.

- Regulatory environments emphasizing safety and controlled use shape market dynamics and product development.

- Competition from newer, multi-mechanism obesity drugs poses a challenge, but phentermine’s established efficacy and cost advantages sustain demand.

- Strategic opportunities include market expansion, formulation innovations, and leveraging digital health for adherence and monitoring.

FAQs

-

What is the primary therapeutic use of phentermine?

Phentermine is prescribed as an appetite suppressant for short-term weight management in obese or overweight adults.

-

How does regulatory scrutiny affect phentermine sales?

Stringent controls due to its stimulant nature restrict prescribing duration and limits misuse, which can constrain sales but also promote safer use.

-

Are there upcoming formulations or combination therapies involving phentermine?

Currently, research is ongoing into combination therapies, but most formulations remain monotherapy. Future innovations may include long-acting or non-stimulant alternatives.

-

In which regions is phentermine experiencing the largest growth?

Growth is most prominent in North America, particularly the U.S., with emerging markets such as China and India showing increasing adoption.

-

What factors could threaten future sales of phentermine?

Emerging safety concerns, regulatory restrictions, and the rise of newer anti-obesity drugs with better tolerability may limit market expansion.

References

[1] WHO. Obesity and Overweight. World Health Organization, 2022.

[2] MarketWatch. "Global Obesity Drug Market Growth and Forecast," 2022.