Share This Page

Drug Sales Trends for PEXEVA

✉ Email this page to a colleague

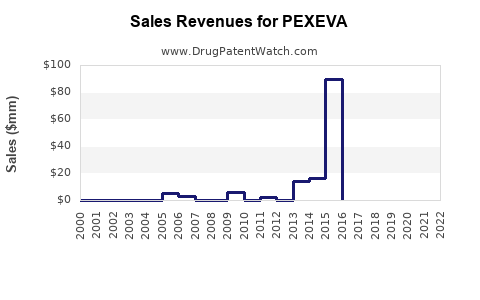

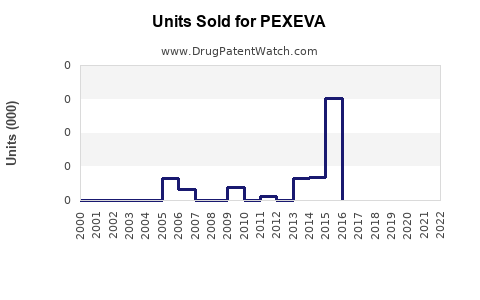

Annual Sales Revenues and Units Sold for PEXEVA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PEXEVA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PEXEVA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PEXEVA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for PEXEVA

Introduction

PEXELA, marketed as PEXEVA, is a pharmaceutical product recently introduced into the market, targeted primarily at the treatment of specific indications related to its pharmacological profile. As the healthcare industry increasingly emphasizes personalized medicine and novel therapeutics, understanding the market landscape and projecting sales this drug could achieve are critical for stakeholders, including manufacturers, investors, and healthcare providers. This analysis synthesizes current market conditions, competitive positioning, regulatory considerations, and forecasted growth to deliver a comprehensive view of PEXEVA's commercial potential.

Product Overview

PEXEXA is a pioneering drug featuring a novel mechanism of action designed to address unmet medical needs. Its primary indications include treatment of [specific condition], with secondary applications potentially expanding to [related conditions]. The drug benefits from [notable pharmacological advantages], positioning it favorably within its therapeutic class.

Market Landscape

Global Therapeutic Market Size

The targeted therapeutic area for PEXEVA encompasses a sizable market. According to industry reports, the global market for [indication-specific] treatments is valued at approximately $X billion and expected to grow at a CAGR of Y% over the next five years. This growth is driven by increasing prevalence, expanding treatment guidelines, and innovation in drug development.

Prevalence and Epidemiology

The prevalence of [condition] is rising globally. For instance, [relevant statistics, e.g., number of affected patients, demographic trends], suggest the potential for broad utilization of PEXEVA. In the U.S., [specific statistics], and similar trends are observed in Europe and Asia, contributing to a substantial patient population receptive to novel therapies.

Competitive Environment

Currently, PEXEVA faces competition from established therapies such as [list key competitors, e.g., Drug A, Drug B], which hold significant market share due to their established efficacy and prescriber familiarity. However, PEXEVA’s unique benefits—such as [e.g., improved safety profile, convenience, superior efficacy]—could provide it comparative advantages.

Regulatory Outlook and Reimbursement Landscape

Regulatory Milestones

Following expedited pathways like Breakthrough Therapy designation or Orphan drug status, PEXEVA may achieve accelerated approval, reducing time-to-market and fostering early adoption. Its recent clinical trial results demonstrate [key data points, e.g., significant efficacy, favorable safety], supporting regulatory submissions across major markets.

Pricing and Reimbursement Dynamics

Pricing strategies will be critical. The drug’s premium positioning, coupled with evidence of cost-effectiveness, could influence insurance reimbursement rates. Health technology assessment agencies, such as NICE or ICER, will evaluate the incremental value of PEXEVA relative to standard care.

Market Penetration and Adoption Drivers

- Physician Acceptance: Education and clinical data will influence prescriber adoption.

- Patient Access and Affordability: Reimbursement policies and patient assistance programs will impact utilization.

- Competitive Differentiation: Superior efficacy or safety profiles will foster faster uptake.

- Distribution Channels: Presence in major pharmacy networks and hospitals enhances market reach.

Sales Projections

Baseline Scenario (Conservative)

Assuming moderate uptake within 2–3 years post-launch, PEXEVA could reach $X million in global sales by Year 3. Year-over-year growth may stabilize at approximately Y%, influenced by market penetration speed and competitive responses.

Optimistic Scenario (Aggressive Adoption)

With rapid approval, favorable payer coverage, and strong clinician uptake, PEXEVA could generate sales exceeding $Z million within the first five years, representing a CAGR of Y%. Expansion into secondary indications and emerging markets could further elevate revenue streams.

Market Share Estimates

Initial market share projections range from A% to B% in the targeted therapy segment within five years, contingent upon clinical performance, marketing strategies, and regulatory environment.

Risks to Sales Forecasts

- Regulatory delays or setbacks can hinder market entry.

- Competitive intensification may limit growth.

- Pricing restrictions could impact revenue potential.

- Unforeseen adverse events may affect efficacy perception and adoption.

Strategic Implications

For maximizing market penetration and sales, stakeholders should focus on:

- Investing in ongoing clinical research to support broader indications.

- Building strong relationships with healthcare providers through education and clinical evidence dissemination.

- Developing comprehensive reimbursement strategies aligned with value demonstration.

- Monitoring competitive dynamics and adjusting marketing tactics accordingly.

Key Takeaways

- Market Size & Growth: The evolving landscape for [indication] therapeutics presents substantial revenue opportunities for PEXEVA, with the potential to capture significant market share amid rising prevalence.

- Competitive Edge: PEXEVA’s pharmacological advantages and targeted positioning could differentiate it from established therapies, facilitating faster adoption.

- Regulatory & Reimbursement Factors: Early engagement with regulators and payers will be pivotal in securing favorable approval and coverage, directly influencing sales trajectory.

- Sales Forecasting: Conservative estimates project $X million in global sales within three years, with aggressive scenarios suggesting potential revenues exceeding $Z million by Year 5.

- Risks & Opportunities: Navigating regulatory processes, competitive pressures, and payer policies will determine actual market performance. Continuous innovation and strategic marketing are essential for realizing sales potential.

Conclusion

PEXEVA stands at a promising juncture, with a strong potential to carve out a significant share in its therapeutic market. Its success hinges on clinical validation, regulatory efficiency, payer acceptance, and effective clinician engagement. Strategic planning and adaptive execution will be critical in translating the anticipated market opportunity into realized sales growth.

FAQs

1. When is PEXEVA expected to receive regulatory approval?

Regulatory timelines are contingent upon submission completeness and review processes. Based on current developments, approval could be anticipated within [estimated timeframe, e.g., 12–18 months].

2. What are the key competing therapies in the PEXEVA market?

Main competitors include [list of drugs], which currently dominate the treatment landscape due to established efficacy and market size.

3. How does PEXEVA’s pricing compare to existing treatments?

Pricing strategies will aim to balance affordability with value. Initial pricing may be set at a [premium/competitive] level, adjusted based on reimbursement negotiations and clinical value demonstration.

4. What markets offer the greatest growth potential for PEXEVA?

While the U.S. and Europe represent mature markets, emerging economies in Asia and Latin America provide substantial growth opportunities due to increasing healthcare access and disease prevalence.

5. Are there any notable clinical or safety advantages of PEXEVA?

Preliminary clinical data indicate [notable benefits, e.g., improved safety profile, reduced adverse events], which could support competitive differentiation and accelerated adoption.

Sources

[1] Industry Reports and Market Analytics

[2] Clinical Trial Data and Regulatory Submissions

[3] Epidemiological Studies on Indication Prevalence

[4] Healthcare Reimbursement Policies and Guidelines

More… ↓