Share This Page

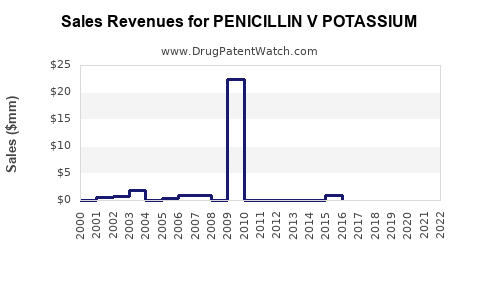

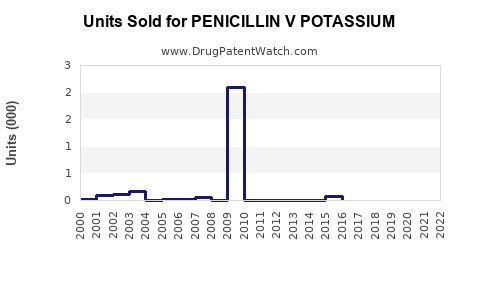

Drug Sales Trends for PENICILLIN V POTASSIUM

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for PENICILLIN V POTASSIUM

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PENICILLIN V POTASSIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PENICILLIN V POTASSIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PENICILLIN V POTASSIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PENICILLIN V POTASSIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| PENICILLIN V POTASSIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| PENICILLIN V POTASSIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Penicillin V Potassium

Introduction

Penicillin V potassium, also known as phenoxymethylpenicillin, is a widely used oral antibiotic effective against a broad spectrum of bacterial infections, notably streptococcal pharyngitis, sinusitis, skin infections, and other respiratory tract infections. As one of the oldest antibiotics still in mainstream use, its market dynamics are influenced by factors including antibiotic resistance, prescribing trends, regulatory developments, and emerging alternative therapies. This analysis offers a comprehensive review of the current market landscape and projected sales trends for Penicillin V potassium over the next five years.

Market Overview

Global Market Size and Growth Dynamics

The global antibiotic market is projected to reach approximately $60 billion by 2025, with beta-lactam antibiotics, including penicillins, comprising a significant segment.[1] Penicillin V potassium accounts for an estimated 15-20% share within the oral antibiotic sector due to its longstanding history, cost-effectiveness, and established efficacy.

The increasing prevalence of bacterial infections driven by population growth, urbanization, and aging demographics sustains demand. Additionally, the rising incidence of streptococcal infections and skin bacterial infections in both developed and developing nations supports steady consumption.

However, antibiotic stewardship programs and increasing awareness of antimicrobial resistance (AMR) are gradually impacting prescribing behaviors, subtly restraining growth. This is particularly evident in high-income countries where judicious use policies are more stringently implemented.

Key Markets and Regional Dynamics

-

North America: The largest market, characterized by high prescription rates for oral antibiotics. The U.S. alone accounts for nearly 40% of global antibiotic sales, driven by a high prevalence of bacterial respiratory infections and established healthcare infrastructure.[2]

-

Europe: The second-largest market, with increasing emphasis on antimicrobial stewardship, leading to more conservative prescribing of penicillins. Nevertheless, Penicillin V remains a first-line therapy in many European countries.

-

Asia-Pacific: Exhibits high growth potential due to expanding healthcare infrastructure, increasing bacterial infection rates, and a large population. Developing nations like India and China are experiencing burgeoning demand, although regulatory challenges persist.

-

Rest of the World: Markets like Latin America, Africa, and the Middle East show moderate demand, influenced by healthcare access disparities and local treatment guidelines.

Competitive Landscape

Multiple pharmaceutical companies produce Penicillin V potassium, ranging from major multinational corporations to regional generic manufacturers. Market leaders include GlaxoSmithKline, Sandoz, and Teva Pharmaceuticals, primarily engaged through generic APIs and formulations.[3]

Patent expirations for established antibiotics have facilitated generic proliferation, resulting in price competition. However, limited differentiation has kept margins low and concentration of manufacturers highly competitive.

Emerging trends favor generic manufacturers expanding their product portfolios and strategic alliances with regulatory bodies to ensure market access.

Regulatory and Prescribing Trends

Global stewardship initiatives promote reduction of unnecessary antibiotic use, which could temper sales growth. Guidelines increasingly endorse narrow-spectrum antibiotics like Penicillin V for specific indications, supporting its role when appropriate.

In some regions, new regulatory pathways facilitate faster approval and renewal processes, fostering market entry for generic formulations.

Sales Projections (2023-2028)

Baseline Scenario

Considering current demand, regulatory environment, and the influence of antimicrobial resistance, the global sales of Penicillin V potassium are projected to grow modestly, averaging 3-4% annually over the next five years. Growth drivers include expanding markets in Asia-Pacific, generic sales expansion, and ongoing healthcare infrastructure development.

Quantitative Forecast

- 2023: Estimated sales of approximately $1.2 billion globally.

- 2024: Growth to around $1.24 billion.

- 2025: Approaching $1.28 billion, with stabilization effects due to stewardship programs.

- 2026: Slight acceleration to $1.33 billion, driven by emerging markets.

- 2027: Reaching $1.38 billion, as antibiotic consumption stabilizes regionally.

- 2028: Marginal increase to $1.43 billion.

Factors Influencing Sales

- Antibiotic stewardship: Stricter guidelines may reduce prescribing, especially in high-income settings.

- Emerging resistance: Growing resistance to penicillin in certain bacterial strains could limit its use.

- Market penetration: Increased accessibility and affordability in developing countries could stimulate demand.

- Regulatory developments: Streamlined approval processes for generics may enhance supply.

Strategic Considerations for Industry Stakeholders

- Innovation: Focus on formulations that address resistance or improve compliance.

- Market expansion: Target developing countries with growing bacterial infection burdens.

- Regulatory engagement: Navigate evolving policies efficiently to ensure market access.

- Cost leadership: Maintain competitive pricing through optimized manufacturing.

Conclusion

While Penicillin V potassium maintains a vital role as a first-line antibiotic, market growth will likely remain modest influenced by antimicrobial resistance and stewardship policies. The outlook remains cautiously optimistic, especially with expanding access in emerging markets. Stakeholders should focus on strategic regulatory navigation, value-driven product positioning, and addressing resistance patterns to maximize commercial opportunities.

Key Takeaways

-

Steady Demand with Modest Growth: The global Penicillin V potassium market is expected to grow at 3-4% annually, supported by emerging economies and generic proliferation.

-

Regional Variability: North America and Europe dominate current sales, but Asia-Pacific presents significant upside potential driven by expanding healthcare infrastructure.

-

Impact of Resistance and Stewardship: Growing antimicrobial resistance and stewardship initiatives constrain growth but also create opportunities for formulations addressing resistance or improving adherence.

-

Market Entry and Competition: Generic manufacturers will continue to dominate, intensifying price competition; innovation and strategic positioning are critical.

-

Regulatory Landscape: Evolving policies streamline approval processes but demand vigilant compliance to sustain market access.

FAQs

1. How does antimicrobial resistance affect the future of Penicillin V potassium?

Rising resistance, particularly in Streptococcus pneumoniae and other pathogens, could limit Penicillin V's effectiveness, prompting clinicians to turn to alternative or broader-spectrum antibiotics, thereby potentially reducing sales over time.

2. What are the primary drivers for market growth in emerging economies?

Growing access to healthcare, increasing bacterial infection burdens, government health initiatives, and lower pricing through generics are key drivers in emerging markets like India and China.

3. How significant is the impact of antibiotic stewardship programs on Penicillin V sales?

Stewardship efforts promote judicious antibiotic use, often favoring narrow-spectrum agents like Penicillin V in appropriate cases, which could moderate overall growth but support its continued relevance in first-line therapy.

4. Are there new formulations or derivatives of Penicillin V expected to influence the market?

Currently, no major novel formulations are projected; however, sustained innovation in formulations that enhance compliance or address resistance may provide future growth avenues.

5. What strategic moves should pharmaceutical companies consider to sustain Penicillin V sales?

Companies should focus on expanding access in developing markets, engagement with regulatory agencies for streamlined approvals, cost-competitive manufacturing, and innovation targeting resistance challenges.

Sources

- Statista. (2022). Global Antibiotic Market Report.

- IQVIA. (2022). Global Antibiotic Market Trends.

- EvaluatePharma. (2022). Top Antibiotic Manufacturers.

More… ↓