Share This Page

Drug Sales Trends for PAXIL CR

✉ Email this page to a colleague

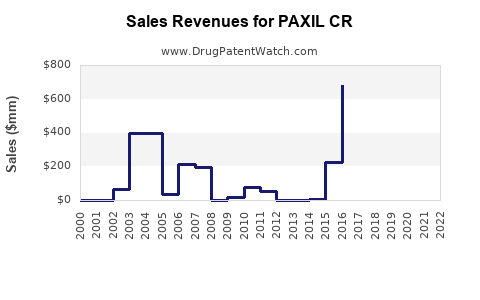

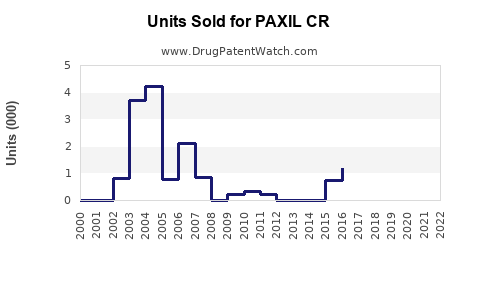

Annual Sales Revenues and Units Sold for PAXIL CR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PAXIL CR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PAXIL CR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PAXIL CR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PAXIL CR | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| PAXIL CR | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for PAXIL CR

Introduction

PAXIL CR (paroxetine controlled-release), a serotonin reuptake inhibitor, is a well-established pharmaceutical used primarily for major depressive disorder, generalized anxiety disorder, social anxiety disorder, and obsessive-compulsive disorder. Since its FDA approval in 2001, PAXIL CR has maintained a significant market share within the antidepressant class. This analysis explores current market dynamics, competitive positioning, regulatory considerations, and long-term sales projections, providing strategic insights for stakeholders.

Market Landscape Overview

The global antidepressant market was valued at approximately USD 16 billion in 2022, with selective serotonin reuptake inhibitors (SSRIs) representing the dominant segment, accounting for nearly 70% of the market share [1]. PAXIL CR, as a branded SSRI, benefits from established efficacy, physician familiarity, and patient adherence advantages due to its once-daily formulation.

Market Drivers

- Prevalence of Mental Health Disorders: According to WHO, over 264 million people suffer from depression worldwide, underscoring sustained demand for effective pharmacotherapies [2].

- Growing Awareness and Reduced Stigma: Increased mental health awareness and destigmatization have expanded treatment acceptance.

- Advanced Formulations and Patient Compliance: Controlled-release formulations enhance adherence by reducing dosing frequency and minimizing side effects.

Market Challenges

- Generic Competition: The patent for PAXIL CR expired in multiple jurisdictions between 2012-2014, enabling generics to enter at significant price points, exerting downward pressure on sales.

- Emergence of Newer Agents: The introduction of novel antidepressants, including SNRI agents and atypical antidepressants, offers alternative options, vying for market share.

- Regulatory and Safety Profiles: Concerns over SSRI-related adverse effects, such as sexual dysfunction and withdrawal, influence prescribing habits.

Competitive Positioning

Despite the impact of generics, PAXIL CR remains relevant due to brand loyalty, documented efficacy, and favorable pharmacokinetics. Key competitors include:

- Generic Paroxetine: Significantly cheaper, accounting for a large proportion of prescriptions.

- Other Branded SSRIs: Prozac (fluoxetine), Zoloft (sertraline), Lexapro (escitalopram) garner substantial market share.

- Novel Agents: Brexpiprazole, vortioxetine, and vilazodone offer alternative mechanisms, tapping into unmet needs such as faster onset or improved tolerability.

Regulatory and Patent Landscape

The expiration of patents spanning 2012-2014 allowed generic manufacturers wide market entry, reducing PAXIL CR’s revenue streams. However, some formulations or dosing regimens remain under patent protection or data exclusivity, enabling brand retention in certain markets.

Regulatory developments, including the FDA’s emphasis on drug safety and post-marketing surveillance, influence formulations and marketing strategies. Label updates reflecting safety risks have been issued; these may influence prescriber and patient preferences.

Historical Sales Performance

From a peak in the mid-2000s, sales of PAXIL CR declined sharply post-generic entry. For example:

- 2007: Estimated global sales exceeded USD 1 billion [3].

- 2012-2014: Post-patent expiry, sales dropped precipitously, with estimates falling below USD 300 million globally.

- Recent Years: Stabilized at moderate levels via retention in specific niches or markets with limited generic penetration, such as Japan and certain European countries.

Future Sales Projections

Short-Term Outlook (Next 3-5 Years)

- Stable Demand in Select Markets: In regions with limited generic access, PAXIL CR could sustain sales of USD 100-150 million annually.

- Market Share Shift to Generics: In mature markets, sales are projected to decline further, potentially stabilizing around USD 50-75 million due to stockpiling or off-label uses.

Medium to Long-Term Projections (5-10 Years)

- Market Contraction: Given prevailing generic competition, sales are expected to diminish steadily, approaching the USD 20-50 million range unless new formulations or indications are introduced.

- Potential for Niche Uptake: Continued use in specific indications or populations (e.g., pediatric, geriatric) may offer marginal growth opportunities.

- Pipeline and Formulation Innovations: If a reformulation with improved safety or efficacy is introduced, it could extend the lifecycle.

Influencing Factors

- Regulatory Changes: Stringent post-marketing safety requirements could impact formulations.

- Market Trends: Increasing preference for psychotherapies and newer medications may further erode market share.

- Patent Strategies: Use of secondary patents or formulation exclusivity could temporarily bolster sales.

Strategic Recommendations

- Focus on Niche Markets: Target markets or indications where generics are less prevalent.

- Invest in Lifecycle Extension: Develop reformulations or combination therapies.

- Leverage Brand Loyalty: Engage with prescribers through evidence-based marketing emphasizing efficacy and safety.

- Monitor Competitive Movements: Stay vigilant on emerging therapies to adapt marketing and R&D strategy.

Key Takeaways

- Market Dynamics Are Shifting: Post-patent expiry, PAXIL CR faces significant generic competition, leading to a steady decline in sales.

- Regional Variations Persist: Certain markets with regulatory, prescribing, or reimbursement barriers continue to sustain higher sales levels.

- Innovation Is Critical: Future opportunities hinge on reformulation, combination therapies, or new indications.

- Long-Term Sales Are Likely to Decline: Absent significant lifecycle extensions, PAXIL CR’s sales will continue to diminish over the next decade.

- Strategic Focus Should Be Niche-Driven: Stakeholders should emphasize specialized markets, chronic patients, and markets with limited generic penetration.

FAQs

Q1: How does generic competition impact PAXIL CR's market share?

Generic availability has caused a sharp decline in PAXIL CR's sales since patent expirations, shifting volume toward cost-effective formulations. The brand retains residual loyalty in certain markets, but overall market share diminishes as physicians and patients opt for generics.

Q2: Are there any recent developments to extend PAXIL CR’s market lifespan?

Limited reforms, such as formulation improvements or new indications, could provide temporary sales boosts. Currently, no significant lifecycle extension strategies have been publicly announced.

Q3: Which regions are most likely to sustain PAXIL CR sales?

Japan, European countries with restrictive patent enforcement or slow generic adoption, and certain emerging markets with lower healthcare modernization levels may sustain relatively higher sales.

Q4: How do emerging antidepressants affect PAXIL CR sales projections?

Novel agents with better safety profiles, Faster onset, or additional therapeutic benefits target unmet needs and are decreasing the market share of older agents like PAXIL CR.

Q5: What are the key regulatory considerations for PAXIL CR moving forward?

Regulatory bodies emphasizing post-market safety data and alternative formulations may impose additional requirements, influencing future formulations, marketing activities, and sales trajectories.

References

[1] MarketWatch, "Antidepressants Market Size & Trends," 2022.

[2] WHO, "Depression Fact Sheet," 2022.

[3] IQVIA, "Global Pharma Sales Data," 2012-2014.

More… ↓