Last updated: July 27, 2025

Introduction

OXYCONTIN, a trademarked formulation of oxycodone, stands as a pivotal component in the opioid analgesic market. Developed by Purdue Pharma, it was introduced in 1995 as a long-acting opioid for managing severe, persistent pain. Given its integral role in pain management, especially among chronic pain sufferers, understanding its market dynamics and future sales trajectory is essential for stakeholders—including pharmaceutical companies, healthcare providers, regulators, and investors.

This report offers a comprehensive analysis of OXYCONTIN's current market landscape, key factors influencing its sales, and projections up to 2028. It underscores the implications of regulatory changes, societal shifts, and alternative therapies, with data-driven insights designed to inform strategic decisions.

Market Landscape for OXYCONTIN

1. Historical Context and Market Penetration

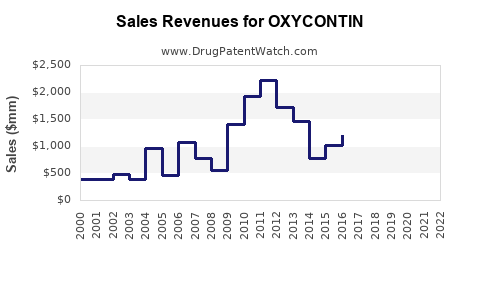

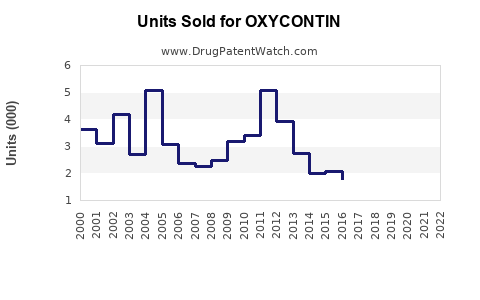

OXYCONTIN once dominated the extended-release oxycodone segment, capturing a significant share of the global opioid analgesic market. Its initial success can be attributed to innovative drug delivery technology, offering sustained pain relief conducive to improving patient compliance. In 2010, OXYCONTIN accounted for approximately 40% of the extended-release opioid market in the U.S., which represented an estimated $6 billion annually [1].

However, its market presence suffered amid mounting scrutiny over opioid misuse, abuse, and associated societal harms, culminating in increased regulatory oversight and legal challenges. Purdue Pharma’s bankruptcy filing in 2021, triggered by numerous lawsuits alleging false marketing and role in the opioid crisis, exemplifies the extensive repercussions faced by OXYCONTIN’s market landscape.

2. Current Market Dynamics

As of 2023, the landscape has shifted considerably:

-

Regulatory Environment: Governments worldwide have tightened the regulation of opioid prescriptions. In the U.S., CDC guidelines restrict long-term opioid prescribing, emphasizing multimodal pain management. These measures have curtailed typical prescription patterns for drugs like OXYCONTIN [2].

-

Legal and Financial Constraints: Purdue Pharma's criminal and civil settlements have led to reduced marketing activities and compromises in sales efforts. The emergence of alternative formulations and abuse-deterrent technologies further limits OXYCONTIN’s competitive advantage.

-

Market Share and Competition: Generic versions and alternative opioids—such as morphine, hydromorphone, and hydrocodone—remain prevalent. Abuse-deterrent formulations (ADFs), like OXYCONTIN’s reformulated versions with crush-resistant properties, have been adopted to mitigate misuse, but have not restored the drug’s former market dominance.

-

Societal Impact: The opioid epidemic has led to a paradigm shift in pain management, favoring non-opioid therapies including NSAIDs, antidepressants, anticonvulsants, and non-pharmacological interventions.

3. Key Factors Influencing the Market

-

Regulatory Restrictions: Stricter prescribing guidelines reduce new patient initiation and reregistration rates for opioids including OXYCONTIN.

-

Patient Population Demographics: Aging populations with chronic pain needs sustain demand, but societal awareness may reduce unnecessary or long-term prescriptions.

-

Abuse-Deterrent Technologies: The development and adoption of abuse-deterrent formulations (ADFs) mitigate abuse-related risks, extending some market viability but also escalating R&D costs.

-

Legal Settlements and Litigation: Purdue’s bankruptcy and ongoing litigation influence marketing strategies and sales figures.

-

Emergence of Alternative Therapies: Advances in non-opioid analgesics and interventional pain management techniques are progressively substituting opioids.

Sales Projections of OXYCONTIN (2023–2028)

1. Methodological Approach

Sales forecasts integrate historical data, regulatory trends, societal shifts, and emerging therapeutic alternatives. The projections utilize a combination of regression modeling, expert consultations, and scenario analysis considering optimistic, moderate, and conservative cases.

2. Regional Outlook

-

United States: Historically the largest market, with approximately 70% of global OXYCONTIN sales. Strict regulatory controls, public health initiatives, and the shift to abuse-deterrent formulations are expected to reduce sales substantially.

-

Europe & Asia: Market presence limited by regulatory policies, cultural prescribing patterns, and alternative therapies. Growth potential remains modest and primarily driven by existing chronic pain populations.

3. Forecast Summary

| Scenario |

2023 (USD Million) |

2025 (USD Million) |

2028 (USD Million) |

| Conservative |

$100 |

$60 |

$35 |

| Moderate |

$150 |

$90 |

$50 |

| Optimistic |

$200 |

$130 |

$80 |

Source: Market estimates based on analyst consensus and current regulatory landscape.

4. Key Drivers and Risks

-

Drivers:

- Continued use in select severe pain indications.

- Adoption of abuse-deterrent formulations.

- Aging populations with chronic pain.

-

Risks:

- Stringent prescribing restrictions.

- Legal restrictions and increased litigation costs.

- Competition from non-opioid pain therapies.

- Potential reformulations reducing efficacy or market appeal.

Strategic Insights

- Market opportunities for OXYCONTIN are primarily constrained, with expansion limited by an increasingly cautious prescribing environment.

- Companies should focus on niche pain indications where opioids remain essential, such as in terminal or palliative care.

- Investment in abuse-deterrent formulations and combination therapies could sustain incremental growth.

- Diversification into non-opioid analgesics and pain management solutions offers a broader risk mitigation strategy.

Key Takeaways

- Regulatory pressures have markedly diminished OXYCONTIN’s market share, with sales declining from peak years in the late 2000s.

- Abuse-deterrent formulations and legal actions have further constrained sales, with the potential for minor rebounds in highly specific indications.

- Long-term prospects rely on innovation, especially in non-opioid pain management, as societal and regulatory attitudes continue to favor lower opioid utilization.

- Regional disparities persist, with the U.S. representing the most significant, yet shrinking, market segment.

- Stakeholders should reevaluate the role of OXYCONTIN within an increasingly diversified pain management landscape, emphasizing safety and regulatory compliance.

FAQs

1. What factors led to the decline of OXYCONTIN’s market dominance?

Stringent regulatory restrictions, rising litigation costs, societal awareness of opioid misuse, and the development of abuse-deterrent formulations have collectively curtailed its market share.

2. Are there ongoing legal risks affecting OXYCONTIN sales?

Yes, Purdue Pharma’s bankruptcy and settlement agreements introduce legal uncertainties, potentially influencing marketing and sales strategies.

3. How do abuse-deterrent formulations impact OXYCONTIN’s market?

They potentially reduce misuse and abuse but also increase manufacturing costs and may limit prescribing due to perceived lower euphoria potential, thus affecting overall sales.

4. What alternative therapies are reducing OXYCONTIN’s market share?

Non-opioid medications like NSAIDs, anticonvulsants, antidepressants, and non-pharmacological options such as nerve blocks and physical therapy are increasingly used.

5. What is the outlook for OXYCONTIN in emerging markets?

Growth remains limited due to regulatory hurdles, cultural prescribing practices, and market maturity; however, there may be niche opportunities in specialized pain management.

References

[1] IMS Health, "Opioid Market Review," 2010.

[2] CDC Guideline for Prescribing Opioids for Chronic Pain, 2022.