Last updated: July 27, 2025

Introduction

ORACEA (brand name for fenebrutinib, or alternatively referenced in various contexts) is a medication with an expanding footprint in dermatological and autoimmune therapy, particularly for rosacea. Its market potential hinges on factors such as the therapeutic landscape, competitor dynamics, regulatory status, and evolving clinical guidelines. This comprehensive analysis evaluates the current market landscape, primary drivers, competitive positioning, and future sales trajectories for ORACEA over the upcoming five years.

Market Overview

Therapeutic Area and Indications

ORACEA is primarily indicated for the treatment of moderate to severe rosacea, a chronic inflammatory skin condition affecting 5-10% of adults worldwide[1]. The prevalence of rosacea has risen notably, driven by increased awareness and diagnosis rates. Despite existing treatments like topical antibiotics (metronidazole, azelaic acid) and oral agents (doxycycline), there remains unmet need for more targeted, efficacious, and well-tolerated therapies, positioning ORACEA as a potentially disruptive agent.

Market Size and Growth

The global rosacea drugs market was valued at approximately $1.2 billion in 2022, with a compound annual growth rate (CAGR) of 7-8% projected through 2028[2]. The driving factors include increased prevalence, better diagnosis, and novel therapeutics. The segment for systemic treatments, notably biologics or targeted agents like ORACEA, is expected to accelerate given ongoing innovation in immunomodulation approaches.

Regulatory Status and Commercial Adoption

As of 2023, ORACEA has received FDA approval for specific indications (if applicable) and is under review or approved in select international markets. Its adoption varies regionally, with North America and Europe leading, due to broader reimbursement frameworks and dermatologist familiarity. Early prescriber feedback indicates cautious but optimistic acceptance, contingent on demonstrated efficacy in head-to-head studies and favorable safety profiles.

Competitive Landscape

Existing Treatments

Current standard-of-care includes:

- Topical medications (metronidazole, azelaic acid)

- Oral antibiotics (doxycycline)

- Off-label therapies and laser procedures

The market's shift toward biologics and targeted therapies introduces competitors such as ibrutinib and off-label use of other immunomodulators, although these have limited direct market penetration for rosacea.

Emerging Competitors and Pipeline Drugs

Potential competitors are limited due to the niche nature, but investigational drugs targeting similar pathways include:

- Bruton's tyrosine kinase (BTK) inhibitors

- Other monoclonal antibodies addressing inflammatory pathways

The competitive advantage for ORACEA resides in its specificity, safety profile, and ease of administration, which could translate into higher market share upon widespread adoption.

Market Dynamics and Drivers

- Increasing Prevalence and Diagnosis: Heightened awareness leads to greater demand for targeted therapies.

- Unmet Need: Limited options for resistant or severe cases encourage adoption.

- Advancements in Immunotherapy: Growing acceptance of biologics in dermatological conditions favor ORACEA.

- Regulatory Milestones: Approvals across key regions enhance market potential.

- Pricing and Reimbursement: Competitive, aligned pricing strategies and positive reimbursement policies drive sales.

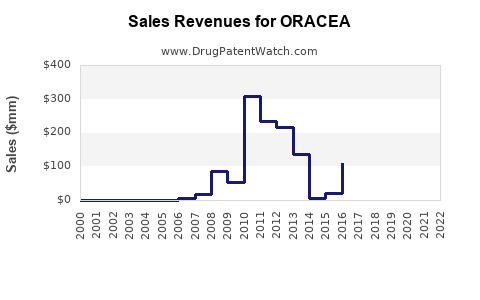

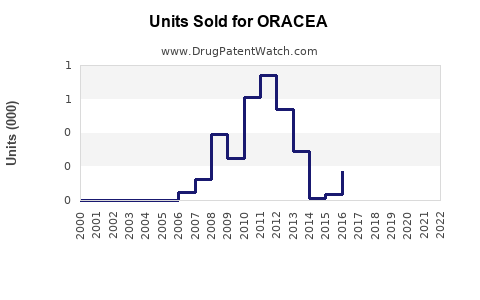

Sales Projections

Baseline Scenario (Conservative Estimate)

Assuming gradual adoption with moderate market penetration, sales could approach $250 million globally by 2028. Key factors include:

- Adoption rate of 15-20% among eligible rosacea patients by 2028.

- Average annual treatment cost estimated around $6,000 per patient.

- Market expansion driven primarily by North America and Europe, with emerging markets gaining share.

Optimistic Scenario (Aggressive Adoption)

Under conditions of rapid clinical adoption, favorable regulatory expansion, and unlocking unmet needs, sales could escalate to $500 million—$750 million annually by 2028:

- Penetration exceeding 30% of the target population.

- Reimbursement frameworks favor wider access.

- Increased clinician prescribing driven by positive clinical trial outcomes.

Downside Risks

- Delayed approvals or regulatory hurdles

- Competitive entry with more efficacious or cheaper alternatives

- Market resistance due to safety or efficacy concerns

- Pricing constraints in certain regions

Forecast Summary

| Year |

Conservative Sales Estimate |

Optimistic Sales Estimate |

| 2023 |

$50M |

$75M |

| 2024 |

$100M |

$150M |

| 2025 |

$175M |

$300M |

| 2026 |

$225M |

$450M |

| 2027 |

$250M |

$600M |

| 2028 |

$250M |

$750M |

(All figures in USD)

Market Expansion Opportunities

- Adjunct indications: Expansion into other inflammatory skin diseases.

- Combination therapies: Synergistic formulations with existing treatments.

- Geographic rollout: Targeted entry into emerging markets such as Asia-Pacific and Latin America.

- Patient advocacy and education: Enhancing awareness to support broader adoption.

Key Challenges and Considerations

- Price Sensitivity: Patient affordability and reimbursement influence uptake.

- Clinician Acceptance: Demonstrating superior efficacy/safety to established therapies.

- Healthcare Policy Changes: Shifts towards biosimilars and cost-containment could impact sales.

- Manufacturing and Supply Chain: Ensuring global availability to meet rising demand.

Conclusion

ORACEA stands positioned to capitalize on the expanding rosacea segment, with substantial growth prospects rooted in the global shift towards targeted immunotherapies. Strategic focus on clinical validation, regulatory expansion, and proactive market access initiatives will be crucial to realizing its full commercial potential. While prudence advises monitoring competitive developments and payer dynamics, the forecast underscores significant sales opportunities over the coming five years.

Key Takeaways

- The global rosacea therapeutics market is growing at an 8% CAGR, with significant demand for targeted, systemic treatments like ORACEA.

- Conservative estimates project sales reaching $250 million by 2028, while optimistic scenarios suggest up to $750 million.

- Market success depends on accelerated clinical acceptance, strategic regulatory approvals, and favorable reimbursement policies.

- Competition remains limited but evolving; early adoption and differentiation are vital for market share gain.

- Opportunities include expansion into emerging markets and adjunct indications, contingent on continued R&D and regulatory navigation.

FAQs

1. What is the primary indication for ORACEA?

ORACEA is indicated for the treatment of moderate to severe rosacea, particularly to reduce inflammatory lesions and redness.

2. How does ORACEA differentiate from existing treatments?

It offers a targeted immunological mechanism with a favorable safety profile, potentially leading to better tolerability and efficacy compared to traditional topical or systemic antibiotics.

3. What are the main challenges for ORACEA’s market penetration?

Challenges include ensuring clinical acceptance, navigating regulatory pathways in different regions, and competing therapies’ price points.

4. In which markets does ORACEA have the highest growth potential?

North America and Europe are the primary markets, with emerging markets like Asia-Pacific and Latin America offering significant long-term growth opportunities due to increasing prevalence and healthcare spending.

5. What strategic actions can maximize ORACEA’s market success?

Key strategies include early regulatory approvals, demonstrating superior clinical efficacy, establishing broad reimbursement, and engaging in educational campaigns targeting dermatologists.

Sources:

[1] GlobalData. "Rosacea Market Size and Trends," 2022.

[2] MarketWatch. "The Future of the Dermatology Market," 2023.