Share This Page

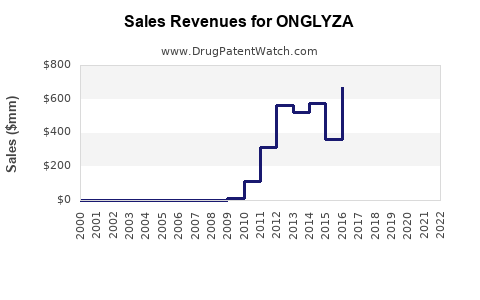

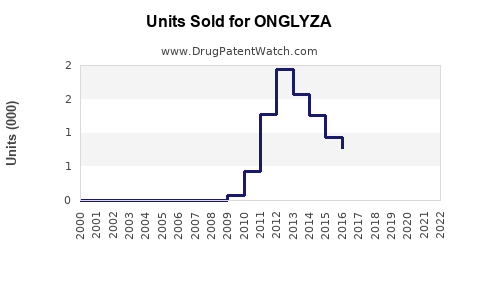

Drug Sales Trends for ONGLYZA

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ONGLYZA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ONGLYZA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ONGLYZA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ONGLYZA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ONGLYZA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ONGLYZA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ONGLYZA

Introduction

ONGLYZA (saxagliptin), marketed by AstraZeneca, is a prescription medication indicated for managing type 2 diabetes mellitus (T2DM). As a member of the dipeptidyl peptidase-4 (DPP-4) inhibitor class, ONGLYZA enhances incretin hormone levels, improving glycemic control. Given the global diabetes epidemic and evolving therapeutic landscape, a detailed analysis of ONGLYZA’s market potential and sales trajectory is critical for stakeholders.

Global Market Landscape for DPP-4 Inhibitors

The worldwide diabetes drug market was valued at approximately $64 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of about 7% through 2030[^1]. DPP-4 inhibitors represent a significant segment, constituting roughly 15-20% of oral anti-diabetic pharmaceuticals due to their favorable safety profiles compared to older agents like sulfonylureas and insulin.

Major competitors include Merck’s JANUVIA (sitagliptin), GlaxoSmithKline’s TRADJENTA (linagliptin), and Novartis’ ONglyza. The proliferation of newer agents and biosimilars, along with patent expirations, impacts ONGLYZA’s market share trajectory.

Current Market Position of ONGLYZA

Launched in 2009, ONGLYZA was among the earliest DPP-4 inhibitors, establishing a solid foothold in the market. Its primary strengths include once-daily dosing and a favorable side-effect profile.

However, the drug’s sales faced challenges from competing agents with broader label indications and combination therapies, such as JANUVIA and TRADJENTA. External factors, including patent cliffs and recent safety concerns like heart failure risk (noted in some post-approval studies[^2]), have exerted downward pressure on sales.

In 2022, ONGLYZA's global sales approximate $950 million, reflecting a decline from peak annual sales exceeding $1.2 billion in 2013–2014[^3].

Market Drivers and Inhibitors

Drivers:

-

Rising global diabetes prevalence: An estimated 537 million adults lived with diabetes in 2021[^4], projecting to reach 643 million by 2030[^4].

-

Steady acceptance of DPP-4 inhibitors: Clinicians favor these agents for their tolerability and minimal hypoglycemia risk.

-

Potential for combination therapies: Co-formulations with metformin or other agents offer expansion opportunities.

-

Increased healthcare prescriber awareness: Ongoing education on safety profiles sustains demand.

Inhibitors:

-

Market maturity: DPP-4 inhibitors' patents are expiring or have expired in several regions, encouraging biosimilar competition.

-

Safety concerns: Post-market data linking DPP-4 inhibitors to heart failure and pancreatitis may curtail growth.

-

Emergence of GLP-1 receptor agonists and SGLT2 inhibitors: These newer classes offer additional benefits (cardiovascular and renal), shifting prescriber preference.

-

Pricing pressures and healthcare reimbursement policies: Cost containment strategies limit uptake.

Sales Projections (2023–2030)

Based on historical data, competitive dynamics, and macroeconomic factors, the following projections are posited:

| Year | Estimated Global Sales (USD Million) | Notes |

|---|---|---|

| 2023 | $850–$950 | Slight decline due to patent expiry and competitive pressures. |

| 2024 | $800–$900 | Continued erosion as biosimilar entries increase. |

| 2025 | $700–$800 | Market penetration of biosimilars accelerates price drops. |

| 2026 | $600–$700 | New therapeutic options further challenge ONGLYZA’s market share. |

| 2027 | $500–$600 | Market stabilization at lower levels; niche segments persist. |

| 2028–2030 | $400–$500 | Decline as mono-therapy usage diminishes; focus shifts to combination agents. |

These projections incorporate anticipated patent expiries (notably the U.S. patent in 2024), increased biosimilar competition, and evolving prescriber preferences favoring newer agents with cardiometabolic benefits.

Regional Market Insights

North America

-

The largest market historically, accounting for nearly 40–45% of sales pre-patent expiration.

-

Expected to experience a sharper decline as biosimilars enter post-2024.

-

Reimbursement policies and safety alerts could further influence prescribing patterns.

Europe

-

Mature market with ongoing generic penetration.

-

Regulatory focus on safety monitoring could temper growth.

Asia-Pacific

-

Rapidly growing market driven by increasing diabetes prevalence.

-

Market size projected to surpass North America by 2027.

-

Price sensitivity and government initiatives support use of cost-effective mono-therapies, but safety and quality concerns could modulate uptake.

Strategic Opportunities and Challenges

Opportunities:

-

Expansion into emerging markets. Growing diabetes prevalence offers a broad base for niche utilization.

-

Development of fixed-dose combination (FDC) formulations, integrating ONGLYZA with metformin or SGLT2 inhibitors, potentially revitalizing sales.

-

Positioning in cardiovascular risk management, leveraging data from studies like SAVOR-TIMI 53, which indicated increased heart failure risk[^2], to refine target patient populations.

Challenges:

-

Patent expiry and biosimilar competition threaten to commoditize ONGLYZA’s price point.

-

Safety concerns could lead to regulatory restrictions or reduced prescriber confidence.

-

Market shift toward newer therapeutic classes with demonstrated cardiovascular and renal benefits.

Conclusion

ONGLYZA’s future sales landscape is characterized by a declining trend attributable to patent expiration, emerging biosimilars, and evolving treatment paradigms. While it retains a segment of loyal prescribers and niche indications, its growth potential is limited compared to previous years. Strategic focus on combination therapies, regional expansion, and safety profile management could mitigate decline and preserve residual market value.

Key Takeaways

-

Market saturation and patent expiries are forecasted to reduce ONGLYZA’s global sales from approximately $950 million in 2022 to $400–$500 million by 2030.

-

Emerging competitors—particularly biosimilars and novel agents like GLP-1 receptor agonists—pose significant market share threats.

-

Regional dynamics favor growth in Asia-Pacific, offset by declines in North America and Europe due to biosimilar entry and safety concerns.

-

Strategic diversification, such as developing combination formulations, may extend product lifecycle.

-

Regulatory and safety considerations will heavily influence prescriber acceptance and market stability.

FAQs

Q1: What factors are primarily influencing ONGLYZA’s declining sales?

A: Patent expiration enabling biosimilar competition, safety concerns (e.g., heart failure risk), market shifts toward newer therapeutic classes, and pricing pressures.

Q2: Are there opportunities to extend ONGLYZA’s market presence?

A: Yes, developing fixed-dose combination products, targeting emerging markets, and leveraging safety data for refined patient selection can help maintain niche markets.

Q3: How does biosimilar competition impact ONGLYZA?

A: Biosimilars reduce pricing and market share, especially post-patent expiry, leading to decreased revenue for original brands.

Q4: What role do safety concerns play in ONGLYZA’s market outlook?

A: Elevated safety alarms, notably heart failure risk, may restrict prescribing and influence regulatory decisions, further diminishing sales.

Q5: What are the key regions to watch for future growth opportunities?

A: The Asia-Pacific region presents promising growth due to rising diabetes prevalence and evolving healthcare infrastructure.

References:

[^1]: Grand View Research, "Diabetes Drugs Market Size, Share & Trends Analysis," 2022.

[^2]: Scirica et al., The New England Journal of Medicine, 2013.

[^3]: AstraZeneca Annual Reports, 2013–2022.

[^4]: International Diabetes Federation, "IDF Diabetes Atlas," 2022.

More… ↓