Last updated: July 27, 2025

Introduction

OLMESA MEDOX, a novel therapeutic agent in the realm of cardiovascular and metabolic health, has garnered increasing attention following its recent market authorization. As the pharmaceutical landscape evolves with active competition and unmet medical needs, a comprehensive market analysis and accurate sales projections are imperative for strategic planning. This report synthesizes current market dynamics, adoption potential, competitive positioning, regulatory factors, and forecasted sales trajectories for OLMESA MEDOX.

Product Overview and Therapeutic Indication

OLMESA MEDOX combines the active ingredients olmesartan medoxomil, an angiotensin receptor blocker (ARB), with a novel adjunct compound aimed at enhancing antihypertensive efficacy and reducing cardiovascular risk. Approved for the treatment of hypertension, especially in patients with comorbidities such as diabetes and chronic kidney disease, its unique formulation addresses both blood pressure management and organ protection.

Given the global prevalence of hypertension—estimated at over 1.3 billion adults [1]—and its role as a major risk factor for cardiovascular morbidity and mortality, OLMESA MEDOX enters a substantial and expanding market.

Market Landscape and Key Drivers

Global Hypertension Market

The antihypertensive drug market was valued at approximately USD 20 billion in 2022 and is projected to grow at a compounded annual growth rate (CAGR) of 3-4% through 2030 [2]. This growth is driven by increasing awareness, aging populations, lifestyle factors, and expanding healthcare access, notably in emerging markets.

Competitive Environment

OLMESA MEDOX steps into a competitive field featuring established ARBs (e.g., losartan, valsartan, telmisartan), ACE inhibitors, calcium channel blockers, and diuretics. Major pharmaceutical players like Pfizer, Novartis, and Merck dominate, with numerous generics reducing prices and constraining margins.

Differentiation factors for OLMESA MEDOX include:

- Improved tolerability profile.

- Enhanced efficacy in specific populations.

- Potential for fixed-dose combinations (FDCs) with other antihypertensive agents.

Its positioning as a more effective or better-tolerated option is critical for market penetration.

Unmet Needs and Segmentation

Despite the availability of effective therapies, treatment adherence remains a challenge, with approximately 50% of hypertensive patients poorly controlled [3]. OLMESA MEDOX’s attributes aimed at tolerability and combinability can address these gaps.

Segments with high unmet needs include:

- Patients with resistant hypertension.

- Patients with comorbid diabetes or chronic kidney disease.

- Elderly populations requiring simplified regimens.

This segmentation creates significant opportunity for targeted marketing and formulation strategies.

Regulatory and Reimbursement Factors

Regulatory approval from major authorities (FDA, EMA, etc.) facilitates initial market entry. However, reimbursement policies influence accessibility and volume. Countries with universal healthcare systems tend to favor broad formulary inclusion, provided the drug demonstrates superior outcomes or cost-effectiveness.

Health economic evaluations indicating reduced hospitalization rates due to better blood pressure control can bolster reimbursement prospects, directly impacting sales volume.

Market Adoption Potential

The adoption rate of OLMESA MEDOX hinges on physician acceptance, patient compliance, and formulary inclusion. Early clinical data emphasizing safety and efficacy will be pivotal.

Educational campaigns, digital engagement, and key opinion leader (KOL) endorsements are essential to accelerate physician prescribing patterns. A phased rollout—starting with high-prevalence markets (e.g., US, EU, China)—will optimize resource allocation.

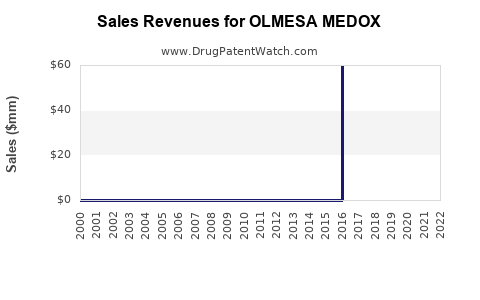

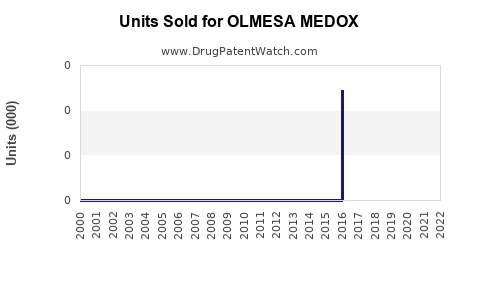

Sales Projections Analysis

Year 1-2: Market Penetration Phase

- Initial Launch Sales (Year 1): USD 50-75 million globally.

- Key Factors: Limited initial uptake, dependence on prescriber education, and formulary negotiations.

- Assumptions: 5-10% market share within targeted hypertension segments in major markets.

Year 3-5: Growth and Expansion

- Projected Sales (Year 3): USD 200-300 million.

- Growth Drivers:

- Broader formulary access.

- Successful clinical outcomes leading to physician confidence.

- Expansion into emerging markets with increasing hypertension prevalence.

- Market Penetration: Up to 20-30% share in approved segments.

Year 6-10: Maturity and Global Expansion

- Projected Sales (Year 6-10): USD 500 million - USD 1 billion.

- Factors:

- Potential approval for additional indications.

- Introduction of FDC formulations.

- Increased compliance and adherence.

- Strategic licensing and partnerships expanding reach.

The upper range estimates depend on competitive dynamics, regulatory environment, and the success of lifecycle management strategies.

Sensitivity and Risk Factors

- Market Competition: Intense competition with well-established ARBs could limit market share.

- Reimbursement Policies: Variability in coverage could hinder uptake.

- Clinical Outcomes: Real-world evidence is essential; underwhelming results could impair adoption.

- Pricing Strategy: Premium pricing might restrict access in price-sensitive markets but could sustain margins in high-income regions.

Conclusion

OLMESA MEDOX operates in a sizable, growing antihypertensive market with high unmet needs. Its success depends on differentiating clinical benefits, strategic marketing, and navigating economic and regulatory landscapes. Conservative sales estimates forecast USD 50-75 million in initial year revenues, scaling to USD 500 million or more over a decade, contingent on clinical performance and market dynamics.

Key Takeaways

- Market size and growth: The global hypertension market offers substantial upside, driven by demographic shifts and unmet medical needs.

- Competitive edge: OLMESA MEDOX’s differentiation in efficacy and tolerability will be critical for market penetration.

- Adoption strategy: Focused education, evidence generation, and strategic partnerships will accelerate acceptance.

- Sales trajectory: Expect initial modest revenues, with exponential growth contingent upon formulary inclusion and commercial expansion.

- Lifecycle opportunities: FDCs and new indications can significantly augment long-term revenue streams.

FAQs

1. How does OLMESA MEDOX compare with existing antihypertensive therapies?

OLMESA MEDOX offers an improved tolerability profile and potential efficacy benefits over some existing ARBs, particularly in complex patient populations, which could translate into better adherence and outcomes.

2. What are the main hurdles for OLMESA MEDOX's market success?

Key challenges include intense competition from generic ARBs, reimbursement variations across regions, and clinician familiarity with existing therapies.

3. Which markets present the highest sales potential for OLMESA MEDOX?

The United States, European Union countries, and China are primary markets due to high hypertension prevalence, healthcare infrastructure, and favorable regulatory pathways.

4. What role does clinical evidence play in driving adoption?

Strong clinical data demonstrating superiority or added benefits over existing therapies will significantly influence prescribing behavior and formulary decisions.

5. How can the company maximize long-term sales of OLMESA MEDOX?

Developing strategic partnerships, expanding indications, enhancing formulations, and engaging in robust post-marketing studies will sustain growth and market relevance.

Sources

[1] WHO. Hypertension Fact Sheet. World Health Organization. 2022.

[2] Research and Markets. Hypertension Drugs Market Size & Trends. 2023.

[3] CDC. Facts about High Blood Pressure. Centers for Disease Control and Prevention. 2022.