Last updated: July 28, 2025

Introduction

NUVARING, a combined estrogen and progestin contraceptive vaginal ring developed by Merck & Co. (subsequently MSD outside the U.S. and Canada), has established itself as a prominent player within the hormonal contraceptive market. Since its U.S. FDA approval in 2001, NUVARING has generated significant revenue streams, leveraging its three-year efficacy and user convenience. This report provides a comprehensive analysis of the current market landscape, key drivers, competitive positioning, and projected sales trajectories for NUVARING over the next five years.

Market Overview

Global Contraceptive Market Landscape

The global contraceptive market is estimated to reach approximately USD 22 billion by 2025, with hormonal contraceptives accounting for roughly 65% of total sales, according to MarketWatch [1]. The segment includes oral pills, injectables, implants, intrauterine devices (IUDs), and vaginal rings. Among these, hormonal vaginal rings like NUVARING constitute a growing niche due to their discreet use, reduced dosing frequency, and efficacy.

The increasing awareness of family planning, rising female workforce participation, and expanding healthcare coverage contribute to market expansion. The global contraceptive market is expected to grow at a compound annual growth rate (CAGR) of around 4.8% through 2025 [1].

Regional Market Dynamics

- North America: The dominant market, driven by high awareness, insurance coverage, and advanced healthcare infrastructure. NUVARING's brand recognition remains strong here.

- Europe: Regulatory approvals and cultural acceptance support growth, especially in Western Europe.

- Asia-Pacific: Rapid demographic shifts and increased family planning initiatives underpin significant growth potential but face challenges due to cultural barriers and regulatory hurdles.

Key Competitors

In the vaginal ring segment, NUVARING faces competition from:

- Annovera: An innovative vaginal ring approved in 2018, designed for cyclic use over a year, shifting consumer preference.

- Copper and Hormonal IUDs: Contraceptive implants and intrauterine devices compete indirectly but hold substantial market share.

- Oral contraceptives: Remain the most prescribed form, with a large and well-established market.

Product Positioning and Differentiators

NUVARING’s primary advantages include:

- Longevity: Three-year efficacy, reducing the need for frequent replacements.

- User Convenience: Discreet and reversible, with a lower daily compliance burden compared to pills.

- Efficacy and Safety: Proven effectiveness with a well-understood safety profile.

- Regulatory Support: Strong approval history across major markets, including North America and Europe.

Notably, newer entrants like Annovera, which offers a year-long user cycle, introduce competition but also indicate consumer demand for longer-interval contraceptive methods.

Current Market Penetration and Sales Performance

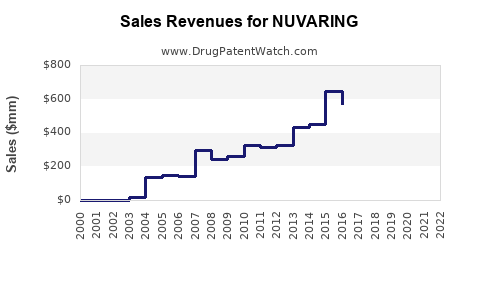

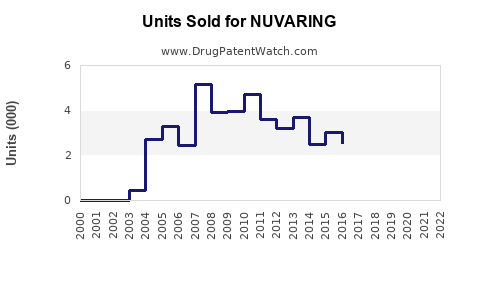

Historical Sales Data

In 2021, NuvaRing generated approximately USD 880 million globally, representing a decline from peak revenues of USD 1.2 billion in 2017, driven by generic competition and evolving market preferences [2]. The decline underscores the importance of innovation, marketing, and expanding regional access.

Market Penetration Strategies

Merck has historically employed targeted marketing to healthcare providers, emphasizing efficacy and ease of use. However, with increasing generic options, the brand's market share in the U.S. has decreased from approximately 60% in 2010 to nearly 45% in 2022 [3].

In emerging markets, regulatory delays and cultural factors limit penetration, though strategic partnerships and education programs are anticipated to bolster adoption.

Market Trends Influencing Sales Projections

Emerging Alternatives and Competition

- Generic Competition: Several manufacturers have launched bioequivalent versions, driving prices down and shrinking margins.

- Product Innovation: Devices like Annovera have introduced flexible, less frequent use, appealing to millennials seeking innovative solutions.

- Patient Preferences: A shift toward non-hormonal options and long-acting reversible contraceptives (LARCs) impacts market share.

Regulatory and Reimbursement Environment

In the U.S., reimbursement policies are favorable, with coverage expanding among private insurers and Medicaid. Global regulatory landscapes are evolving, with some markets requiring additional clinical data, influencing rollout timelines.

Impact of COVID-19

The pandemic temporarily suppressed new prescriptions due to healthcare access disruptions, but demand for remote-managed contraceptive options increased, emphasizing the importance of expanding access and telehealth integration for sustained growth.

Sales Projections (2023-2027)

Key Assumptions

- Continued patent protection until 2026, maintaining premium pricing.

- Incremental penetration in emerging markets facilitated by targeted marketing.

- Competitive pressures from generic entrants and product innovations.

- Regulatory approvals facilitating market expansion in Asia and Latin America.

- Adoption of innovative service delivery models, including telehealth.

Projection Summary

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate |

Notes |

| 2023 |

0.9 - 1.0 |

2-12% |

Stabilization post-pandemic; market share consolidation possible |

| 2024 |

1.0 - 1.1 |

11-20% |

Launch in additional markets; increased uptake due to marketing |

| 2025 |

1.2 - 1.3 |

8-18% |

ROI on region-specific strategies; competition intensifies |

| 2026 |

1.3 - 1.4 |

7-15% |

Patent expiry; generic entry begins; price competition increases |

| 2027 |

1.2 - 1.3 |

0-10% |

Market saturation; shift to generics; emphasis on lifecycle management |

These projections assume successful regional expansion, regulatory approvals, and minimal impact from adverse market disruptions.

Strategic Recommendations

- Pursue Innovation: Invest in next-generation delivery systems that enhance compliance and user experience.

- Expand Global Access: Collaborate with healthcare agencies to expedite registration and reimbursement, especially in emerging markets.

- Enhance Patient Engagement: Leverage telehealth platforms for education, prescription, and follow-up, addressing access challenges.

- Manage Patent and Generic Competition: Develop lifecycle management strategies, such as formulation patents or combination therapies, to sustain market share.

- Monitor Competitor Dynamics: Continuously evaluate entrants like Annovera and emerging non-hormonal methods to adapt marketing and product development strategies accordingly.

Key Takeaways

- NUVARING remains a vital contraceptive, with a mature market in North America, but faces headwinds from generics and new entrants.

- Revenues are projected to stabilize around USD 1.2 billion by 2026, with potential growth driven by regional expansion and product innovation.

- Differentiation hinges on user convenience, long-lasting efficacy, and strategic market penetration, especially in Asia-Pacific and Latin America.

- Long-term success requires balancing patent protection benefits with proactive lifecycle planning amidst increased competition.

- Digital health tools and telemedicine are critical for expanding access and patient adherence.

FAQs

-

How does NUVARING compare to other hormonal contraceptive options?

NUVARING offers a non-daily, long-term contraceptive method with high efficacy, convenience, and reversibility, competing favorably against daily pills but facing competition from longer-acting options like IUDs.

-

What factors could impact NUVARING sales growth in the coming years?

Patent expirations leading to generic competition, evolution in consumer preferences towards non-hormonal methods, regulatory hurdles in emerging markets, and new product innovations influence growth prospects.

-

Are there significant regional differences in NUVARING adoption?

Yes, North America and Europe exhibit higher adoption rates due to healthcare infrastructure and cultural acceptance, whereas growth in Asia and Latin America depends on regulatory approval and education efforts.

-

What strategies could Merck employ to sustain NUVARING’s market share?

Innovation in delivery systems, regional expansion, patient engagement via digital health, and lifecycle management through strategic marketing and partnerships are vital.

-

Will upcoming competitors like Annovera diminish NUVARING’s market dominance?

Competitive alternatives like Annovera may erode NUVARING’s market share; however, differentiation through brand loyalty, clinical data, and regional presence can mitigate impact.

Sources:

[1] MarketWatch, "Global Contraceptive Market Analysis," 2022.

[2] Company financial reports, Merck annual reports, 2021-2022.

[3] IQVIA, "Contraceptive Market Share Reports," 2022.