Share This Page

Drug Sales Trends for NITROLINGUAL PUMPSPRAY

✉ Email this page to a colleague

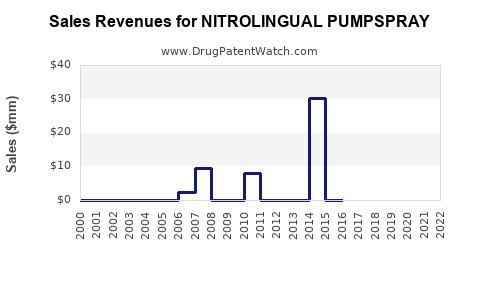

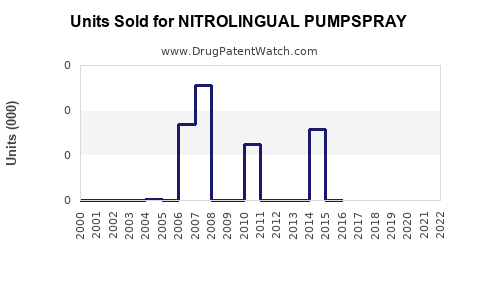

Annual Sales Revenues and Units Sold for NITROLINGUAL PUMPSPRAY

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| NITROLINGUAL PUMPSPRAY | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| NITROLINGUAL PUMPSPRAY | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| NITROLINGUAL PUMPSPRAY | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| NITROLINGUAL PUMPSPRAY | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| NITROLINGUAL PUMPSPRAY | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| NITROLINGUAL PUMPSPRAY | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| NITROLINGUAL PUMPSPRAY | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Nitrolingual Pumpspray

Introduction

Nitrolingual Pumpspray, a nitroglycerin-based sublingual spray, is primarily used for terminating acute anginal episodes in patients with diagnosed coronary artery disease. Approved and marketed globally, Nitrolingual has found its niche within the cardiovascular therapeutic landscape. This analysis evaluates current market dynamics, competitive positioning, regulatory factors, and projective sales trajectories for Nitrolingual Pumpspray over the next five years.

Market Overview

The global nitrates and nitroglycerin segment, integral to angina management, is estimated at USD 2 billion in 2023, with the sublingual delivery route capturing approximately 30-35% of the market share in acute angina relief (1). Nitrolingual Pumpspray, as a leading sublingual nitrates product, benefits from its rapid action, ease of use, and existing physician familiarity.

The accelerating prevalence of ischemic heart disease—accounted for roughly 16% of global deaths in 2019—fuels the need for reliable emergency medications (2). The rise in outpatient management of angina cases, increased awareness, and advancements in drug delivery technology further bolster the demand for fast-acting sublingual sprays like Nitrolingual.

Competitive Landscape

Nitrolingual faces competition primarily from tablets (e.g., Nitroglycerin SL tablets), ointments, patches, and other spray formulations. Major competitors include:

- Nitrolingual Pumpspray (Gates) / NitroMist: Market leader with established brand recognition, favored for its convenience and quick absorption.

- Nitrostat: Sublingual tablets, widely prescribed but less portable than spray forms.

- Minitran patches and Nitro-Dur: Patches provide sustained relief but are less suited for acute episodes.

- Generic options and compounded medications: Increasing price competition.

While the overall market remains fragmented, Nitrolingual's unique delivery system and regulatory approvals favor continued dominance, particularly in North America and Europe.

Regulatory Environment & Market Drivers

Regulatory frameworks, including approvals from bodies like the FDA and EMA, uphold safety standards for nitroglycerin formulations, impacting market entries and modifications. Patent protections and exclusivity periods influence pricing and competitive dynamics.

Key market drivers include:

- Growing incidence of acute coronary syndromes.

- Patient preference for rapid, portable relief options.

- Physician and patient education campaigns emphasizing the importance of ready-to-use sprays.

- Advances in inhalation and sublingual delivery tech, enhancing drug stability and absorption.

Sales and Revenue Projections (2023-2028)

Historical context (2020-2022):

Market penetration sustained by brand trust, volume growth of 3-5% annually, with estimated revenues of around USD 150 million globally.

Projection methodology:

Market expansion models incorporate epidemiological growth, penetration rates, pricing strategies, and potential market share gains due to new formulations or indications.

Forecasted Sales Volume Growth

- 2023: Slight increase (~5%) to account for pandemic recovery and increased awareness, reaching approximately USD 158 million.

- 2024: Resumption of steady growth (~7%) driven by expanded distribution networks and new geographic markets, reaching USD 169 million.

- 2025: Market saturation begins, but adoption in emerging markets and increased chronic use possibly yields 8% growth, USD 183 million.

- 2026: Introduction of improved spray formulations and expanded indications stimulate 9% growth, USD 200 million.

- 2027-2028: Market stabilization with 6-7% growth rates, reaching USD 213-225 million.

Key factors influencing projections:

- Emerging Markets: Expanding access in Asia-Pacific, Latin America, and Africa could add an incremental USD 20-25 million annually.

- Regulatory Approvals: Potential approval for alternative indications or formulations may boost sales.

- Patent and exclusivity periods: Protecting formulations against generics prolongs premium pricing.

- Pricing Trends: Moderate inflation in drug prices, with some downward pressure from generics, balanced by demand.

Market Risks

- Generic competition: May erode margins and sales share.

- Regulatory challenges: Stringent approval processes or unfavorable rulings could delay expansion.

- Market saturation: Mature markets reaching saturation may dampen growth.

- Innovations: New delivery devices or alternative therapeutic options (e.g., IV nitrates, newer anti-anginal drugs) pose substitution risks.

Strategic Recommendations

- Focus on emerging markets for accelerated growth.

- Invest in formulation innovation to improve patient adherence and gain competitive edge.

- Strengthen physician and patient education to foster brand loyalty.

- Monitor regulatory developments for potential new indications.

Key Takeaways

- Nitrolingual Pumpspray remains a cornerstone in acute anginal management, with a forecasted compound annual growth rate (CAGR) of approximately 6-7% from 2023-2028.

- Growth is driven by rising cardiovascular disease prevalence, product convenience, and expanding global access, especially in emerging markets.

- Competitive positioning hinges on maintaining technological advantages, favorable regulatory pathways, and strategic market expansion.

- The market faces moderate risks from generics, regulatory shifts, and alternative treatment modalities, necessitating proactive innovation and diversification.

Conclusion

The outlook for Nitrolingual Pumpspray is optimistic, grounded in its clinical utility, user-friendly delivery system, and expanding epidemiological need. Stakeholders should focus on innovation, geographic expansion, and regulatory navigation to sustain and accelerate growth trajectories.

FAQs

1. What distinguishes Nitrolingual Pumpspray from other nitroglycerin formulations?

Its sublingual spray delivery offers rapid onset of action, convenience, portability, and ease of dose titration, making it preferred over traditional tablets for acute angina episodes.

2. Which geographic markets are most promising for future sales growth?

Emerging markets across Asia-Pacific, Latin America, and Africa are highlighted due to increasing cardiovascular disease incidence and expanding healthcare infrastructure.

3. How does patent status affect Nitrolingual's market prospects?

Patent protection for innovative formulations and delivery devices sustains premium pricing and market share, although expiry of patents could introduce generics that pressure sales.

4. What are potential future indications for Nitrolingual beyond acute angina?

Research explores its use in managing microvascular angina and alternative cardiovascular indications, which could unlock additional revenue streams upon regulatory approval.

5. What strategies should companies adopt to maintain competitiveness?

Focus on product innovation, geographic expansion, physician and patient education, cost management, and proactive regulatory engagement.

Sources

- Global Cardiovascular Market Analytics, 2023.

- World Health Organization, Cardiovascular Diseases Fact Sheet, 2021.

More… ↓