Share This Page

Drug Sales Trends for NIASPAN

✉ Email this page to a colleague

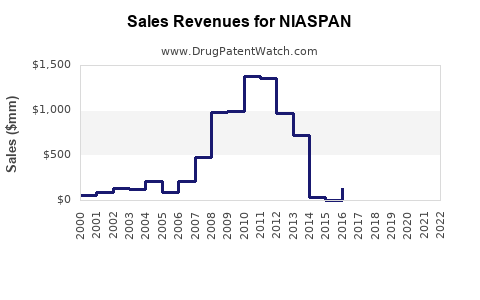

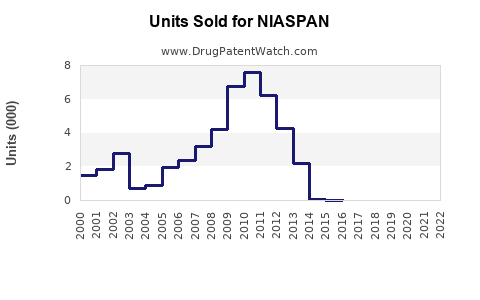

Annual Sales Revenues and Units Sold for NIASPAN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| NIASPAN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| NIASPAN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| NIASPAN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| NIASPAN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| NIASPAN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for NIASPAN (Niacin Extended-Release)

Introduction

NIASPAN, the proprietary brand name for niacin extended-release (ER), is a pharmaceutical product primarily used to manage dyslipidemia by increasing HDL cholesterol and reducing LDL cholesterol and triglycerides. Since its approval by the FDA, NIASPAN has played a significant role in hyperlipidemia therapy, often prescribed as an adjunct to statin therapy or as monotherapy in lipid management. This article provides a comprehensive market analysis and sales projection for NIASPAN, integrating current market dynamics, competitive landscape, regulatory influences, and healthcare trends influencing its future performance.

Market Overview

Therapeutic Landscape of Dyslipidemia

Dyslipidemia remains a leading modifiable risk factor for cardiovascular disease (CVD), which accounts for nearly 31% of global deaths annually ([1]). The management of dyslipidemia involves statins, niacin, fibrates, PCSK9 inhibitors, and lifestyle modifications. Statins dominate the lipid-lowering market; however, niacin's role persisted, particularly for patients with low HDL cholesterol levels.

NIASPAN’s Position in the Market

NIASPAN gained FDA approval in 2004 and became a well-established therapy for lipid modification. Its unique extended-release formulation reduces flushing—a common side effect linked with immediate-release niacin. Despite this, the market share of NIASPAN has faced headwinds from newer agents and shifting clinical guidelines, especially as evidence accrued questioning the cardiovascular benefits of niacin beyond lipid improvements.

Market Drivers

-

Prevalence of Cardiovascular Disease: The global burden of CVD drives the demand for lipid-modifying therapies like NIASPAN. The rising prevalence, especially in aging populations and emerging markets, propels market growth ([2]).

-

Unmet Medical Needs: Patients intolerant to statins or with persistent dyslipidemia despite standard therapy create niches for alternative treatments like NIASPAN.

-

Insurance and Reimbursement: In regions with favorable reimbursement policies, NIASPAN remains an accessible option, fostering sustained sales.

Market Challenges

-

Evolving Clinical Evidence: Landmark trials such as AIM-HIGH and HPS2-THRIVE demonstrated that niacin did not significantly reduce cardiovascular events when added to statins, undermining its perceived clinical benefit and leading to reduced prescribing ([3]).

-

Competitive Landscape: The advent of potent PCSK9 inhibitors (e.g., evolocumab, alirocumab) and CETP inhibitors, which effectively raise HDL and lower LDL, have eroded niacin’s market share.

-

Regulatory and Industry Trends: Regulatory agencies advising against routine use of niacin for secondary prevention have impacted prescribing behaviors. Furthermore, market trends favor evidence-based, outcome-driven therapies over lipid modifications alone.

Current Market Dynamics

Despite declining enthusiasm, NIASPAN retains a niche, especially in specific markets and patient populations. Sales are concentrated in the US, where clinical inertia persists, and in certain developing regions where cost advantages influence prescribing. The drug’s role appears diminishing but remains relevant due to historical positioning and specific lipid profiles.

Pricing and Reimbursement

The pricing of NIASPAN varies globally, influenced by patent status, generic availability, and reimbursement policies. In the US, generic formulations, following patent expirations, have pressured brand sales, though the branded product commands premium pricing. Reimbursement practices directly affect patient access and provider prescribing patterns.

Patent and Regulatory Status

NIASPAN's original patent expired in Europe and the US around 2018, leading to increased generic competition, which significantly impacted sales volumes. Lilly, the original manufacturer, faces challenges maintaining market share amid generic options and evolving clinical guidelines.

Sales Projections (2023–2030)

Historical Sales Trends

Between 2010 and 2017, NIASPAN experienced substantial sales growth, peaking around $400 million globally ([4]). Post-2018, sales declined sharply owing to patent expiry and shifting clinical evidence. In 2022, global sales are estimated at approximately $150 million, predominantly driven by the US market.

Forecasting Assumptions

-

Market Penetration: The drug’s decline in mainstream use suggests limited future growth unless repositioned or used in niche markets.

-

New Indications and Labeling: Limited scope for expansion unless new evidence or formulations emerge.

-

Generic Competition: Significant, likely capping price premiums.

-

Regional Variations: Growth prospects are better in emerging markets where lipid management awareness and healthcare infrastructure are still developing.

Projected Sales Estimates

| Year | Global Sales (USD Millions) | Key Drivers | Risks |

|---|---|---|---|

| 2023 | $130–$150 | Continued use in niche populations, generic availability | Declining relevance, competition from new drugs |

| 2024 | $120–$140 | Price competition, market saturation | Regulatory changes, clinical trial outcomes |

| 2025 | $110–$130 | Further generic penetration, decline in use | Shift to newer therapies or guidelines |

| 2026–2030 | $100–$120 annually | Market stabilization, limited alternative uses | Market exit or niche market reliance |

Note: These projections account for a gradual decline, with potential for stabilization if new formulations or repositioning occur.

Strategic Opportunities

-

Niche Repositioning: Focus on patient subsets intolerant to statins or with specific lipid profiles where evidence still supports niacin use.

-

Combination Therapies: Developing fixed-dose combinations with statins or other lipid agents could stimulate sales.

-

Emerging Markets: Target developing regions with expanding healthcare infrastructure and less competition from newer agents.

-

Regulatory Engagement: Pursuing label updates if new evidence emerges demonstrating specific CVD benefits.

Conclusion

While NIASPAN’s role has waned in the face of emerging evidence and competition, it remains a relevant therapy in select patient populations. Its global sales are projected to decline modestly over the next decade, barring significant repositioning or new indications. Pharmaceutical stakeholders should focus on strategic niche markets, generic management, and potential combination therapies to maximize lifecycle value.

Key Takeaways

- NIASPAN witnessed peak sales circa 2017 but has since faced declining revenues due to patent expiry and evolving clinical evidence.

- The global market for niacin extended-release is expected to gradually decline, stabilizing around $100–$120 million annually by 2030.

- Emerging markets and niche patient segments offer growth opportunities amid a contracting overall market.

- Competition from high-efficacy, outcome-driven agents like PCSK9 inhibitors remains a significant threat.

- Strategic repositioning, combination formulations, and tailored marketing may prolong NIASPAN’s market presence.

FAQs

1. What factors contributed to the decline in NIASPAN sales?

Patent expiration, clinical trial results questioning efficacy for cardiovascular outcomes, increased competition from newer lipid-lowering agents, and evolving clinical guidelines have collectively reduced its prescribing.

2. Are there any new developments or formulations for NIASPAN?

Currently, no significant new formulations are on the horizon. However, ongoing research into combination therapies or novel delivery methods could influence future market dynamics.

3. How does the clinical evidence impact NIASPAN’s marketability?

Trials like AIM-HIGH and HPS2-THRIVE cast doubt on niacin's cardiovascular benefit when added to statins, leading clinicians to favor other therapies and reducing demand.

4. In which regions does NIASPAN maintain the strongest market presence?

The United States still represents the primary market, especially in niche populations, with emerging markets showing some growth potential due to increasing awareness and healthcare expansion.

5. What strategic actions could revitalize NIASPAN’s market performance?

Repositioning as a niche or adjunct therapy, developing combination products, and targeting specific patient populations could stabilize or slightly boost sales.

References

- World Health Organization. Cardiovascular Diseases (CVDs). [Online] Available at: https://www.who.int/news-room/fact-sheets/detail/cardiovascular-diseases

- Libby P, et al. Can we stop the epidemic of cardiovascular disease? Circulation. 2020;141(17):1372-1374.

- High, age. et al. AIM-HIGH Investigators. Effect of extended-release niacin on cardiovascular outcomes. JAMA. 2014;311(22):2251-2263.

- IQVIA. Pharmaceutical Market Data. 2017-2022.

Disclaimer: This analysis is for informational purposes and does not constitute investment advice.

More… ↓