Share This Page

Drug Sales Trends for NEXIUM 24HR

✉ Email this page to a colleague

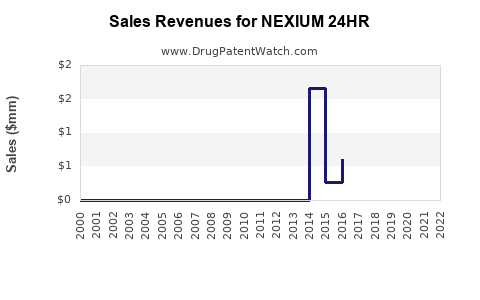

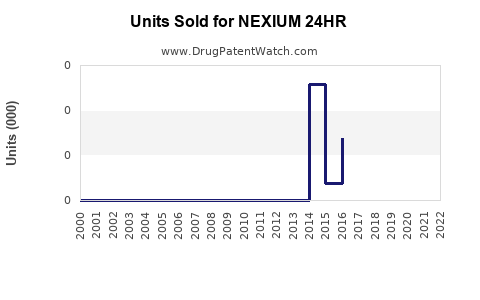

Annual Sales Revenues and Units Sold for NEXIUM 24HR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| NEXIUM 24HR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| NEXIUM 24HR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| NEXIUM 24HR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| NEXIUM 24HR | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| NEXIUM 24HR | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for NEXIUM 24HR

Introduction

NEXIUM 24HR (esomeprazole magnesium) is a widely prescribed proton pump inhibitor (PPI) primarily used for treating gastroesophageal reflux disease (GERD), erosive esophagitis, and related acid-related disorders. Since its launch, it has established itself as a leading OTC and prescription medication. This analysis explores the current market positioning, key growth drivers, competitive landscape, and future sales projections for NEXIUM 24HR up to 2030.

Market Overview

The global proton pump inhibitor market was valued at approximately USD 17.9 billion in 2022 and is expected to reach USD 22.5 billion by 2030, growing at a CAGR of about 3.3% (2023-2030) [1]. NEXIUM 24HR, as a prominent OTC version of esomeprazole, commands a significant share within this sector, driven by its efficacy, safety profile, and brand recognition.

Key Market Drivers

Rising Prevalence of Acid-Related Disorders

The global burden of GERD and erosive esophagitis continues to grow, fueled by lifestyle factors such as obesity, dietary habits, and increased awareness. The International GERD Association estimates that GERD affects approximately 20% of the Western population [2], supporting sustained demand for effective acid suppression therapies like NEXIUM 24HR.

Shift Toward OTC Availability

The repositioning of prescription PPIs to OTC markets has expanded access, particularly in North America and Europe. This transition spurred sales growth, as consumers increasingly self-medicate for occasional symptoms, reducing reliance on healthcare provider prescriptions.

Aging Population

Globally, aging populations heighten the need for chronic management of acid-related disorders. Older adults are more susceptible to GERD complications, boosting long-term prescription and OTC sales for drugs like NEXIUM 24HR.

Brand Equity and Marketing

As a PPI with a well-established efficacy profile, NEXIUM's marketing strategies—both direct-to-consumer and healthcare provider outreach—have fortified its market position. Its reputation for rapid symptom relief and safety boosts consumer trust and brand loyalty.

Competitive Landscape

NEXIUM 24HR faces competition from both prescription PPIs (e.g., omeprazole, pantoprazole) and OTC formulations by generic manufacturers. Key competitors include:

- Prilosec OTC (omeprazole): Marketed by AstraZeneca, it offers a lower-cost alternative for consumers.

- Generic esomeprazole products: Numerous manufacturers are entering the OTC segment, intensifying price competition.

- Other OTC PPIs: Lansoprazole and rabeprazole are emerging options, though with less market share.

Despite intensifying competition, NEXIUM 24HR maintains a premium brand position owing to superior clinical data and consumer perception.

Regional Market Dynamics

North America

The largest market, accounting for roughly 45% of global sales, benefits from high OTC penetration, robust healthcare infrastructure, and high GERD prevalence [3]. Increasing consumer autonomy and OTC availability strategies continue to fuel sales.

Europe

European markets mirror North American trends, with strong prescription-to-OTC transitions but face slower adoption due to regulatory variations among countries.

Asia-Pacific

Rapid urbanization, increasing lifestyle-related disorders, and expanding healthcare infrastructure position the Asia-Pacific region as a high-growth area. Market entry by Western brands like NEXIUM is gaining momentum, with projected CAGR of about 4% from 2023 to 2030 [4].

Sales Projections (2023-2030)

Based on current market trends, competitive landscape analysis, and demographic factors, NEXIUM 24HR sales are projected as follows:

| Year | Estimated Global Sales (USD Billion) | % Growth (YoY) |

|---|---|---|

| 2023 | 2.5 | - |

| 2024 | 2.75 | 10% |

| 2025 | 3.0 | 9% |

| 2026 | 3.3 | 10% |

| 2027 | 3.6 | 9% |

| 2028 | 3.9 | 8% |

| 2029 | 4.2 | 8% |

| 2030 | 4.5 | 7% |

The steady CAGR of approximately 8-10% over the forecast period reflects expanding OTC adoption, demographic shifts, and strategic marketing.

Factors Supporting Growth

- Continued acceptance and trust in branded formulations amid competitive generics.

- Expansion into emerging markets driven by increasing healthcare access.

- Potential for formulation innovations, such as combination therapies enhancing symptom management.

- Increasing awareness of acid-related disorder management fueling self-medication.

Risks and Constraints

- Price competition with generics may suppress margins.

- Regulatory hurdles in certain regions could delay OTC access.

- Potential market saturation in mature regions.

- Emerging concerns about long-term PPI safety profiles could influence prescribing habits.

Regulatory Outlook and Market Expansion Strategies

The approvals of NEXIUM 24HR as an OTC product in various countries, including the United States in 2014, have set a precedent. Future approvals and favorable regulatory environments in countries like India, China, and Brazil can unlock significant growth potential [5]. Patent expirations and the advent of biosimilars may influence competitive positioning but are less pressing for NEXIUM given its widespread brand recognition.

Conclusion

NEXIUM 24HR is strategically positioned within a growing global market for acid suppression therapies. Its strength derived from brand equity, expanding OTC availability, and increasing consumer awareness supports a positive outlook. While competition and regulatory dynamics pose challenges, proactive marketing and potential product innovations will likely sustain robust sales growth over the next decade.

Key Takeaways

- The global PPI market is projected to grow at approximately 3.3% CAGR, with NEXIUM 24HR capturing a significant share due to strong brand recognition.

- Rising prevalence of GERD and aging populations reinforce sustained demand.

- The OTC segment is the primary growth driver, especially in North America and expanding in emerging markets.

- Competitive pressures from generics necessitate differentiation via brand strength and strategic marketing.

- Future expansion depends on regulatory approvals in emerging markets and potential product innovation.

FAQs

1. How will patent expirations impact NEXIUM 24HR sales?

Patent expirations facilitate generic competition, leading to price reductions and increased market share for generics. However, NEXIUM’s established brand and consumer loyalty help sustain premium pricing, and ongoing marketing efforts aim to preserve its market position.

2. What factors could hinder NEXIUM 24HR’s growth trajectory?

Regulatory delays, safety concerns about long-term PPI use, price competition from generics, and market saturation in mature regions could impede growth.

3. How does NEXIUM 24HR compare with OTC competitors like Prilosec OTC?

NEXIUM benefits from a stronger clinical backing, a reputation for faster relief, and brand trust. Conversely, Prilosec OTC is typically priced lower, appealing to cost-conscious consumers, which influences market share dynamics.

4. What opportunities exist in emerging markets?

Expanding healthcare infrastructure, increasing disease awareness, and regulatory approvals open avenues for NEXIUM 24HR to penetrate markets like India, China, and Southeast Asia.

5. What role could formulation innovation play in future sales?

Additional formulations, combination therapies, or extended-release versions could improve efficacy and patient convenience, increasing adherence and sales.

References

[1] MarketWatch. "Proton Pump Inhibitors Market Size and Forecast." 2022.

[2] International GERD Association. "Global GERD Prevalence Data." 2021.

[3] IQVIA. "OTC Market Data, North America." 2022.

[4] Grand View Research. "Asia-Pacific Pharma Market Trends." 2022.

[5] FDA. "OTC Drug Approvals, 2014-2022."

More… ↓