Share This Page

Drug Sales Trends for MS CONTIN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for MS CONTIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MS CONTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MS CONTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MS CONTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MS CONTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| MS CONTIN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for MS CONTIN (Morphine Sulfate Extended-Release)

Introduction

MS CONTIN (morphine sulfate extended-release) remains a cornerstone in the management of chronic pain, especially for patients requiring around-the-clock opioid therapy. As a long-acting opioid analgesic, its clinical utility and regulatory landscape significantly influence its market dynamics and sales trajectory. This analysis offers a comprehensive review of the current market landscape, competitive positioning, regulatory environment, and projected sales growth for MS CONTIN.

Market Overview

Global Chronic Pain Treatment Market

The global chronic pain management market is sizable, projected to reach USD 19.3 billion by 2027, expanding at a CAGR of approximately 4.2% (Fortune Business Insights). Opioid analgesics constitute a substantial segment within this market, owing to their efficacy in severe pain management, despite regulatory pressures and ongoing opioid crisis concerns.

Drug Profile: MS CONTIN

MS CONTIN is formulated as an extended-release formulation of morphine sulfate, approved by the FDA in 1987. It addresses pain management needs where sustained analgesic coverage is essential. Its pharmacokinetic profile offers a slow, steady release of morphine, reducing the frequency of dosing and improving patient compliance.

Market Dynamics

Drivers

- Rising Prevalence of Chronic Pain: Conditions such as cancer pain, osteoarthritis, and lower back pain contribute to increased demand for opioids like MS CONTIN.

- Elderly Population Growth: Aging populations in North America and Europe heighten chronic pain cases, driving sustained demand.

- Physician Preference for Extended-Release Formulations: Enhanced patient compliance and better pain control lead clinicians to prescribe formulations like MS CONTIN.

- Regulatory Approvals and Labeling: Existing FDA approval and established brand recognition bolster market stability.

Challenges

- Regulatory Scrutiny and Opioid Crisis: Increased regulations, prescribing restrictions, and addiction concerns have constrained growth.

- Alternative Therapies: The rise of non-opioid pain medications and interventional pain management techniques offer competition.

- Market Competition: Other extended-release opioids, such as OxyContin (oxycodone ER) and fentanyl patches, challenge MS CONTIN’s market share.

Competitive Landscape

Leading competitors include:

- OxyContin (Oxycodone ER): A potent, widely utilized alternative providing similar extended analgesic effects.

- Fentanyl Transdermal Patches: Offer potent, long-lasting relief with different administration routes.

- Other Morphine Formulations: Such as Kadian and Ariana.

Market positioning of MS CONTIN hinges on its legacy, long duration, and clinician familiarity, but ongoing regulatory constraints dampen growth potential.

Regulatory Environment

Globally, opioid regulations have tightened, especially post-2010s, driven by the US opioid epidemic. The DEA’s scheduling of opioids in the US classifies morphine as Schedule II, imposing strict prescribing and dispensing controls.

In Europe, countries enforce various regulatory frameworks, often balancing control with access. Advances in abuse-deterrent formulations and prescription monitoring programs are influencing availability and prescribing trends.

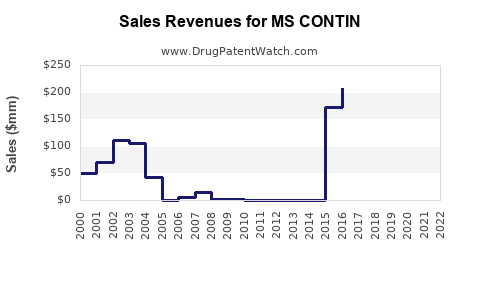

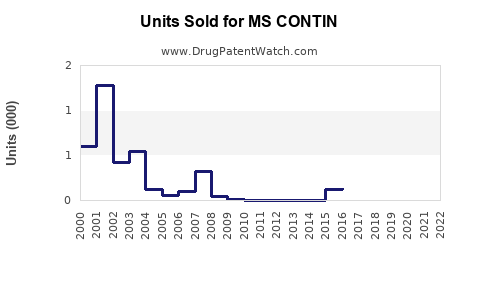

Sales History and Trends

Historical data indicates:

- Steady Decline in US Sales: US sales peaked in late 2000s (~USD 200 million annually) but have since declined due to regulatory restrictions and market saturation.

- Stable International Presence: Europe and emerging markets maintain moderate sales owing to demand and regulatory flexibility.

- Impact of Patent & Formulation Changes: MS CONTIN’s original formulation is generic, with few recent patent protections, limiting exclusivity-driven sales growth.

Future Sales Projections

Based on market trends, regulatory outlooks, and competitive dynamics, the following projections are posited:

| Year | Estimated Sales (USD millions) | Growth Rate | Assumptions |

|---|---|---|---|

| 2023 | 150 | -10% | Continued regulatory pressure and market saturation |

| 2024 | 135 | -10% | Tightening prescription controls |

| 2025 | 120 | -11% | Growing competition and shift towards non-opioid therapies |

| 2026 | 110 | -8% | Slight market stabilization; niche demand persists |

| 2027 | 105 | -4.5% | Maturation phase with minimal incremental growth |

Summary: Sales are projected to decline gradually over the next five years, reflecting the broader opioid market contraction and increased competition. However, niche applications and established prescribing habits may sustain baseline demand.

Opportunities for Growth

- Novel Formulations and Abuse-Deterrent Technologies: Developing abuse-resistant versions may reinvigorate product interest.

- Expanding into Emerging Markets: Countries with rising healthcare infrastructure and less restrictive opioid policies could present growth avenues.

- Partnerships with Pain Management Centers: Targeted marketing efforts may sustain sales within specialized clinics.

- Differentiation via Clinical Evidence: Robust data demonstrating efficacy and safety could sustain clinician confidence.

Risks and Mitigation Strategies

- Regulatory Challenges: Ongoing crackdowns necessitate proactive compliance and risk management.

- Public Perception: Addressing concerns about opioid safety through education and alternative formulations can reduce stigma.

- Market Entry Barriers: Patent expirations open the door for generics, increasing price competition.

Conclusion

MS CONTIN’s market outlook diminishes modestly in the face of regulatory hurdles, market saturation, and competitive alternatives. While clinical utility remains valid, especially within specific patient populations, the trend towards reducing opioid reliance constrains its future sales potential. Companies and stakeholders should consider innovation, diversification, and strategic positioning to harness remaining market opportunities.

Key Takeaways

- Market Maturity: MS CONTIN faces declining sales primarily due to increased regulatory controls and opioid risk concerns.

- Competitive Pressure: Alternatives like oxycodone ER and fentanyl patches challenge market share.

- Emerging Markets: Growth potential exists outside North America, where regulations are less restrictive.

- Innovation Needed: Abuse-deterrent formulations and non-opioid combinations can revitalize interest.

- Sustainability Strategies: Focus on education, compliance, and targeted market segments will be vital for maintaining baseline sales.

FAQs

1. How does regulatory scrutiny impact MS CONTIN sales?

Stringent prescribing regulations and increased monitoring reduce accessibility, leading to decreased prescription volumes and sales.

2. Are there upcoming formulations that could replace MS CONTIN?

Yes, abuse-deterrent and non-opioid formulations are emerging, potentially supplanting traditional formulations in clinical practice.

3. What markets show the most growth potential for MS CONTIN?

Emerging markets with evolving healthcare infrastructure and less restrictive opioid policies present growth opportunities.

4. How do patent expirations affect MS CONTIN’s market viability?

Patent expirations enable generic competition, driving down prices and limiting branded sales growth.

5. What strategic moves can companies make to sustain sales?

Investing in innovation, expanding into new geographies, and establishing partnerships with pain management services are key strategies.

Sources:

[1] Fortune Business Insights, "Chronic Pain Management Market Size & Global Forecast," (2022).

More… ↓