Last updated: July 29, 2025

Introduction

Morphine sulfate remains a cornerstone in pain management, especially within palliative care, surgical settings, and emergency medicine. As a potent opioid analgesic, it is prescribed for moderate to severe pain, making its market dynamics pivotal in pharmaceutical industry planning. This analysis evaluates current market conditions, growth drivers, competitive landscape, regulatory considerations, and provides robust sales projections for morphine sulfate over the next five years.

Market Overview

Global Market Size and Trends

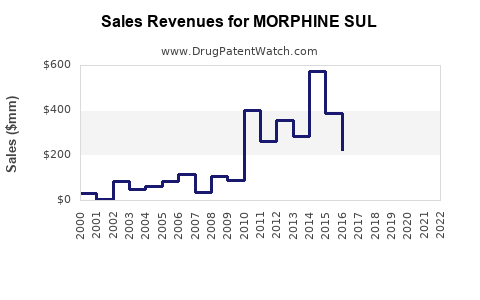

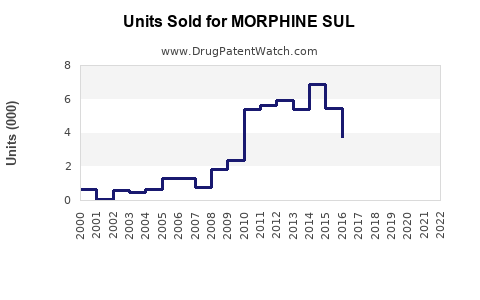

The global opioid analgesics market, including morphine sulfate, was valued at approximately USD 4.2 billion in 2022, with a compound annual growth rate (CAGR) projected at 4.2% through 2027 [1]. Morphine constitutes a significant share due to its longstanding clinical efficacy, especially in oncological and chronic pain management.

Emerging markets exhibit increasing adoption driven by expanding healthcare infrastructure, rising cancer prevalence, and improving pain management awareness. Meanwhile, developed regions, such as North America and Europe, dominate demand, accounting for roughly 60% of the total market.

Demand Drivers

-

Rising Cancer Incidence

Globally, approximately 19 million new cancer cases were diagnosed in 2020, with projections surpassing 28 million by 2040 [2]. Pain control remains central to palliation, with morphine sulfate as first-line therapy, bolstering demand.

-

Increased Surgical Procedures

Advances in minimally invasive surgery and expanding healthcare coverage boost surgical pain management needs.

-

Aging Population

The elderly population, particularly in OECD countries, exhibits higher chronic pain prevalence, necessitating potent analgesics.

-

Regulatory Environment and Opioid Accessibility

While regulations complicate opioid distribution, improved supply chain and healthcare policies in emerging markets are expanding access to morphine.

Market Constraints and Challenges

-

Regulatory and Legal Barriers

Stringent controls on opioid distribution, especially in the U.S., restrict supply and prescribing. The DEA’s scheduling of opioids impedes unrestricted availability [3].

-

Opioid Crisis and Public Perception

The opioid epidemic has led to increased scrutiny, prescription guidelines tightening, and alternative pain management approaches, potentially limiting growth.

-

Manufacturing and Supply Chain Disruptions

Fluctuations in raw material prices and geopolitical factors can impact supply stability.

Competitive Landscape

Major manufacturers include Purdue Pharma, Mallinckrodt, Pfizer, and Teva Pharmaceuticals. Market exclusivity for certain formulations has waned due to patent expirations, facilitating generic entries that dominate price-sensitive markets.

The shift towards injectable and extended-release formulations offers incremental growth avenues. Additionally, national policies favoring balanced pain management are encouraging innovation, albeit under strict oversight.

Sales Projections (2023–2028)

Baseline Assumptions:

- Steady global economic growth supports increased healthcare expenditure.

- Regulatory failures or shifts vary regionally but generally favor sustainable demand.

- Growing awareness and acceptance of pain management will sustain steady prescription rates.

Projected Market Revenue:

| Year |

Estimated Global Revenue (USD Billion) |

Growth Rate (%) |

| 2023 |

4.4 |

4.8% |

| 2024 |

4.6 |

4.5% |

| 2025 |

4.9 |

6.5% |

| 2026 |

5.2 |

6.1% |

| 2027 |

5.5 |

5.8% |

| 2028 |

5.8 |

5.5% |

Key Growth Areas:

- Injectable Formulations: Rapid growth anticipated in hospital settings.

- Generic Expansion: Cost-effective formulations continue gaining market share.

- Emerging Markets: Asia-Pacific and Latin America projected to exhibit the highest CAGR (~6-7%) due to rising healthcare access and cancer rates.

Strategic Opportunities

- Formulation Diversification: Developing long-acting and transdermal patches can capture niche segments.

- Regulatory Engagement: Proactive compliance can facilitate smoother market entry and expansion.

- Partnerships and Alliances: Collaborations with healthcare providers and governments can improve distribution channels.

Regulatory Considerations

Use of morphine sulfate involves navigating complex regulatory frameworks:

- United States: Controlled Substances Act (Schedule II), strict prescribing protocols.

- Europe: EMA guidelines requiring rigorous approval pathways.

- Emerging Markets: Varying standards but increasingly aligning with WHO guidelines.

Intellectual property rights have diminished with patent expiries, increasing generic competition, which impacts pricing strategies but also broadens market access.

Conclusion

The morphine sulfate market exhibits stable, sustained growth driven by global demographic shifts, increasing disease burdens, and expanding healthcare infrastructure, especially in emerging economies. Despite regulatory constraints and public health concerns, strategic adaptations and innovation can secure ongoing demand. The next five years appear promising, provided market participants navigate compliance landscapes effectively and continue healthcare-driven product innovation.

Key Takeaways

- Solid Market Foundation: Morphine sulfate remains essential in pain management with an expected CAGR of around 4.8% through 2028.

- Growth Catalysts: Rising cancer incidence, aging populations, and infrastructural improvements in developing countries fuel demand.

- Competitive Dynamics: Generic manufacturers dominate; innovation in formulations offers growth prospects.

- Regulatory Navigations: Compliance with strict legal standards remains crucial to capitalize on market opportunities.

- Strategic Focus: Diversification into novel formulations and expansion into emerging markets are critical for sustained growth.

FAQs

1. How will the opioid crisis affect the future of morphine sulfate sales?

Regulatory tightening and public health initiatives may limit prescribing. However, controlled and responsible use in medical settings ensures continued demand. Market growth will depend on balancing access and oversight.

2. Are generic versions impacting the profitability of branded morphine sulfate products?

Yes. The expiration of patents has led to increased generic competition, lowering prices but expanding accessible markets, especially in cost-sensitive regions.

3. What are the key regulatory challenges for manufacturers?

Compliance with controlled substance laws, obtaining approvals for new formulations, and managing supply chain restrictions are central. Variability across regions necessitates tailored regulatory strategies.

4. Which emerging markets hold the most promise for morphine sulfate sales?

Asia-Pacific and Latin America, driven by rising cancer rates and healthcare investment, are expected to exhibit high growth potential in the coming years.

5. How can companies differentiate in the morphine sulfate market?

Focus on developing extended-release or transdermal formulations, ensuring regulatory compliance, establishing strong distribution networks, and engaging in partnerships with healthcare stakeholders.

Sources

[1] MarketWatch, "Opioid Analgesics Market Size, Share & Trends Analysis," 2022.

[2] International Agency for Research on Cancer, "Global Cancer Statistics," 2020.

[3] Drug Enforcement Administration, "Controlled Substances Schedule," 2022.