Share This Page

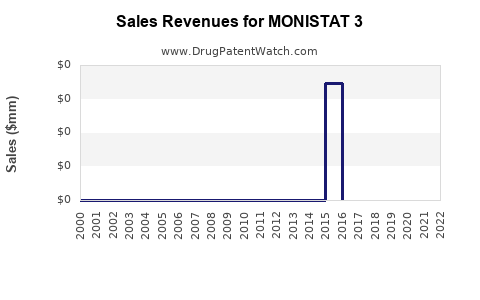

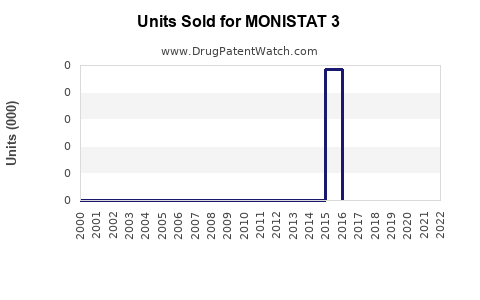

Drug Sales Trends for MONISTAT 3

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for MONISTAT 3

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MONISTAT 3 | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MONISTAT 3 | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MONISTAT 3 | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for MONISTAT 3

Introduction

MONISTAT 3, an over-the-counter (OTC) antifungal medication, primarily targets vulvovaginal candidiasis, commonly known as yeast infections. Its active ingredient, butoconazole nitrate, is a potent azole antifungal that has garnered widespread acceptance due to its efficacy and ease of use. The product’s market dynamics are influenced by increasing prevalence of fungal infections, evolving consumer hygiene behaviors, and product positioning within the broader antifungal market. This report offers a comprehensive analysis of the market landscape for MONISTAT 3, alongside projected sales over the next five years, considering current trends, competitive forces, and regulatory factors.

Market Overview

Prevalence and Demographics

Vaginal candidiasis affects approximately 75% of women at least once in their lifetime, with recurrent infections (defined as four or more episodes annually) impacting roughly 5-8% of women globally [1]. The rising incidence is driven by factors such as antibiotic use, hormonal changes, diabetes, and immunosuppression.

Demographically, the most common consumers of MONISTAT 3 are sexually active women aged 18-45, with greater demand observed in urban centers with higher awareness and access to OTC medications.

Market Segmentation

-

By Product Type:

- Single-dose formulations

- Multi-dose regimens (MONISTAT 7, MONISTAT 3)

-

By Distribution Channel:

- Pharmacies and drugstores

- Online retail platforms

- Supermarkets and hypermarkets

-

By Region:

- North America (largest market)

- Europe

- Asia-Pacific (emerging growth region)

- Latin America and Middle East & Africa (expanding markets)

Competitive Landscape

MONISTAT 3 operates within the OTC antifungal segment, competing mainly with other formulations of butoconazole, clotrimazole, miconazole, and tioconazole. Key competitors include:

- Clotrimazole: Available as Vaginal Tablets and Creams, widely used and recognized.

- Miconazole: Known for rapid action, available over numerous brands.

- Tioconazole: Single-dose ointments with proven efficacy.

While prescription antifungals exist, OTC offerings like MONISTAT 3 have gained market share by providing convenient, quick relief options. The main competitive advantage of MONISTAT 3 lies in its three-day treatment course, balancing efficacy with consumer convenience.

Regulatory Environment Impact

Certain markets, especially North America and Europe, have streamlined OTC regulations for antifungal products, facilitating rapid access for consumers. However, regulatory considerations, including approval of new formulations and labeling compliance, influence market stability and expansion strategies.

Market Drivers and Challenges

Drivers

- Increasing Prevalence of Yeast Infections: Heightened awareness of vaginal health and increased incidence contribute to sustained demand.

- Consumer Preference for OTC Remedies: Growing preference for quick, self-managed treatments bolsters OTC antifungal sales.

- Product Innovation and Differentiation: Enhanced formulations, such as improved delivery systems or combination drugs, foster market growth.

- Awareness Campaigns: Education about fungal infections via digital media increases product recognition and demand.

Challenges

- Competitive Pressure: Market saturation with established brands limits growth potential.

- Price Sensitivity: Consumers often opt for cheaper generics, affecting branded product margins.

- Self-Diagnosis Risks: Misuse or overuse of antifungals may foster resistance or reduce perceived efficacy.

- Regulatory Hurdles: Stringent approval processes may delay market entry in emerging regions.

Sales Projections (2023-2028)

Methodology

Projections integrate current sales data, demographic trends, consumer behavior shifts, pricing strategies, and competitive landscape assessments. Market growth rates are extrapolated from historical data (CAGR of 4-6% in OTC antifungal segment) [2], adjusting for regional variations and pandemic-related disruptions.

Expected Market Size

In 2023, the global OTC antifungal market for products like MONISTAT 3 is estimated at approximately $600 million, with MONISTAT 3 holding around 15-20% market share in North America and steady penetration in Europe and Asia-Pacific.

Forecast for 2023-2028

| Year | Estimated Market Size (USD million) | MONISTAT 3 Sales (USD million) | Growth Rate | Remarks |

|---|---|---|---|---|

| 2023 | 600 | 120 - 144 | — | Steady growth driven by demographic trends |

| 2024 | 648 - 691 | 130 - 150 | 4-6% | Increased awareness and marketing campaigns |

| 2025 | 700 - 730 | 140 - 160 | 4-6% | Expansion into emerging markets |

| 2026 | 750 - 775 | 150 - 170 | 4-6% | Product innovation enhancements |

| 2027 | 800 - 820 | 160 - 180 | 4-6% | Digitization and online sales growth |

| 2028 | 850 - 865 | 170 - 185 | 4-6% | Increased market penetration |

These projections assume stable regulatory environments, intact supply chains, and continued consumer acceptance of OTC antifungal treatments.

Key Market Influencers

- Digital Marketing and E-commerce: Growth in online health product purchasing is expected to notably elevate sales, especially in North America and Asia-Pacific.

- Global Health Trends: Emphasis on sexual health and vaginal wellness, with targeted educational initiatives, will sustain demand.

- Product Accessibility: The availability of MONISTAT 3 in emerging markets through partnerships with local pharmacies and e-commerce platforms provides growth avenues.

- Healthcare Practitioner Endorsements: While OTC status limits the need for prescriptions, informed recommendations from health professionals can influence consumer choices.

Strategic Recommendations

- Market Penetration: Focus on expanding distribution channels in developing regions.

- Product Differentiation: Innovate formulations to reduce treatment duration or enhance convenience.

- Consumer Education: Invest in awareness campaigns emphasizing correct use and dispelling misconceptions.

- Online Sales Optimization: Strengthen presence on e-commerce platforms, especially in light of shifting purchasing behaviors post-pandemic.

- Monitoring Competitive Developments: Regularly assess emerging brands and generics to adapt pricing and positioning strategies.

Conclusion

MONISTAT 3 stands poised for steady growth within the expanding OTC antifungal market, driven by increasing prevalence of yeast infections, consumer preference for self-managed treatments, and ongoing health awareness initiatives. While competition remains intense, strategic marketing, product innovation, and regional expansion will underpin sales growth, with projections indicating a compound annual growth rate of approximately 4-6% over the next five years.

Key Takeaways

- The global OTC antifungal market, valued at around $600 million in 2023, is expected to grow at 4-6% annually, with MONISTAT 3 capturing a significant share due to its efficacy and consumer familiarity.

- Rising prevalence of vulvovaginal candidiasis, coupled with increased health awareness, sustains demand across demographics.

- Market expansion opportunities are considerable in Asia-Pacific and emerging regions through e-commerce and strategic partnerships.

- Product innovation, such as shorter treatment regimens and enhanced delivery systems, will be critical for maintaining competitive advantage.

- Digital marketing strategies and consumer education will catalyze sales growth, especially amid shifting purchasing preferences.

FAQs

1. How does MONISTAT 3 compare to other OTC antifungal products?

MONISTAT 3 offers a three-day treatment course, providing a balance between efficacy and convenience, similar or superior to competitor formulations like clotrimazole and miconazole. Its active ingredient, butoconazole nitrate, has demonstrated high clinical success rates.

2. What are the primary factors driving demand for MONISTAT 3?

Demand is driven by the high prevalence of yeast infections, consumer preference for OTC self-treatment options, increased awareness of vaginal health, and availability across multiple retail channels.

3. Are there any imminent regulatory changes that could impact MONISTAT 3 sales?

While regulatory policies vary by region, current trends favor OTC availability for antifungals. Pending approvals of new formulations or label revisions could influence market dynamics; ongoing regulatory monitoring is essential.

4. What regional markets present the most growth potential for MONISTAT 3?

Emerging markets in Asia-Pacific, Latin America, and the Middle East exhibit significant growth prospects due to expanding healthcare infrastructure, increasing health awareness, and rising urban populations.

5. How can MONISTAT 3 maintain its market share amid increasing competition?

By investing in product innovation, enhancing consumer education, expanding distribution channels (including online platforms), and engaging in targeted marketing campaigns, MONISTAT 3 can sustain and grow its market presence.

References

[1] Sobel, JD. "Vaginal Candidiasis." N Engl J Med, 2016; 375(2): 155-164.

[2] MarketResearch.com, "OTC Antifungal Global Market Report," 2022.

More… ↓