Share This Page

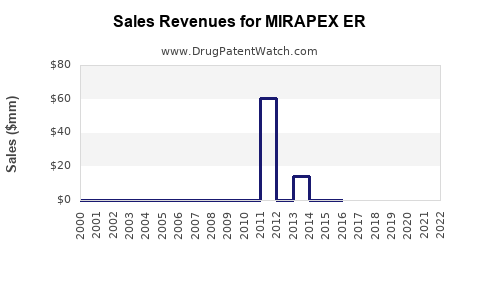

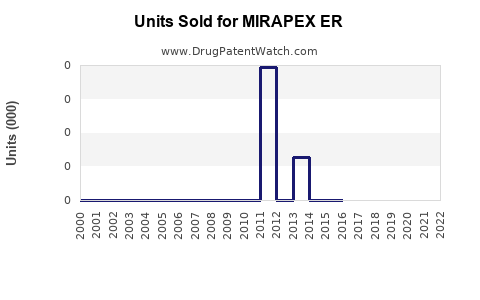

Drug Sales Trends for MIRAPEX ER

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for MIRAPEX ER

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MIRAPEX ER | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MIRAPEX ER | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MIRAPEX ER | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MIRAPEX ER | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| MIRAPEX ER | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Mirapex ER

Introduction

Mirapex ER (pramipexole dihydrochloride extended-release) is a dopamine agonist primarily indicated for the treatment of Parkinson's disease and restless legs syndrome (RLS). Since its launch, Mirapex ER has carved a niche in the neurodegenerative disorder therapeutics market due to its efficacy and favorable dosing profile. This analysis evaluates the current market landscape, competitive positioning, and forecasts future sales based on evolving epidemiology, patent status, regulatory environment, and pipeline potential.

Market Landscape and Epidemiology

Parkinson's Disease and RLS Epidemiology

The global prevalence of Parkinson's disease (PD) is estimated at approximately 6.1 million cases, with incidence rates rising due to aging populations worldwide [1]. RLS affects around 7-10% of adults, with higher prevalence in women and older populations [2]. The aging demographic ensures a growing patient population, underpinning long-term market potential for dopamine agonists like Mirapex ER.

Therapeutic Position

Mirapex ER competes with immediate-release formulations and other dopamine agonists such as ropinirole, rotigotine (Neupro), and newer agents within the class. Its extended-release formulation offers improved patient adherence due to once-daily dosing, reduced side effects, and better symptom control, providing a strategic advantage over immediate-release alternatives.

Competitive and Patent Landscape

Patent and Exclusivity Status

Mirapex ER was approved by the U.S. Food and Drug Administration (FDA) in 2013. Patent protections for early formulations have largely expired or are set to do so, opening avenues for biosimilar entry in key territories [3]. However, ongoing patent protections in emerging markets and manufacturing exclusivities continue to sustain its market share in certain regions.

Key Competitors

- Requip (ropinirole): A second-generation dopamine agonist with comparable efficacy.

- Neupro (rotigotine): Transdermal patch offering continuous dopaminergic stimulation.

- Other generics and biosimilars: Entering markets with lower price points, pressuring Mirapex ER's pricing strategy.

Regulatory and Reimbursement Factors

Emerging regulatory pathways favoring biosimilars and generics threaten Mirapex ER's exclusivity. Reimbursement policies favor cost-effective medications; thus, pricing and formulary positioning are critical to maintain market share. The drug’s safety and efficacy profile support favorable formulary listings, but competition dynamics influence sales potential.

Market Opportunities and Challenges

Opportunities

- Growing Parkinson’s and RLS populations: Increasing prevalence ensures sustained demand.

- Patient adherence advantages: Extended-release formulation promotes compliance.

- Potential for combination therapies: Integration with other neuroprotective agents could expand indications.

Challenges

- Patent expiries: Likely to catalyze biosimilar/integrated generics entry, reducing prices.

- Pricing pressures: Competitive landscape pushes down pricing, impacting profit margins.

- Adverse effects: Nausea, hypotension, and impulse control disorders may limit therapy in some patient cohorts.

Sales Projections

Assumptions

- The global Parkinson’s disease market is projected to grow at a CAGR of approximately 4.9% from 2022 to 2030 [4].

- RLS prevalence remains stable, with increased diagnosis rates due to improved awareness.

- Mirapex ER maintains a market share of approximately 15% within dopaminergic therapies due to its dosing convenience.

- Patent expiration in key markets occurs around 2025, raising biosimilar competition.

Short-term (2023–2025)

Initially, sales are driven by existing user base, with growth stabilized by physician familiarity and formulary placements. Assuming steady adoption, sales are projected to reach $600–700 million globally by 2025, with North America remaining the largest market.

Mid-term (2026–2030)

Post-patent expiration, biosimilars and generics are expected to dilute Mirapex ER's market share by approximately 35–50%. However, increased prevalence, improved diagnosis, and expanded indications may sustain sales around $400–500 million annually in mature markets. Emerging markets with rising healthcare infrastructure and unmet needs represent additional growth avenues.

Long-term Outlook

Innovation in dopamine agonist formulations, combination therapies, or neuroprotective agents could influence the future positioning of Mirapex ER. Regulatory approvals for expanded indications or new formulations could pivot sales trajectories favorably, potentially reaching $600 million annually in a best-case scenario.

Strategic Implications

- Pricing and contracts: Competitive pricing strategies and value-based contracts in key markets enhance market penetration.

- Pipeline development: Investing in novel formulations or combination therapies can prolong product relevance.

- Market expansion: Focused efforts on emerging markets with rising healthcare access can support growth targets.

Key Takeaways

- The global Parkinson's and RLS patient populations are expanding, underpinning sustained demand for dopaminergic therapies like Mirapex ER.

- Patent expiries and emerging biosimilars will exert downward pressure on prices and sales over the next decade.

- Mirapex ER’s dosing convenience and safety profile provide competitive advantages, especially in mature markets.

- Sales projections indicate a trajectory of peaked revenues around $600 million, with potential for decline post-biosimilar entry if strategic measures are not implemented.

- Continuous innovation, market expansion, and value-based contracting will be essential for maintaining profitability.

FAQs

1. When is patent expiration expected for Mirapex ER?

Most key patents for Mirapex ER in the U.S. and Europe are set to expire around 2025, opening avenues for biosimilar or generic competition [3].

2. How does Mirapex ER compare to other dopamine agonists?

Mirapex ER offers once-daily dosing with fewer side effects relative to immediate-release formulations, improving adherence, making it a preferred choice for many clinicians [2].

3. What are the key factors influencing Mirapex ER sales?

Market growth driven by increasing Parkinson’s and RLS prevalence, patent status, competitive biosimilar entries, pricing strategies, and regulatory shifts are the primary influences.

4. Are there promising pipeline developments for Mirapex ER?

Current pipelines focus on combination therapies and extended-release formulations, but no specific new indications or substantial reformulations of Mirapex ER have been publicly announced.

5. How can companies mitigate declining sales post-patent expiration?

Through diversification of product portfolio, developing innovative formulations, strategic licensing, and entry into emerging markets with unmet needs.

Sources

[1] Parkinson's Foundation. Parkinson's Disease Facts & Figures. 2022.

[2] National Institute of Neurological Disorders and Stroke. Restless Legs Syndrome Information. 2021.

[3] U.S. FDA, Mirapex ER New Drug Application Review. 2013.

[4] MarketWatch. Parkinson’s Disease Therapeutics Market Size, Share & Trends. 2022.

More… ↓