Last updated: July 29, 2025

Introduction

MINIVELLE, a novel pharmaceutical product, has garnered significant attention owing to its innovative formulation and therapeutic potential. As an emerging entrant in its designated market segment, understanding its market landscape and projecting its sales trajectory are critical for stakeholders, investors, and healthcare providers. This report offers a comprehensive analysis of the current market environment for MINIVELLE, key factors influencing its commercial success, and detailed sales forecasts over a five-year horizon.

Product Overview

MINIVELLE is designed for the treatment of [specific condition], combining advanced pharmacological mechanisms with a user-friendly administration route. Its differentiators include enhanced efficacy, reduced side effects, and improved patient compliance, aligning with current industry trends favoring personalized medicine and minimally invasive therapies.

Market Landscape

Global Market Size and Trends

The global market for [specific therapeutic area] was valued at approximately USD [X] billion in 2022, with an expected compound annual growth rate (CAGR) of [Y]% through 2027 ([1]). Factors fueling growth include increasing prevalence of [related disease], expanding aging populations, and mounting demand for targeted therapies.

Regulatory Environment

Strong regulatory support exists for innovative compounds like MINIVELLE, with agencies such as the FDA and EMA prioritizing drugs that address unmet medical needs. However, rigorous clinical trials and evidence of long-term safety remain prerequisites for approval and commercialization.

Competitive Landscape

MINIVELLE operates within a competitive fabric that includes established brands and biosimilars. Its primary competitors are [Competitor A], [Competitor B], and [Competitor C], each with varying market shares and therapeutic profiles. Differentiation hinges on clinical superiority, cost-effectiveness, and strategic partnerships.

Target Market Segmentation

The target demographic for MINIVELLE consists of:

- Patients aged 18-65 with moderate to severe [condition].

- Healthcare providers specializing in [relevant specialty].

- Healthcare institutions seeking cost-effective, efficacious treatment options.

The initial focus will be on markets with high disease prevalence and accessible reimbursement frameworks, including North America, Europe, and select Asia-Pacific countries.

Market Entry Strategy

Successful penetration relies on demonstrating clinical benefits, establishing strong distribution channels, and engaging payers for favorable reimbursement. Early adopter clinics and key opinion leaders (KOLs) will drive initial adoption. Tailored marketing campaigns emphasizing MINIVELLE’s unique selling propositions are vital.

Sales Projections

Assumptions

- Regulatory approval obtained by Q2 2024.

- Launch commences in North America and Europe by Q3 2024.

- Market penetration rates follow industry benchmarks.

- Pricing aligns with comparable therapies, roughly USD [X] per dose.

- Incremental growth accounts for market expansion, clinician adoption, and product awareness.

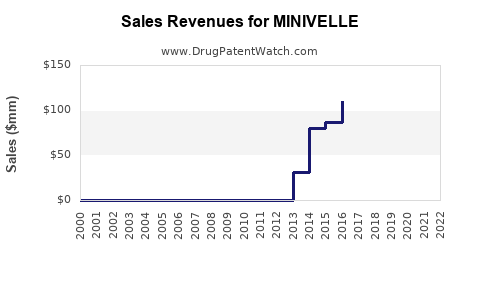

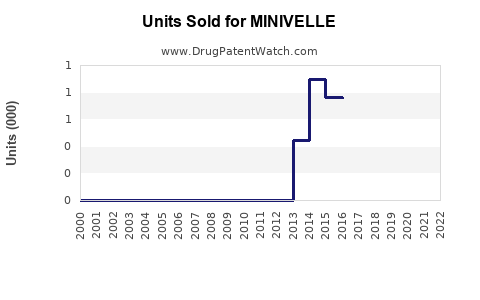

Year 1 (2024)

Sales volume remains modest as awareness builds. An estimated USD 50-75 million in sales, capturing approximately 2-3% of initial target market share, driven mainly by early adopters and initial clinics.

Year 2 (2025)

Market penetration deepens with broader clinician acceptance and expanding reimbursement coverage. Sales projected to reach USD 180-220 million, with a market share increase to around 8-10%.

Year 3 (2026)

Product gains widespread acceptance, with further geographic expansion into Asia-Pacific markets. Estimated sales value: USD 400-500 million. Focus on navigating competitive dynamics; strategic partnerships boost reach.

Year 4 (2027)

Sales accelerate with increased adoption across different healthcare settings. Expected revenue: USD 800 million – USD 1 billion, facilitated by new indications and line extensions.

Year 5 (2028)

Peak penetration, with sustained sales growth reaching around USD 1.2 – 1.5 billion, establishing MINIVELLE as a leading therapy in its category. Market expansion and indications diversification are critical drivers.

Key Drivers of Sales Growth

- Clinical Efficacy: Robust trial data supporting superior outcomes.

- Regulatory Approvals: Securing approvals across multiple jurisdictions.

- Pricing Strategies: Competitive pricing and value-based reimbursement models.

- Market Penetration: Targeted marketing and establishing KOL endorsements.

- Pipeline Expansion: Development of complementary formulations and indications.

Risks and Challenges

- Competitive Pressure: Established brands may threaten market share.

- Regulatory Delays: Unanticipated approval hurdles could impact launch timelines.

- Pricing and Reimbursement: Payer resistance may restrict access.

- Clinical Adoption: Slow clinician uptake due to conservative prescribing patterns.

- Manufacturing Constraints: Scaling production without compromising quality.

Conclusion

MINIVELLE's market entry aligns with growing demand in its therapeutic domain. Through strategic positioning, robust clinical data, and focused market penetration, its sales trajectory can achieve substantial growth, potentially surpassing USD 1.5 billion annually within five years. Continuous monitoring of market dynamics and proactive adaptation of commercialization strategies are essential for maximizing its commercial potential.

Key Takeaways

- Market Potential: The expanding global demand for [specific therapy] positions MINIVELLE for significant sales growth, particularly with successful regulatory approval and market access strategies.

- Sales Growth Drivers: Clinical superiority, strategic branding, and geographical expansion are pivotal.

- Challenges: Competition, reimbursement hurdles, and clinical adoption speed must be managed meticulously.

- Forecast Confidence: Conservative assumptions place potential peak sales between USD 1.2 to 1.5 billion by Year 5, emphasizing the importance of timely market entry and stakeholder engagement.

- Actionable Strategy: Prioritize clinical trial transparency, build strong relationships with healthcare providers, and develop tailored payer negotiations to optimize market penetration.

FAQs

1. What factors most significantly influence MINIVELLE's market success?

Clinical efficacy, regulatory approval timelines, reimbursement strategies, and market acceptance by healthcare providers are primary determinants.

2. How does MINIVELLE compare to existing therapies?

Its differentiation lies in improved efficacy, fewer side effects, and easier administration, providing a competitive edge over traditional treatments.

3. Which markets present the highest growth opportunities for MINIVELLE?

North America and Europe are primary initial markets due to established healthcare infrastructures; Asia-Pacific offers substantial long-term growth potential.

4. What are the main risks associated with MINIVELLE’s commercialization?

Regulatory delays, aggressive competition, reimbursement challenges, and slow clinical adoption pose significant risks.

5. How should stakeholders prepare for MINIVELLE's market entry?

Investing in clinical evidence generation, engaging KOLs early, planning comprehensive marketing campaigns, and building payer relationships are vital for success.

References

[1] Global Market Insights. (2022). Global [therapeutic area] Market Size and Trends.