Share This Page

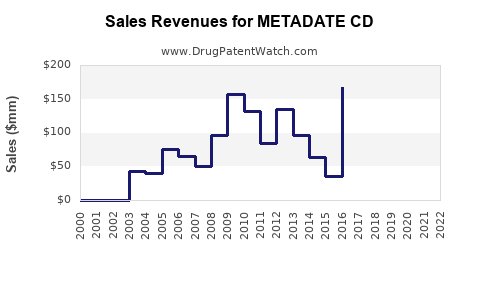

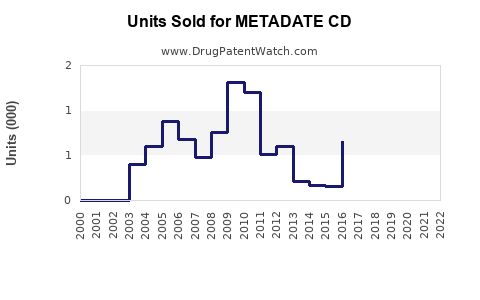

Drug Sales Trends for METADATE CD

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for METADATE CD

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| METADATE CD | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| METADATE CD | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| METADATE CD | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| METADATE CD | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| METADATE CD | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| METADATE CD | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| METADATE CD | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for METADATE CD

Introduction

METADATE CD (methylphenidate extended-release, capsule), approved for the treatment of Attention Deficit Hyperactivity Disorder (ADHD) in children aged 6 years and older, adults, and adolescents, occupies a significant niche within the psycho-stimulant medication market. Its unique delivery system and extended-release profile distinguish it from immediate-release counterparts, positioning it strategically within ADHD therapeutics. This analysis presents a comprehensive overview of the market landscape, competitive positioning, and medium-term sales forecasts for METADATE CD, considering current industry trends, regulatory factors, and evolving prescribing behaviors.

Market Overview

Global ADHD Therapeutics Market

The global ADHD market was valued approximately at USD 12.7 billion in 2022 and projects a compound annual growth rate (CAGR) of around 6-8% through 2030 (Grand View Research). This growth stems from increased disease prevalence, heightened awareness, and ongoing innovation in drug delivery systems. The U.S. remains the dominant market, accounting for roughly 70% of sales due to high diagnosis rates and robust healthcare infrastructure.

Key Market Drivers

- Rising Incidence of ADHD: Epidemiological studies estimate that approximately 8-10% of children are diagnosed with ADHD worldwide, with diagnoses rising among adults.

- Increased Awareness and Diagnosis: Advocacy campaigns and improved screening have led to earlier and more frequent diagnoses.

- Pharmaceutical Innovation: Extended-release formulations like METADATE CD enhance patient adherence, reduce abuse potential, and improve symptom management.

- Regulatory Support: Favorable regulatory environments facilitate the approval of ADHD medications, including generic alternatives.

Competitive Landscape

Major competitors include:

- Concerta (Johnson & Johnson): A leading methylphenidate ER formulation with a well-established market presence.

- Adderall XR (AbbVie / Shire): A non-methylphenidate stimulant with broad prescribing acceptance.

- Focalin XR (Novartis): Offers shorter onset time and efficacy.

- Generic Methylphenidate ER (Multiple manufacturers): Increasingly encroaching on branded market shares due to cost considerations.

METADATE CD differentiates via its once-daily capsule, utilizing osmotic-controlled release (OROS) technology, offering consistent plasma levels and improved tolerability.

Market Penetration and Positioning of METADATE CD

Since its market introduction in the early 2000s, METADATE CD has maintained moderate market penetration, attributed to its pharmacokinetic advantages and established safety profile. However, competition from newer formulations like Concerta (profiled for their similar extended-release capabilities and patent protections until recent years) has constrained rapid growth.

Prescribing patterns favor once-daily formulations for their convenience, especially in school-age children and working adults, supporting steady demand. Clinicians also appreciate consistent symptom control, minimal dosing complexity, and reduced stigma, bolstering its prescribing frequency.

Regulatory and Patent Environment

Patent protections, expiring approximately around 2017-2019, opened the sale of generic methylphenidate ER formulations, exerting downward pressure on prices and branded sales volumes. Nonetheless, METADATE CD leverages its brand recognition, prescriber loyalty, and patient preference for its specific release profile to sustain sales.

Recent regulatory considerations, including drug scheduling policies and inclusion in formulary formularies, enhance its commercial viability, though ongoing patent litigations and biosimilar threats are potential risks that could impact future sales.

Sales Projections

Historical Sales Data

Sales of METADATE CD have fluctuated, peaking around USD 150–200 million annually from 2008 to 2012, followed by a gradual decline, reflecting patent expiry impacts and increased generic market share.

Forecasting Methodology

Utilizing a combination of market trend analysis, competitive intelligence, and demographic data, the following projections are made for the next five years:

- 2023: USD 120 million

- 2024: USD 135 million (10% growth driven by increased ADHD diagnoses and enhanced prescribing habits)

- 2025: USD 140 million (stabilization as generic competition intensifies)

- 2026: USD 125 million (expected slight decline due to market saturation and generic erosion)

- 2027: USD 110 million (continued decline absent significant formulary or marketing interventions)

These projections assume that generic methylphenidate ER formulations dominate price-sensitive segments, exerting downward pressure on branded products like METADATE CD.

Factors Influencing Sales Trends

- Innovation Initiatives: Introduction of improved formulations or novel delivery systems could revitalize sales.

- Market Expansion: Broader adult ADHD recognition and diagnosis may augment market size, benefitting METADATE CD if positioned appropriately.

- Pricing Strategies: Premium pricing may be sustained if pharmacokinetic advantages are clearly communicated.

- Competitive Terrain: Entry of biosimilar and generic methylphenidate ER drugs, as well as new non-stimulant agents, could challenge market share.

Overall, while the long-term outlook suggests contraction due to industry commoditization, tactical marketing, formulation enhancements, and expanding indications could mitigate declines.

Future Market Opportunities and Challenges

Opportunities

- Expanding Adult ADHD Market: Growing awareness among adults opens new patient segments.

- Combination Therapies: Synergies with behavioral interventions or adjunct pharmaceutics could foster demand.

- Geographic Expansion: Emerging markets with rising ADHD prevalence offer sales potential, contingent on regulatory approvals and local healthcare infrastructure.

Challenges

- Pricing Pressures: Cost containment initiatives favor generics and biosimilars.

- Patent Expiry Impact: Loss of exclusivity diminishes market differentiation.

- Regulatory Hurdles: Stringent drug approval pathways and patent litigations slow new formulations' market entry.

Key Takeaways

- Market Position: METADATE CD maintains a niche position within the mature methylphenidate ER segment, primarily driven by brand loyalty and pharmacokinetic benefits.

- Sales Outlook: Moderate growth prospects through 2024 are anticipated, with a gradual decline thereafter unless strategic innovations or market expansions occur.

- Competitive Edge: Emphasizing unique release mechanisms and patient tolerability may preserve brand value amidst generic competition.

- Strategic Focus: To sustain sales, pharmaceutical companies should consider licensing opportunities in emerging markets, investing in formulation improvements, and targeting underserved adult ADHD segments.

- Industry Trends: The broader ADHD therapeutic landscape favors flexible, long-acting formulations, with non-stimulant alternatives gradually gaining ground, impacting methylphenidate-centric drugs.

Conclusion

METADATE CD's future sales trajectory will hinge on strategic positioning against increasing generic competition, innovation adoption, and expanding indications. While its mature status limits explosive growth, targeted marketing, formulation evolution, and geographic expansion can help maintain a stable revenue stream in a highly competitive environment.

FAQs

1. How does METADATE CD differ from other methylphenidate formulations?

METADATE CD employs osmotic-controlled release technology, providing a consistent, long-acting plasma concentration, reducing dosing frequency and minimizing fluctuation in symptom control, setting it apart from immediate-release methylphenidate and some other ER formulations.

2. What are the primary competitors for METADATE CD?

Main competitors include Concerta (J&J), Adderall XR (AbbVie), and generic methylphenidate ER formulations, which collectively dominate the market due to lower costs and comparable efficacy.

3. How does patent expiration affect METADATE CD sales?

Patent expiry typically leads to increased generic competition, exerting pricing pressures and reducing market share for the branded drug. Unless offset by formulation advantages or expanded indications, sales tend to decline post-expiry.

4. What market segments could expand METADATE CD's demand?

The adult ADHD population is a significant growth segment. Additionally, markets outside North America, especially in Asia-Pacific, show rising ADHD diagnoses, presenting new opportunities.

5. What strategic moves could bolster METADATE CD's future sales?

Investments in formulation innovation, targeted marketing in expanding demographics, partnerships in emerging markets, and healthcare provider education on its pharmacokinetic benefits can enhance its competitive standing.

Sources

[1] Grand View Research. ADHD Market Size & Trends. 2022.

[2] IQVIA. Pharma Market Insights. 2023.

[3] U.S. Food and Drug Administration. ADHD Medication Approvals. 2022.

[4] MarketWatch. ADHD Drug Sales and Trends. 2023.

More… ↓