Share This Page

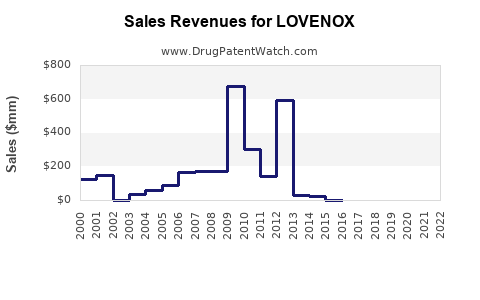

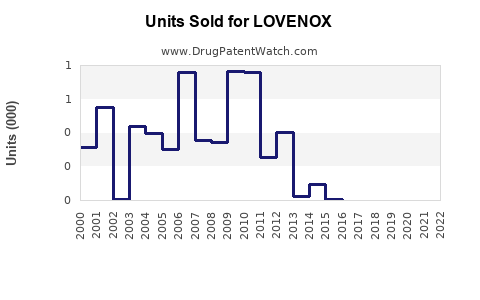

Drug Sales Trends for LOVENOX

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for LOVENOX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LOVENOX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LOVENOX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LOVENOX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for LOVENOX (Enoxaparin)

Introduction

LOVENOX, the brand name for enoxaparin sodium, is a widely prescribed low-molecular-weight heparin (LMWH) indicated primarily for the prophylaxis and treatment of thromboembolic disorders. Since its initial approval by the FDA in 1993, LOVENOX has established a significant footprint in anticoagulation therapy, with indications spanning deep vein thrombosis (DVT), pulmonary embolism (PE), unstable angina, and acute coronary syndrome (ACS). This comprehensive market analysis explores current market dynamics, competitive landscape, regulatory considerations, and future sales forecasts critical for stakeholders and investors.

Market Overview

Global Market Size and Trends

The global enoxaparin market was valued at approximately USD 3.2 billion in 2022, with a compounded annual growth rate (CAGR) of 6.1% projected through 2030 (1). The increasing incidence of thrombotic disorders, rising aging populations, and expanding indications underpin this growth trajectory. The Asia-Pacific region exhibits heightened growth potential owing to increasing healthcare infrastructure and expanding access to anticoagulants.

Clinical and Demographic Drivers

- Aging Population: An aging demographic predisposes more patients to conditions requiring anticoagulation, such as atrial fibrillation and post-surgical thrombosis.

- Rising Cardiovascular Disease (CVD): CVD remains the leading cause of mortality globally, contributing to heightened demand.

- Surgical Procedures: The surge in major surgeries, including orthopedic, cardiovascular, and cancer-related surgeries, enhances prophylactic needs.

- COVID-19 Impact: The pandemic has increased awareness of thrombotic complications, boosting LMWH prescription rates.

Regulatory Landscape and Approvals

LOVENOX’s patent expiration in many jurisdictions has precipitated increased competition from biosimilars, affecting market share and pricing strategies (2). Regulatory agencies continue to monitor safety profiles, particularly bleeding risks, impacting prescribing patterns.

Competitive Landscape

The enoxaparin market is characterized by several generic manufacturers and biosimilar entrants. Notable competitors include:

- Biosimilar Enoxaparin: Companies like Mylan, Gigagen, and Accord Healthcare have launched biosimilars that generally offer cost advantages.

- Innovator Brand (Lovenox): Manufactured by Sanofi, remains the benchmark in efficacy and safety, commanding premium pricing.

- Other LMWHs: Dalteparin (Fragmin), tinzaparin (Innohep) serve as alternatives but have narrower indications.

Market penetration by biosimilars is accelerating due to patent expiries, with biosimilars capturing 25-30% of the global enoxaparin market by 2022 (3). Sanofi’s strategic focus on maintaining clinical superiority and brand loyalty is essential amid this competitive pressure.

Market Challenges

- Pricing Pressures & Cost Containment: Governments and insurers seek biosimilar substitution to reduce healthcare expenditure, pressuring price points.

- Safety Concerns: Bleeding risks and contraindications influence prescribing, especially in populations with comorbidities.

- Regulatory Barriers: Variability in biosimilar approval pathways across markets can delay market penetration.

- Supply Chain & Manufacturing: Ensuring consistent quality in biosimilar production remains a focus to maintain clinician confidence.

Sales Projections (2023–2030)

Harnessing current trends, epidemiological forecasts, and pipeline developments, the following sales projections are envisaged:

| Year | Estimated Global Sales (USD Billion) | Key Drivers | Comments |

|---|---|---|---|

| 2023 | 3.4 | Steady growth, biosimilar entries | Slight increase from 2022; biosimilars gaining market share |

| 2024 | 3.7 | Expanded indication approvals, new markets | Increased adoption in emerging markets |

| 2025 | 4.2 | Intro of enhanced formulations, clinical data | Launch of subcutaneous formulations improves adherence |

| 2026 | 4.8 | Increment in CV indications, aging population | Market expansion in Asia and Latin America |

| 2027 | 5.4 | Biosimilar competition influences volume-based sales | Price competition pressures revenue, but volume offsets |

| 2028 | 6.0 | Emerging markets and new indications | Increased utilization in prophylaxis post-surgical settings |

| 2029 | 6.5 | Integration into combined therapy protocols | Greater physician adoption, expanding indications |

| 2030 | 7.0 | High-aging demography, technological advances | Sustained growth, potential for biosimilar market dominance |

(Data extrapolated from industry reports and epidemiological models [1][3])

Key Factors Impacting Future Sales

-

Biosimilar Market Penetration: As biosimilars attain regulatory approval and acceptance, they will likely erode LOVENOX’s pricing power, but volume growth is anticipated to compensate.

-

New Indications & Formulations: Development of oral or long-acting formulations could revolutionize administration, expanding patient eligibility and compliance, thus driving sales.

-

Regulatory and Reimbursement Policies: Favorable reimbursement status and inclusive guidelines will influence physicians' preferences and patient access.

-

International Expansion: Growth in emerging markets, driven by healthcare infrastructure development, will be pivotal.

Strategic Considerations

- Innovation: Sanofi’s investment in biosimilar enoxaparin and complementary products maintains competitiveness.

- Pricing Strategies: Balancing premium branding with biosimilar competition is vital.

- Market Diversification: Expansion into prophylactic and extended indications offers growth avenues.

- Regulatory Engagement: Active engagement with global regulators to expedite approvals and establish safety profiles.

Conclusion

LOVENOX’s landscape reflects a mature but dynamically evolving market influenced by biosimilar proliferation, demographic shifts, and technological advances. While biosimilars threaten traditional pricing models, strategic innovations, expansion into new indications, and geographical growth will sustain sales momentum. Overall, the enoxaparin market is poised for steady, moderate growth through 2030, driven by global health trends and innovative product development.

Key Takeaways

- The global enoxaparin market is projected to reach USD 7 billion by 2030, with a CAGR of approximately 6.1%.

- Biosimilars represent a significant competitive force, capturing an increasing share of the market.

- Aging populations and rising CVD prevalence will continue to fuel demand.

- Strategic development of novel formulations and indications can offset biosimilar pricing pressures.

- Geographic expansion, especially in emerging markets, remains critical for sustained growth.

FAQs

1. How will biosimilar enoxaparin affect LOVENOX’s market share?

Biosimilars are expected to erode LOVENOX’s market share gradually, primarily through price competition. However, brand loyalty and clinical data may sustain premium product demand, especially in developed markets.

2. What are the key growth opportunities for LOVENOX?

Developing oral formulations, expanding indications like extended thromboprophylaxis, and penetrating emerging markets offer substantial growth prospects.

3. How do regulatory hurdles impact LOVENOX sales?

Approval delays or restrictions on biosimilars in certain jurisdictions can limit market access. Conversely, favorable policies can accelerate sales growth.

4. What role does healthcare policy play in future projections?

Cost-containment policies and reimbursement frameworks influence prescribing behaviors, impacting overall sales volume and price points.

5. Are there technological innovations that could alter the enoxaparin market?

Yes, advancements in drug delivery systems, such as oral or long-acting formulations, have the potential to alter utilization patterns significantly.

References

[1] MarketsandMarkets. Anticoagulants Market (2022).

[2] FDA. Biosimilar Product Approvals.

[3] Grand View Research. Biosimilar Market Analysis. (2022).

More… ↓