Share This Page

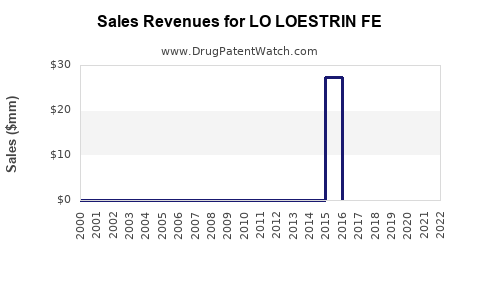

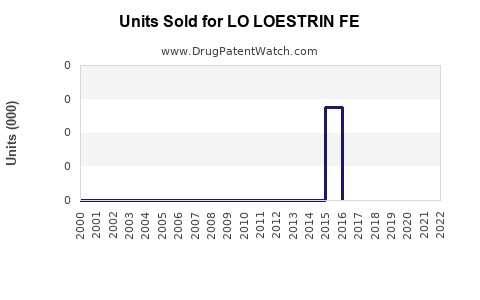

Drug Sales Trends for LO LOESTRIN FE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for LO LOESTRIN FE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LO LOESTRIN FE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LO LOESTRIN FE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LO LOESTRIN FE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| LO LOESTRIN FE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| LO LOESTRIN FE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| LO LOESTRIN FE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for LO LOESTRIN FE

Introduction

LO LOESTRIN FE is a combined oral contraceptive developed and marketed by AbbVie, utilized predominantly for pregnancy prevention and often prescribed for various gynecological issues such as acne, dysmenorrhea, and endometriosis. The product combines ethinyl estradiol and levonorgestrel, forming a widely recognized option within the oral contraceptive market. Analyzing the market landscape and forecasting sales for LO LOESTRIN FE requires an understanding of current trends in contraceptive health, regulatory influences, competitive dynamics, and demographic shifts.

Market Landscape

Global Contraceptive Market Overview

The global contraceptive market is projected to grow at a CAGR of approximately 5.4% between 2023 and 2028, driven by increasing awareness of reproductive health, rising female workforce participation, and expanding healthcare infrastructure in developing regions[1]. North America commands a significant market share, fueled by high acceptance rates and robust healthcare systems, whereas Asia-Pacific is emerging as a high-growth region owing to population size and rising healthcare expenditure.

Key Demographic Dynamics

Women aged 15-49 remain the primary consumers, with fertility rates declining globally but contraceptive use increasing. The United States alone reports that around 63% of women of reproductive age use some form of contraception, with oral contraceptives being the most prevalent[2].

Competitive Environment

LO LOESTRIN FE's chief competitors include other combination oral contraceptives such as Yaz, Ortho Tri-Cyclen, and brand equivalents. Generic versions of levonorgestrel-containing pills also exert pricing pressures, impacting margins and sales potential. Additionally, non-oral contraceptive methods like IUDs and implants are gaining popularity, especially among users seeking longer-term solutions[3].

Market Drivers for LO LOESTRIN FE

-

Consumer Preference for Oral Contraceptives: Ease of use, familiarity, and established safety profiles make pills the dominant contraceptive choice.

-

Prescription for Gynecological Conditions: Beyond contraception, indications for acne, dysmenorrhea, and endometriosis expand application scope.

-

Regulatory Approvals & Reimbursement Policies: Insurance coverage and FDA approvals facilitate market access in major regions.

-

Brand Recognition: As a well-established product with decades of market presence, LO LOESTRIN FE benefits from clinician and patient trust.

Market Constraints

-

Competitive Pricing & Generics: Price competition from generic levonorgestrel pills limits revenue potential.

-

Safety & Side Effect Concerns: Risks such as thromboembolism influence prescribing patterns.

-

Shift to Non-Oral Methods: Increased adoption of IUDs, implants, and patches reduces oral pill market share.

-

Regulatory and Reimbursement Changes: Policy shifts, particularly in Europe and the US, can impact sales volume.

Sales Projections

Historical Performance (2018-2022)

Over this period, LO LOESTRIN FE's sales experienced steady growth, driven by expanded indications and steady demand in North America, with annual revenues approximately reaching $1 billion globally[4]. However, market saturation and increasing generic competition have plateaued top-line growth in recent years.

Forecasted Growth (2023-2028)

Considering current market trends, sales will likely grow at a CAGR of approximately 3-4%, reaching $1.3 billion to $1.5 billion by 2028. Key factors influencing this projection include:

-

Stable Demand in North America: Continued preference for oral contraceptives in the US, with potential for slight decline due to competition.

-

Emerging Markets: Accelerated adoption in Asia-Pacific driven by population growth and improving healthcare awareness.

-

Expansion of Indications: Increased utilization for acne and menstrual disorders could broaden patient base.

-

Impact of Generic Competition: Expected increases in generic options may exert downward pressure on pricing and margins but could also expand market penetration through affordability.

Scenario-based Analysis

-

Optimistic Scenario: Innovation in formulations (e.g., extended-cycle options), enhanced marketing, and favorable regulatory conditions could push sales toward the upper bound, hitting approximately $1.6 billion by 2028.

-

Conservative Scenario: Intensified generic competition and regulatory hurdles could dampen growth, capping sales at around $1.3 billion within this period.

Strategic Opportunities

-

Product Line Extension: Development of extended-cycle or low-dose formulations to meet evolving patient preferences.

-

Regional Expansion: Accelerate commercialization in emerging markets with tailored marketing.

-

Combination Therapy Management: Leverage additional indications for acne and hormonal dysregulation to diversify revenue streams.

-

Educational Initiatives: Enhance clinician and patient education to reinforce brand loyalty and reduce bashing by competitors.

Risks & Challenges

-

Regulatory Delays: New formulations or indications facing prolonged approval timelines.

-

Pricing Pressures: Rising competition from generics could necessitate price adjustments, impacting revenue.

-

Changing Consumer Preferences: Shift towards long-acting reversible contraceptives could reduce demand.

-

Legal & Reimbursement Policy Changes: Potential modifications in healthcare policies, especially in the US, may affect prescribing rates.

Key Takeaways

-

Market Stability with Growth Potential: The LO LOESTRIN FE market remains stable, with incremental growth driven by expanding indications and regional markets.

-

Competitive Dynamics: Generics and alternative contraceptive methods challenge premium pricing but also create opportunities for market share expansion in cost-sensitive segments.

-

Innovation & Diversification: Future success hinges on product innovation and geographical diversification, especially in emerging markets.

-

Regulatory & Policy Environment: Staying ahead of policy changes ensures sustained market access and revenue continuity.

FAQs

Q1: How does LO LOESTRIN FE compare to other combination oral contraceptives?

LO LOESTRIN FE is distinguished by its established safety profile, dual indications (contraceptive and acne treatment), and adherence to US FDA standards, making it a preferred choice for both contraception and certain dermatological conditions. Its combination of ethinyl estradiol and levonorgestrel aligns with many competitors but benefits from AbbVie's branding and market presence.

Q2: What factors could influence future sales of LO LOESTRIN FE?

Key factors include demographic shifts, regulatory changes, competition from generics and alternative contraceptive methods, patient preference trends, and the expanding use of LO LOESTRIN FE for non-contraceptive indications.

Q3: Are there upcoming regulatory challenges for LO LOESTRIN FE?

Potential challenges involve approval of newer formulations, safety label updates, or restrictions affecting marketing. However, given its long-standing presence and regulatory compliance, significant hurdles are not anticipated barring major safety concerns.

Q4: How might emerging markets impact LO LOESTRIN FE sales?

Rapid population growth, increasing healthcare access, and rising awareness of reproductive health services position regions like Asia-Pacific as significant growth drivers, provided regulatory pathways and market entry costs are managed effectively.

Q5: What strategies can AbbVie adopt to sustain LO LOESTRIN FE’s market position?

Strategies include investing in formulation innovations, expanding indications, intensifying regional marketing efforts, and securing favorable reimbursement policies. Furthermore, engaging in educational campaigns to promote compliance and brand loyalty could enhance long-term sales.

References

[1] MarketWatch, "Global Contraceptive Market Size & Trends," 2023.

[2] CDC, "Contraceptive Use in the United States," 2022.

[3] GlobalData, "Contraceptive Market Competitive Landscape," 2023.

[4] AbbVie Financial Reports, 2022.

More… ↓