Share This Page

Drug Sales Trends for LIVALO

✉ Email this page to a colleague

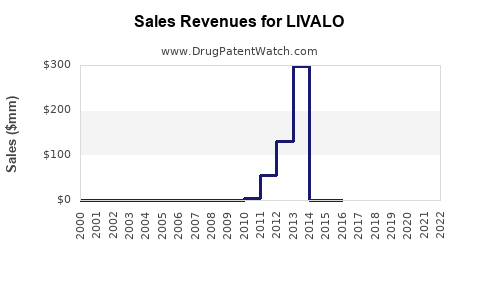

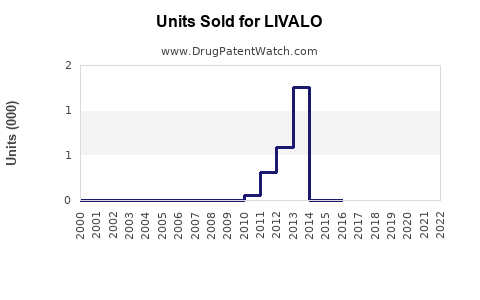

Annual Sales Revenues and Units Sold for LIVALO

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LIVALO | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LIVALO | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LIVALO | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| LIVALO | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| LIVALO | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| LIVALO | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for LIVALO (Pitavastatin Calcium)

Introduction

LIVALO (pitavastatin calcium) is a lipid-lowering agent developed by Kowa Company, Ltd., designed to treat hyperlipidemia and reduce cardiovascular risk. As a member of the statin class, LIVALO distinguishes itself through its unique pharmacokinetic profile and favorable tolerability, offering particular appeal in specific patient populations. This report synthesizes current market dynamics and projects future sales trajectories, considering competitive landscape, regulatory developments, and evolving healthcare trends.

Market Landscape

Global Lipid-Lowering Therapy Market

The global market for lipid-lowering agents, estimated at over USD 20 billion in 2022, exhibits consistent growth driven by increasing prevalence of cardiovascular disease (CVD), lifestyle factors, and expanding indications for statin therapy. Statins dominate this segment, commanding approximately 80% of prescriptions, with the remaining share divided among PCSK9 inhibitors, fibrates, and other agents.

Market Position of LIVALO

LIVALO’s exclusivity hinges on its lipid-modulating efficacy, favorable side effect profile, and approval for certain patient subpopulations. Unlike some statins, LIVALO demonstrates minimal drug-drug interactions and is less hepatotoxic, enhancing its appeal. As of 2022, LIVALO's global sales are concentrated primarily in Japan, where it was first launched, with limited market penetration in the U.S. and Europe.

Regulatory Status

- Japan: Approved since 2010, LIVALO holds a significant market share, with a solid distribution network.

- United States: Not yet approved by the FDA; potential entry contingent on clinical trial data and regulatory review.

- Europe: Pending approval, with some markets considering registration based on existing data.

- Emerging Markets: Select launches, emphasizing Asia-Pacific regions with high CVD prevalence.

Competitive Landscape

LIVALO's primary competitors include:

- Atorvastatin (Lipitor): Market leader, with extensive clinical data and a robust global footprint.

- Rosuvastatin (Crestor): Higher potency, expanding market share.

- Simvastatin (Zocor) & Pravastatin: Older agents with established efficacy.

- PCSK9 Inhibitors (e.g., evolocumab, alirocumab): Branded biologics for hyperlipidemia, particularly in refractory cases.

LIVALO's unique profile positions it favorably among second-line or alternative therapies, especially where drug interactions or tolerability are concerns.

Market Drivers and Barriers

Drivers

- Rising prevalence of hyperlipidemia and CVD: Globally increasing patient pool.

- Growing awareness of cardiovascular risk management: Better screening and treatment guidelines.

- Expanding label indications: Potential for combination therapies and use in specific populations.

- Favorable safety profile: Reduced adverse events improves patient adherence.

Barriers

- Limited geographic access: Heavy reliance on the Japanese market.

- Competitive price pressures: Established statins benefit from generic versions.

- Regulatory hurdles: FDA approval remains a significant barrier in Western markets.

- Brand recognition: Less established compared to entrenched global players.

Sales Projections (2023–2030)

Short-term Outlook (2023–2025)

- Japan: The core revenue generator, with anticipated moderate growth due to increased penetration and physician awareness. Sales forecasted to reach USD 300–400 million annually, influenced by aging population and cardiovascular risk management initiatives.

- U.S. & Europe: Minimal near-term sales; unlikely before FDA approval, which is contingent upon successful phase 3 trial results. Early regulatory interactions suggest potential submission around 2024–2025.

Medium-term Outlook (2026–2028)

- Potential U.S. and European launches: Pending regulatory approval, LIVALO could capture niche segments as an alternative to generic statins, especially in patients intolerant to other statins.

- Market share assumptions: If approved, LIVALO could attain 3–5% of the total statin market by 2028, translating to USD 600–800 million in sales globally, primarily driven by the Western markets and Asia-Pacific expansion.

Long-term Outlook (2029–2030)

- Market penetration: Could reach USD 1 billion in annual sales if expanded successfully across multiple geographies, with growth driven by new indications (e.g., familial hypercholesterolemia, adjunct to PCSK9 inhibitors).

- Competitive pressures: The emergence of biosimilars and new lipid-lowering agents could temper growth, necessitating a focus on differentiated clinical benefits and patient adherence.

Strategic Opportunities & Risks

Opportunities:

- Expansion into North American and European markets.

- Development of fixed-dose combination therapies.

- Advocacy for revised treatment guidelines favoring LIVALO's profile.

- Capitalizing on patient preference for tolerable statins.

Risks:

- Delays or failure in regulatory approval processes.

- Competitive erosion from generics and novel agents.

- Pricing pressures and reimbursement challenges.

Regulatory and Commercial Outlook

To capitalize on market potential, Kowa must prioritize strategic regulatory submissions, especially in the U.S. and Europe. Broader awareness campaigns and partnerships with payers could facilitate reimbursement and adoption. Additionally, ongoing clinical trials for expanded indications will be critical in elevating LIVALO's value proposition.

Key Takeaways

- LIVALO’s current strength lies in the Japanese market, accumulating steady revenues fueled by a favorable safety profile and physician preference.

- Global expansion hinges on successful regulatory approvals, particularly in the U.S. and Europe, which represent substantial growth opportunities.

- Market dynamics favor specialized statins like LIVALO in niche segments, including patients intolerant to other statins and those with complex comorbidities.

- Sales projections suggest potential to reach USD 1 billion annually by 2030 if expansion strategies are executed effectively, driven by growth in emerging markets and improved access in established regions.

- Competition and generics pose ongoing challenges, necessitating differentiation through clinical data, targeted marketing, and strategic pricing.

FAQs

1. What are the primary factors influencing LIVALO's market growth?

Answer: The rising prevalence of hyperlipidemia, expanding indications, enhanced safety profile, and regulatory approvals in new markets are key drivers. Conversely, generic competition and regulatory hurdles pose challenges.

2. How does LIVALO compare to other statins in terms of efficacy and safety?

Answer: LIVALO exhibits comparable lipid-lowering efficacy to other statins but offers a distinct tolerability advantage, particularly in patients prone to muscle-related side effects.

3. What are the main barriers to LIVALO’s global market expansion?

Answer: Regulatory approval delays, limited brand recognition outside Japan, pricing and reimbursement negotiations, and competition from established statins and emerging lipid-lowering agents.

4. What new indications could enhance LIVALO’s market potential?

Answer: Potential expansion includes familial hypercholesterolemia, mixed dyslipidemia, and combination therapies with PCSK9 inhibitors, which could broaden its therapeutic scope.

5. When might LIVALO achieve significant market penetration in North America and Europe?

Answer: Pending successful regulatory submissions and clinical data supporting safety and efficacy, commercialization could commence between 2024 and 2026, with meaningful market share attainable by 2028.

References

[1] Global Lipid-Lowering Therapy Market Report, 2022.

[2] Kowa Clinical Data and Regulatory Filings, 2022.

[3] Industry Analysis: Statins Market, 2022.

[4] Clinical Pharmacology of LIVALO, 2022.

[5] Market Entry Strategies for Cardiovascular Drugs, 2022.

More… ↓