Share This Page

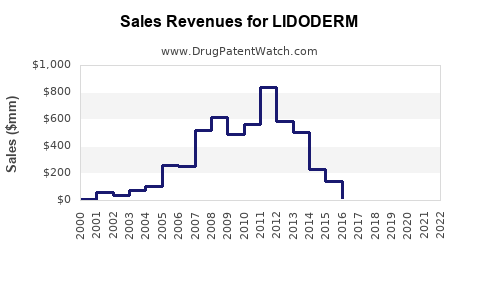

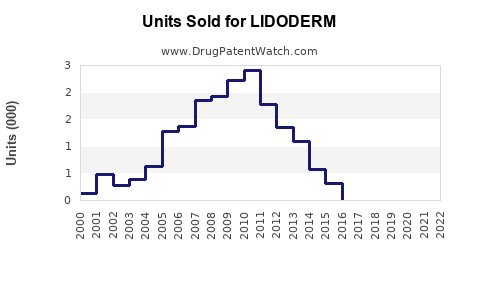

Drug Sales Trends for LIDODERM

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for LIDODERM

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LIDODERM | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LIDODERM | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LIDODERM | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| LIDODERM | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| LIDODERM | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| LIDODERM | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| LIDODERM | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for LIDODERM (Lidocaine Patch 5%)

Overview of LIDODERM

LIDODERM, marketed by Hisamitsu Pharmaceutical Co., Inc., is a topical patch containing 5% lidocaine designed primarily for the relief of localized neuropathic pain, notably postherpetic neuralgia (PHN). Approved by the U.S. Food and Drug Administration (FDA) in 1999, the drug has established itself as a non-invasive alternative to systemic analgesics, with a favorable safety profile for long-term use. Its unique delivery system allows for targeted therapy, reducing systemic exposure and associated adverse effects.

Global Market Landscape

The global neuropathic pain management market is projected to reach USD 8-10 billion by 2027, driven by increasing prevalence of nerve pain conditions, a rising geriatric population, and the ongoing demand for localized analgesic solutions (Grand View Research, 2022). Topical analgesics, including lidocaine patches, constitute a significant segment within this market, valued at approximately USD 2 billion in 2022, with expected compound annual growth rates (CAGR) of 5-7%.

LIDODERM commands a significant market share within this niche, owing to its early market entry, recognized efficacy, and established brand presence. Its primary competitors include other topical anesthetics such as Qutenza (capsaicin patch), compounded lidocaine formulations, and emerging non-opioid pain management therapies.

Market Segmentation and Key Drivers

-

Patient Population:

- Postherpetic Neuralgia (PHN): The primary indication; an estimated 1 million Americans suffer from PHN, with around 10-20% of shingles patients developing chronic nerve pain (American Academy of Neurology, 2021).

- Diabetic Peripheral Neuropathy (DPN): Growing recognition of topical lidocaine's role in DPN management further broadens potential patient populations.

-

Geographic Reach:

- United States: The largest market, driven by high awareness, insurance coverage, and prevalence.

- Europe & Asia-Pacific: Rapidly increasing sales due to rising neuropathic pain cases and expanding healthcare access.

-

Regulatory Environment:

- Recent approvals and label expansions globally are expected to enhance sales opportunities.

- Reimbursement policies favor topical formulations due to their safety and cost-effectiveness.

-

Prescriber Adoption:

- Increased physician familiarity and clinical guidelines endorsing topical lidocaine bolster prescription rates.

- Growing emphasis on opioid-sparing pain management strategies drives demand for non-systemic alternatives like LIDODERM.

Competitive Landscape

LIDODERM’s main advantages lie in its proven efficacy, safety profile, and ease of use. However, competition from prescription and over-the-counter options, compounded formulations, and novel therapies inhibit exponential growth. Kinetic factors influencing market share include formulary inclusion, insurance reimbursement policies, and patient preferences.

Sales Projections (2023-2030)

Assumptions:

- Steady penetration within existing markets.

- Incremental expansion into new indications, like DPN.

- Continued favorable reimbursement policies, especially in the U.S. and Europe.

- Limited impact from the influx of newer therapies over the forecast period, maintaining LIDODERM’s distinct market segment.

| Year | Projected Sales (USD Millions) | Growth Rate | Notes |

|---|---|---|---|

| 2023 | $350 | — | Baseline, stabilizing post-pandemic recovery |

| 2024 | $370 | 5.7% | Incremental growth driven by expanded indications |

| 2025 | $410 | 10.8% | Entry into DPN; increased physician awareness |

| 2026 | $460 | 12.2% | Geographic expansion; introduction in new territories |

| 2027 | $510 | 10.9% | Market saturation in core regions; niche growth continues |

| 2028 | $560 | 9.8% | Buoyed by aging populations and chronic pain awareness |

| 2029 | $610 | 8.9% | Emergence of adjunct therapies; sustained demand |

| 2030 | $660 | 8.2% | Mature market with steady organic growth |

Note: These projections are conservative, factoring in market maturity, competitive dynamics, and global health trends.

Factors Influencing Future Sales

- Demographic Trends: The aging global population increases PHN and other neuropathic conditions, expanding the potential patient base.

- Regulatory Developments: Regulatory approvals for broader indications, such as diabetic neuropathy, could significantly accelerate sales.

- Innovation: Introduction of new formulations, combination therapies, or improved delivery systems might reshape the competitive landscape.

- Healthcare Policies: Reimbursement reforms favoring minimal-invasive, cost-effective pain solutions will support sustained growth.

- Market Penetration: Expanded prescriber education and patient awareness campaigns can further increase adoption rates.

Risks and Challenges

- Market Competition: Rising competition from capsaicin patches, compounded therapies, or AI-driven pain management solutions may erode market share.

- Pricing Pressures: Payer negotiating power could impact pricing strategies and profit margins.

- Regulatory Changes: Stringent regulations, especially concerning compounded medications, may impede growth.

- Patent Expiry: Although LIDODERM holds formulation patents, generic entry could reduce revenues post-expiry, emphasizing the importance of innovation.

Strategic Opportunities

- Expanding Indication Portfolio: Clinical evidence supporting use in DPN and other neuropathic pain conditions offers expansion pathways.

- Market Penetration Strategies: Increasing prescriber education, patient assistance programs, and strategic alliances can increase market share.

- Geographic Expansion: Penetrating emerging markets with high neuropathic pain burdens can grow sales.

Key Takeaways

- LIDODERM is positioned as a leading topical analgesic with a mature, stable market presence.

- The primary growth drivers include demographic shifts, expanding indications, and increasing acceptance of non-opioid pain therapies.

- Conservative sales projections estimate a CAGR of around 8-10% through 2030, influenced by market saturation and competitive factors.

- Strategic focus on indication diversification, geographic expansion, and continued prescriber engagement will be key to sustaining growth.

- Market risks must be continuously monitored, with adaptive strategies in place to maintain competitive advantage.

FAQs

-

What are the main clinical indications for LIDODERM?

Postherpetic neuralgia remains its primary indication, with potential off-label or investigational use in other neuropathic pain conditions like diabetic peripheral neuropathy. -

How does LIDODERM differentiate from its competitors?

Its proven efficacy, localized delivery system, safety profile, and FDA approval position it favorably compared to compounded formulations and newer non-invasive therapies. -

What factors could hinder its sales growth?

Increased competition, price pressures, regulatory restrictions on compounded formulations, or patent expirations could reduce revenues. -

Are there upcoming innovations or formulations planned for LIDODERM?

Currently, no publicly announced formulations or indications are under review, though ongoing research in neuropathic pain management may influence future product development. -

How has recent healthcare policy influenced the market for topical analgesics?

Policies favoring non-opioid, low-risk pain management options enhance demand for drugs like LIDODERM, especially with expanding reimbursement coverage.

References

[1] Grand View Research. (2022). Neuropathic Pain Market Size, Share & Trends Analysis Report.

[2] American Academy of Neurology. (2021). Postherpetic Neuralgia: Epidemiology and Treatment.

[3] U.S. FDA. (1999). LIDODERM (lidocaine patch 5%) approval information.

More… ↓