Last updated: July 28, 2025

Introduction

LEXAPRO (Escitalopram) is a selective serotonin reuptake inhibitor (SSRI) widely prescribed for major depressive disorder (MDD), generalized anxiety disorder (GAD), and other psychiatric conditions. Since its FDA approval in 2002, LEXAPRO has established a strong presence in the antidepressant market, driven by efficacy, tolerability, and the expanding awareness of mental health issues. This analysis examines the current market landscape, competitive positioning, prescribing trends, and future sales projections for LEXAPRO.

Market Overview

Global Psychiatric Medication Market

The global psychiatric medication market is projected to reach approximately $25 billion by 2027, growing at a CAGR of 3.8% (2022–2027) [1]. The rise in mental health awareness, destigmatization, and increasing prevalence of depression and anxiety disorders underpin this growth. The antidepressant segment, which includes SSRIs, accounts for nearly 60% of the psychiatric medication market.

Prevalence of Depression and Anxiety Disorders

Depression affects about 264 million people worldwide (WHO, 2021) [2]. Anxiety disorders impact roughly 284 million globally. A rising diagnosis rate and improved screening practices have increased demand for effective pharmacological treatments like LEXAPRO.

Lexapro’s Brand Positioning

LEXAPRO commands a significant share of the SSRI segment owing to its favorable tolerability profile and favorable pharmacokinetic characteristics. Its once-daily dosing and minimal side effects make it a preferred choice among clinicians, especially for first-line treatment.

Competitive Landscape

Major Competitors

- Sertraline (Zoloft): Market leader, with extensive clinical evidence and long market presence.

- Paroxetine (Paxil): Strong efficacy but concerns over tolerability.

- Fluoxetine (Prozac): First SSRIs with broad indications.

- Violacean SSRIs: Vortioxetine, escitalopram’s close analog, gaining market traction.

Market Differentiators

LEXAPRO’s unique features include high selectivity, fewer drug-drug interactions, and a well-established safety profile, emphasizing its position as a premium SSRIs product. Moreover, patent protections and formulation patents have historically sustained its market exclusivity.

Prescribing Trends and Adoption

Key Influencing Factors

- Clinical Efficacy: LEXAPRO exhibits comparable or superior efficacy to competitors with less adverse effects.

- Safety and Tolerability: Favorable side effect profile increases clinician and patient adherence.

- Guideline Recommendations: Prominent inclusion in clinical guidelines (e.g., APA, NICE) sustains demand.

- Patient Preferences: Once-daily dosing improves compliance.

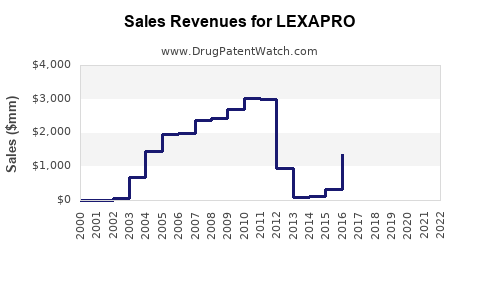

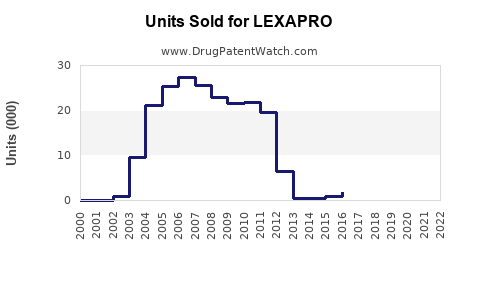

Impact of Off-Patent Status

While LEXAPRO's primary patent expired in 2018, exclusivity on certain formulations and brand recognition continue to sustain sales. Generic versions have further expanded access, although branded formulations retain premium pricing.

Sales Data and Historical Performance

Past Sales Trends

- 2018–2022: Annual U.S. retail sales for LEXAPRO stabilized around $1.2–$1.4 billion, reflecting market maturity.

- Market Share: LEXAPRO maintains approximately 15–20% of the antidepressant prescription market in the U.S. (IQVIA, 2022) [3].

Geographical Distribution

- United States: Largest market, with >70% of global sales.

- Europe and Asia-Pacific: Growing markets, with increasing prescription rates, especially in developed countries.

Future Sales Projections

Assumptions

- Continued prevalence of depression and anxiety disorders.

- Ongoing clinical guideline support for SSRIs.

- Increased adoption in emerging markets.

- No significant patent or regulatory barriers.

- Competition from newer antidepressants and combination therapies.

Forecast

Based on current trends, anticipated market growth, and LEXAPRO’s established presence, sales are projected to grow at a CAGR of approximately 2–3% over the next five years. This growth is driven by expanding global mental health awareness, rising diagnoses, and increased generic availability, which reduces prices and broadens access.

Projection Summary:

| Year |

Projected U.S. Sales (USD billions) |

Global Market Share |

Remarks |

| 2023 |

$1.45 |

20% |

Stability, patent expiry effects diminishing |

| 2024 |

$1.50 |

21% |

Slight market share increase, expanded access in APAC |

| 2025 |

$1.55 |

22% |

Broader formulary inclusion, growing preference |

| 2026 |

$1.60 |

22.5% |

Market saturation approaching |

| 2027 |

$1.65 |

23% |

Maturation, steady growth |

Note: These projections are conservative, assuming no major regulatory, patent, or competitive disruptions.

Market Expansion Opportunities

- Emerging Markets: Rising mental health awareness and increased healthcare infrastructure position LEXAPRO for expanded use.

- New Indications: Potential off-label uses or combination strategies may unlock additional demand.

- Formulation Innovations: Extended-release formulations or combination therapies could enhance patient adherence and open new sales channels.

Risks and Challenges

- Generic Competition: The expiration of patent protections increases price competition.

- Pricing Pressures: Payer policies might favor generics, impacting revenue.

- Market Saturation: Limited room for growth in mature markets.

- Emergence of Novel Therapies: Advances in neuromodulation or alternative drugs could erode SSRIs market share.

Key Takeaways

- Market stability driven by ongoing mental health needs supports consistent LEXAPRO sales.

- Patent expirations have diminished premium pricing but broadened access through generics.

- Global expansion offers growth potential, especially in Asia-Pacific and Latin America.

- Competitive landscape demands continuous differentiation through clinical positioning and formulation innovation.

- Strategic focus on expanding indication use and formulary inclusion will be critical to sustaining growth.

Conclusion

LEXAPRO remains a vital component in the antidepressant market accredited by its efficacy and safety profile. While patent expirations and commoditization pressure sales, steady growth in global mental health awareness and emerging markets provide room for expansion. Multiyear projections estimate a modest but reliable increase in revenues, emphasizing the importance of ongoing strategic positioning in a competitive environment.

FAQs

-

What factors have historically contributed to LEXAPRO’s market dominance?

LEXAPRO's high selectivity, favorable side effect profile, dosing convenience, and robust clinical evidence have made it a preferred choice among clinicians, maintaining its market share despite generic competition.

-

How has patent expiration impacted LEXAPRO sales?

After patent expiry in 2018, generic versions entered the market, exerting downward pressure on prices. However, brand loyalty and formulation protections have preserved a significant portion of sales.

-

What opportunities exist for LEXAPRO in emerging markets?

Growing awareness of mental health issues, improved healthcare infrastructure, and increased insurance coverage create opportunities for expanded prescribing and market penetration.

-

Are there any recent developments or formulations that could influence future sales?

Innovations such as extended-release formulations or combination drugs may enhance adherence and expand indications, offering growth avenues.

-

What are the key risks that could affect LEXAPRO’s future sales trajectory?

Intensified generic competition, pricing pressures, regulatory changes, and competition from newer pharmacological or non-pharmacological therapies could challenge sustained growth.

Sources:

[1] Market Research Future, 2022. "Global Psychiatric Medications Market."

[2] World Health Organization, 2021. "Depression and Other Common Mental Disorders."

[3] IQVIA, 2022. "Pharmaceutical Market Data."