Share This Page

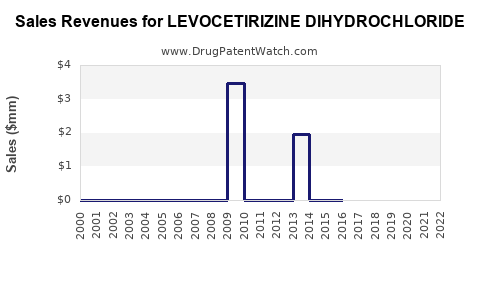

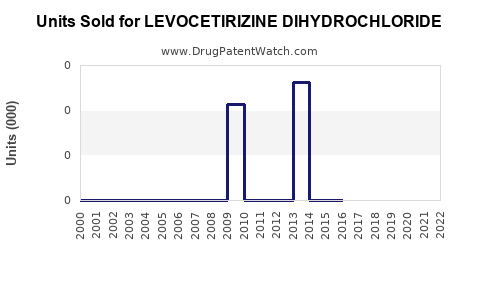

Drug Sales Trends for LEVOCETIRIZINE DIHYDROCHLORIDE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for LEVOCETIRIZINE DIHYDROCHLORIDE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LEVOCETIRIZINE DIHYDROCHLORIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LEVOCETIRIZINE DIHYDROCHLORIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LEVOCETIRIZINE DIHYDROCHLORIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| LEVOCETIRIZINE DIHYDROCHLORIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Levocetirizine Dihydrochloride

Introduction

Levocetirizine dihydrochloride, a potent third-generation antihistamine, is widely used in the management of allergic rhinitis and chronic urticaria. Its favorable safety profile, minimal sedative effects, and effectiveness have driven global demand. This report provides a comprehensive market analysis and sales projection insights for levocetirizine dihydrochloride, emphasizing current trends, competitive landscape, regulatory environment, and future growth potential.

Market Overview

Levocetirizine is the active enantiomer of cetirizine, offering improved efficacy and reduced side effects. The global antihistamine market, valued at approximately USD 2.8 billion in 2022, is projected to grow modestly at a compound annual growth rate (CAGR) of 4.2% through 2030, driven by increasing prevalence of allergy-related conditions.

Within this landscape, levocetirizine maintains an advantageous position due to its safety profile, OTC availability in several regions, and pharmaceutical innovations enhancing bioavailability. The rising aging population, urban pollution, and greater awareness of allergy diagnoses bolster market expansion.

Segment Analysis

Geographical Distribution

- North America: Dominates due to high healthcare expenditure and widespread OTC licensing, with the U.S. accounting for approximately 45% of the market share.

- Europe: Represents around 30%, supported by favorable regulatory frameworks and extensive allergy management protocols.

- Asia-Pacific: Exhibits rapid growth, projected to grow at a CAGR of over 6%, fueled by expanding healthcare infrastructure, rising allergy incidence, and increasing consumer purchasing power.

- Rest of the World: Contributes smaller but increasing shares, especially in Latin America and Middle East regions.

Formulation Types

- Tablets: Majority segment, favored for convenience and longer shelf life.

- Syrups: Increasing in pediatric and geriatric use, especially in emerging markets.

Distribution Channels

- Hospital pharmacies: Significant in severe cases.

- Retail pharmacies: OTC availability increases sales volume.

- Online pharmacies: Growing segment driven by e-commerce proliferation.

Competitive Landscape

Major players include Johnson & Johnson (Zyrtec), Teva Pharmaceuticals, Sandoz, Mylan, and local generic manufacturers. Brand differentiation hinges on pricing strategies, formulation innovations, and market reach.

Generic formulations dominate sales due to affordability, with patent expirations in key markets increasing availability. Manufacturers focus on optimizing production costs, ensuring regulatory compliance, and expanding distribution channels.

Regulatory and Patent Landscape

Levocetirizine dihydrochloride's patent protection has largely expired in many regions (e.g., Europe, North America), facilitating generics' entry. However, some formulations may retain exclusivity based on formulation patents or marketing rights.

Regulatory approval processes remain streamlined in developed regions but pose barriers in emerging markets due to varying standards.

Market Drivers

- Increasing prevalence of allergic rhinitis, estimated to affect over 500 million people globally.

- Rising awareness and self-medication facilitated by OTC availability.

- Innovations improving drug bioavailability and reducing sedation risks.

- Expansion in pediatric and geriatric indications.

Market Challenges

- Competition from other antihistamines and combination therapies.

- Pricing pressures, especially from generics.

- Stringent regulatory approvals in emerging markets.

- Potential side effects and safety concerns.

Sales Projections (2023-2030)

Using a data-driven approach integrating historical sales, market penetration rates, demographic trends, and regional growth patterns, the following projections are outlined:

| Year | Estimated Global Sales (USD Billion) | Growth Rate (%) |

|---|---|---|

| 2023 | 1.2 | 4.2 |

| 2024 | 1.25 | 4.2 |

| 2025 | 1.3 | 4.0 |

| 2026 | 1.36 | 4.6 |

| 2027 | 1.42 | 4.4 |

| 2028 | 1.48 | 4.5 |

| 2029 | 1.55 | 4.7 |

| 2030 | 1.62 | 4.5 |

Notes:

- The upward trajectory considers increasing generic penetration in emerging markets.

- Asia-Pacific's CAGR is assumed at approximately 6%, accounting for rapid market expansion.

- North America and Europe collectively maintain steady growth owing to existing market saturation and prescription-driven sales.

Market Share Projections

- Generics: Expected to capture over 85% of sales by 2030, driven by patent expiries.

- Brand-Name Drugs: Likely to see a slight decline due to OTC availability and generics' cost advantages, but premium formulations may sustain niche markets.

Emerging Trends Influencing the Market

- Personalized Medicine: Potential for tailored allergy treatments influencing pharmacovigilance and sales.

- Digital Health: Integration of telemedicine and online pharmacy platforms expands drug access.

- Sustainability Measures: Manufacturers adopting eco-friendly production to appeal to environmentally conscious consumers.

- Regulatory Evolution: Efforts to streamline approval processes could accelerate market entry in underserved regions.

Strategic Recommendations

- Expand Generic Portfolio: Leverage patent expirations to increase market penetration.

- Focus on Pediatric and Geriatric Indications: Address unmet needs in vulnerable populations.

- Strengthen Distribution: Enhance online and offline pharmacy collaboration.

- Invest in Formulation Innovation: Develop rapid-release or combination therapies to differentiate offerings.

- Navigate Regulatory Frameworks: Ensure compliance to facilitate swift approvals and market access.

Key Takeaways

- The global levocetirizine dihydrochloride market is poised for steady growth, driven by rising allergy prevalence and expanding OTC acceptance, especially in emerging markets.

- Generic formulations will dominate sales, intensifying price competition while expanding consumer access.

- Asia-Pacific presents the most significant growth opportunity, expected to outpace developed regions with a CAGR exceeding 6%.

- Innovation in formulations and digital health integration will remain crucial for market differentiation.

- Regulatory trends and patent landscape shifts necessitate proactive strategic planning for sustained growth.

Conclusion

Levocetirizine dihydrochloride continues to secure its foothold in the antihistamine market through widespread consumer acceptance, regulatory favorable environments, and evolving formulations. Stakeholders should focus on leveraging regional growth opportunities, optimizing product offerings, and navigating patent expiries to maximize market share and sales revenue in the coming years.

FAQs

1. What are the primary factors influencing the growth of levocetirizine dihydrochloride?

The primary factors include rising prevalence of allergic conditions, increased OTC sales, expanding markets in Asia-Pacific, and patent expiries facilitating generic competition.

2. How does patent expiration impact levocetirizine market sales?

Patent expiries enable generic manufacturers to enter the market, typically leading to price reductions, increased accessibility, and overall sales growth, especially in price-sensitive regions.

3. What are the major challenges facing levocetirizine market expansion?

Challenges comprise intense competition from other antihistamines, regulatory hurdles in emerging markets, pricing pressures, and safety concerns related to side effects.

4. Which regions are expected to lead in levocetirizine sales growth?

Asia-Pacific is projected to exhibit the highest growth due to increased healthcare infrastructure and allergy prevalence, with North America and Europe maintaining steady demand.

5. What strategic innovations can companies pursue to retain competitiveness?

Innovations include developing improved formulations, expanding indications, integrating digital distribution channels, and leveraging personalized medicine approaches.

References

[1] Market Research Future. "Antihistamine Market Analysis." 2022.

[2] GlobalData. "Pharmaceutical Market Outlook." 2023.

[3] IMS Health. "Over-the-Counter Drug Sales Trends." 2022.

[4] World Allergy Organization. "Global Allergy Statistics." 2021.

[5] Statista. "Regional Pharmaceutical Sales Data." 2023.

More… ↓