Last updated: July 27, 2025

Introduction

Levetiracetam, marketed under brand names such as Keppra and Keppra XR, stands as a leading anticonvulsant in the management of epilepsy. Since its approval by the FDA in 1999, it has gained widespread acceptance due to its favorable efficacy and tolerability profile. This analysis provides a comprehensive overview of the current market landscape, competitive dynamics, and sales forecasts for Levetiracetam, factoring in recent developments, therapeutic trends, and global demand.

Therapeutic Indications and Market Penetration

Levetiracetam primarily treats focal (partial-onset) seizures, generalized seizures, and status epilepticus. Its broad spectrum and dosing flexibility have cemented its position as a first-line therapy across multiple geographies, notably in North America, Europe, and parts of Asia.

The drug’s safety profile—featuring minimal drug-drug interactions and a low incidence of adverse effects—further boosts its prescription rates, especially among populations vulnerable to polypharmacy, such as elderly patients.

Market Drivers

1. Rising Prevalence of Epilepsy

The global prevalence of epilepsy ranges from 4 to 10 per 1,000 people, with approximately 50 million individuals affected worldwide. Increasing diagnostic detection and awareness contribute to higher medication uptake.

2. Expanding Therapeutic Use

Levetiracetam's approval for various indications and off-label use in psychiatric and neuropathic conditions bolster demand. Its suitability for pediatric, adult, and elderly populations expands overall market reach.

3. Favorable Pharmacokinetic Profile

High bioavailability (~100%), minimal medication interactions, and once or twice-daily dosing improve patient compliance and adherence, reinforcing prescriber preference.

4. Competitive Landscape and Patent Strategies

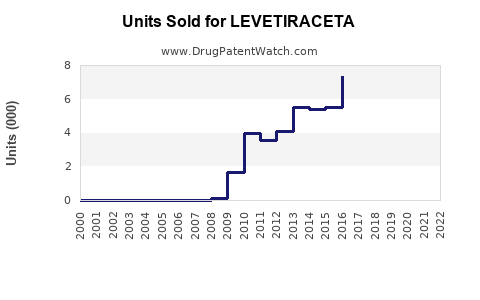

Although original manufacturer UCB Pharma's patent has expired in many regions, robust generic competition has driven prices downward, expanding access and sales volumes.

Competitive Landscape

1. Brand vs. Generic Market Share

The patent expiration accelerated generic penetration, accounting for over 70% of prescriptions in key markets, with branded Levetiracetam retaining approximately 30% share due to prescriber loyalty and formulary preferences.

2. Key Players

- UCB Pharma (Original Developer)

- Teva Pharmaceuticals

- Mylan (now part of Viatris)

- Sandoz

- Sun Pharmaceuticals

Market segmentation indicates a shift towards generic formulations, which dominate volume but impact revenue per unit.

3. Alternative Therapies

Other anticonvulsants like Lamotrigine, Valproate, and newer agents like Brivaracetam (a Levetiracetam analog with potentially superior efficacy for certain epilepsies) influence prescribing trends and sales.

Regional Market Dynamics

- North America: The largest Levetiracetam market driven by high epilepsy prevalence, advanced healthcare infrastructure, and favorable reimbursement policies. US sales alone generate approximately USD 1.2 billion annually, with stable growth trajectory.

- Europe: Mature market with widespread adoption; generic competition is prominent, but high prescribing rates persist.

- Asia-Pacific: Rapid growth fueled by increasing healthcare access, rising incidence, and expanding pharmaceutical infrastructure. Markets such as China and India are projected to exhibit compounded annual growth rates (CAGRs) of 4-6%.

Recent Developments Impacting Market Trajectory

- Clinical Trials and Label Extensions: Levetiracetam is under investigation for potential use in psychiatric disorders, traumatic brain injury, and neuropathic pain, potentially broadening indications.

- Price and Reimbursement Policies: Price negotiations and formulary decisions heavily influence sales, especially in public healthcare systems.

- Emerging Biosimilars: Introduction of biosimilar versions could reduce costs and increase market penetration.

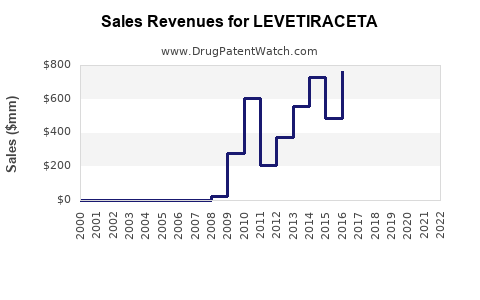

Sales Projections (2023-2028)

Forecasts for Levetiracetam sales reflect steady growth, anchored in increased epilepsy diagnoses, generic penetration, and expanding indications.

| Year |

Estimated Global Sales (USD billion) |

Growth Rate (%) |

| 2023 |

~USD 3.5 billion |

— |

| 2024 |

~USD 3.8 billion |

8.6% |

| 2025 |

~USD 4.2 billion |

10.5% |

| 2026 |

~USD 4.6 billion |

9.5% |

| 2027 |

~USD 5.0 billion |

8.7% |

| 2028 |

~USD 5.4 billion |

8.0% |

The CAGR over this period is projected at approximately 9%, driven by increasing adoption in emerging markets and potential expands to new indications.

Key factors influencing this forecast:

- Generic Competition: Price erosion is expected but offset by volume growth.

- Pipeline Developments: New formulations or combination therapies could stimulate incremental sales.

- Regulatory Approvals: Expansion into off-label indications or orphan status could create additional revenue streams.

Challenges and Risks

- Patent and Regulatory Dynamics: Patent cliffs among originators foster generic proliferation, compressing margins.

- Market Saturation: Mature markets may experience plateauing sales unless new indications emerge.

- Pricing Pressures: Governments and payers focus on cost containment, especially with low-cost generics dominating.

- Emerging Competition: Newer agents offering improved efficacy or safety could supplant Levetiracetam in certain niches.

Strategic Imperatives for Stakeholders

- Invest in R&D: Focus on new formulations, delivery mechanisms, or expanded indications.

- Optimize Pricing Strategies: Balance affordability with profit margins, especially in emerging markets.

- Enhance Market Access: Collaborate with healthcare providers and payers to ensure broad adoption.

- Monitor Competitive Movements: Stay ahead of biosimilar entries and pipeline developments.

Conclusion

Levetiracetam remains a cornerstone in epilepsy management, with a resilient market presence bolstered by clinical efficacy and tolerability. While patent expirations have shifted revenues towards generics, sustained demand across global markets ensures steady growth, projected to reach approximately USD 5.4 billion by 2028. Strategic focus on expanding indications, optimizing market access, and navigating competitive landscapes will be essential for stakeholders aiming to maximize value in this segment.

Key Takeaways

- Levetiracetam's dominant position in epilepsy treatment is supported by its broad therapeutic profile and favorable safety.

- The global sales landscape is shifting toward generics, impacting revenue but increasing volume.

- Growth prospects remain robust, especially in emerging markets and potential new indications.

- Price pressures and competition necessitate strategic innovation and market engagement.

- Continuous monitoring of regulatory trends and pipeline developments is crucial to optimize future sales and market share.

FAQs

1. How has patent expiry affected Levetiracetam's market sales?

Patent expiry led to significant generic entry, reducing per-unit revenue but increasing sales volume due to lower prices, maintaining overall revenue but emphasizing volume growth over premium pricing.

2. Are there any new indications for Levetiracetam currently in clinical trials?

Yes. Clinical research explores Levetiracetam’s potential in psychiatric disorders, traumatic brain injury, and neuropathic pain, which could broaden its therapeutic applications.

3. How does regional variation influence Levetiracetam sales?

Advanced regions like North America and Europe exhibit high adoption due to established healthcare systems, while rapid growth in Asia-Pacific is driven by increasing diagnosis rates and expanding healthcare infrastructure.

4. What is the impact of biosimilars and generics on Levetiracetam's future sales?

Biosimilars and generics lower costs and enhance access, likely maintaining high volume sales but compressing profit margins for brand-name manufacturers.

5. What strategies can pharmaceutical companies adopt to sustain or increase Levetiracetam sales?

Investing in indication expansion, developing combination therapies, enhancing formulations, optimizing pricing, and fostering partnerships with healthcare providers are key strategies.

References

- U.S. Food and Drug Administration. Keppra (Levetiracetam) Prescribing Information. [2022].

- GlobalData Healthcare. Epilepsy Therapeutics Market Report. 2022.

- IQVIA. Pharmaceuticals Market Data. 2022.

- UCB Pharma. Levetiracetam Market Strategy Reports. 2021.

- World Health Organization. Epilepsy Fact Sheet. 2022.