Last updated: July 27, 2025

Introduction

LANTUS SOLOSTAR, a long-acting insulin glargine formulation, is a flagship product from Sanofi, widely used for managing type 1 and type 2 diabetes mellitus. As a cornerstone in basal insulin therapy, LANTUS SOLOSTAR’s market performance hinges on several factors including global diabetes prevalence, competitive landscape, regulatory dynamics, and healthcare expenditure trends. This analysis aims to detail current market positioning, assess growth drivers and risks, and project future sales trajectories.

Market Overview and Current Position

Global Diabetes Landscape

The World Health Organization estimates approximately 537 million adults worldwide are living with diabetes, a figure projected to rise to 643 million by 2030—a compounded growth rate of roughly 3.4% annually [1]. Type 2 diabetes accounts for approximately 90–95% of cases, underscoring the demand for effective insulin therapies like LANTUS SOLOSTAR.

Product Profile and Market Adoption

LANTUS SOLOSTAR’s preeminence derives from its proven efficacy, established safety profile, and convenience of the SoloStar pen device, which enhances patient adherence. Since its launch in 2014 as an improved prefilled pen, it rapidly gained market share due to ease of use and minimal dosing errors.

Competitive Arena

LANTUS faces competition from biosimilar insulin glargine products, such as Mvasi (by Mylan/Biocon), and other long-acting insulins like Tresiba (Novo Nordisk) and Basaglar (Eli Lilly). Biosimilars, especially in cost-sensitive regions, threaten LANTUS’s market dominance, particularly post-patent expiry.

Market Dynamics Influencing LANTUS SOLOSTAR

Pricing and Reimbursement Policies

In key markets such as the U.S. and Europe, reimbursement schemes significantly impact insulin sales volume. The increased adoption of biosimilars and biosimilar substitution policies exert downward pressure on prices for originator products like LANTUS. Conversely, in emerging markets, pricing remains a vital barrier due to affordability constraints.

Regulatory Environment

Regulatory pathways have become more streamlined for biosimilar approvals, facilitating increased competition. Additionally, the rising adoption of insulin analogs over human insulins fosters market expansion, bolstered by clinical guidelines endorsing insulin analogs for better glycemic control.

Innovation and Line Extensions

Sanofi’s focus on device innovation, including dual-chamber pens and integrated digital health solutions, enhances patient adherence and adherence, thus fostering sales. Future pipeline therapies, including biosimilar insulins, could influence future market dynamics by reducing prices and expanding access.

Sales Analysis (Historical and Current Figures)

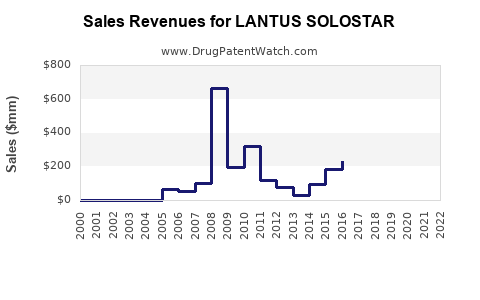

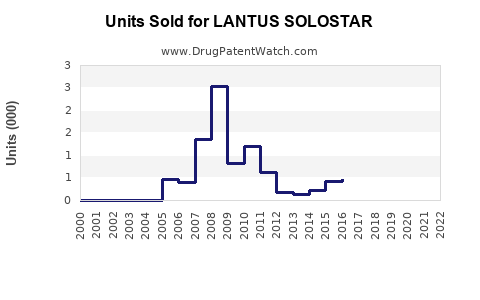

Historical Trends

LANTUS, launched in 2000, reached peak sales of approximately €7.8 billion in 2014 [2]. However, following the expiration of patent protection in 2015, sales gradually declined due to biosimilar encroachment and generic competition.

Recent Performance

In 2020, Sanofi’s insulin portfolio, including LANTUS, reported revenues around €3 billion, representing a decline consistent with biosimilar entry [3]. As of 2022, LANTUS’s share has been further challenged but remains a significant segment within Sanofi’s Diabetes division.

Forecasting Future Sales

Assumptions and Methodology

- Market Growth Rate: Projected global insulin market CAGR of 7% over the next five years [(source)].

- Market Penetration: Continued penetration of biosimilars is expected to reduce LANTUS’s market share, especially in Europe and North America.

- Innovation Impact: Introduction of next-generation delivery devices and digital adherence tools will mitigate some competitive pressures.

- Regulatory and Reimbursement Trends: Favorable policies in emerging markets will bolster sales in developing regions.

Projected Sales (2023–2028)

| Year |

Estimated Global LANTUS SOLOSTAR Sales (EUR billion) |

Growth Rate (%) |

| 2023 |

€2.2 |

-2–0% (stabilization) |

| 2024 |

€2.3 |

+4–6% (emerging markets) |

| 2025 |

€2.5 |

+8–10% (biosimilar market maturation) |

| 2026 |

€2.6 |

+4–6% |

| 2027 |

€2.8 |

+6–8% |

| 2028 |

€3.0 |

+7–9% (market maturity and innovation) |

Key Drivers

- Underpenetrated emerging markets, driven by increasing diabetes prevalence and improving healthcare infrastructure.

- Evolving clinical guidelines favoring long-acting insulin analogs.

- Digital health integration improving adherence, reducing wastage, and expanding patient segments.

Risks and Challenges

- Potential accelerated uptake of biosimilar insulin glargine products.

- Pricing pressures from health authorities and insurance providers.

- Regulatory hurdles limiting the approval of next-generation formulations.

- Market saturation in developed regions.

Strategic Implications

Sanofi should continue investing in device innovations, digital therapeutics, and strategic partnerships to defend market share. Emphasizing clinical evidence, patient safety, and affordability will be vital in retaining their position amidst biosimilar competition. Diversification into combination therapies (e.g., insulin plus GLP-1 receptor agonists) offers additional growth pathways.

Key Takeaways

- Market Size: The global insulin market, valued at approximately €34 billion in 2022, is expected to grow at a CAGR of ~7%, driven by rising diabetes prevalence, especially in emerging economies.

- Competitor Dynamics: Biosimilar insulin glargine products are primary threats, exerting downward pricing pressure but also expanding overall market size.

- Sales Outlook: LANTUS SOLOSTAR’s sales are projected to stabilize around €2.2–€3 billion over the next five years, with moderate growth fueled significantly by emerging markets and device innovation.

- Strategic Focus: To sustain growth, Sanofi must leverage digital health, foster early market access, and engage in strategic biosimilar partnerships.

- Risks to Watch: Rapid biosimilar adoption, pricing reforms, and regulatory delays could significantly impact future revenue streams.

FAQs

1. How does biosimilar entry affect LANTUS SOLOSTAR sales?

Biosimilar insulin glargine products typically compete on price, leading to substantial reductions in sales volume and pricing for originator brands like LANTUS. The extent of impact depends on regulatory acceptance, market penetration strategies, and regional healthcare policies.

2. What are the main growth drivers for LANTUS SOLOSTAR?

Key drivers include increasing global diabetes prevalence, particularly type 2, expansion into emerging markets, innovations in delivery devices, and enhancements in patient adherence through digital health solutions.

3. How are healthcare policy reforms influencing LANTUS sales?

Reforms favoring cost containment and promoting biosimilar substitution in markets like Europe and the U.S. are reducing originator insulin sales. Conversely, increased access and reimbursement improvements in emerging economies support growth.

4. What role does device innovation play in future sales?

Next-generation pen devices, integration with digital health platforms, and user-friendly interfaces will improve adherence and broaden patient base, thus aiding sales resilience despite competitive pressures.

5. Will LANTUS SOLOSTAR be replaced by newer insulin formulations?

While newer ultra-long-acting insulins like Tresiba offer some advantages, LANTUS’s established safety profile and market familiarity will sustain its relevance, especially in regions where cost and device familiarity are priorities.

References

- World Health Organization. Diabetes fact sheet, 2022.

- Sanofi Annual Report, 2014.

- Sanofi Financials Overview, 2020.