Last updated: July 29, 2025

Introduction

Labetalol is a combined alpha- and beta-adrenergic antagonist primarily used in the management of hypertension, hypertensive emergencies, and certain cardiovascular conditions. Its distinctive pharmacological profile positions it as a critical agent within antihypertensive therapy, especially beneficial for patients with pregnancy-induced hypertension and those requiring combined blockade to mitigate sympathetic nervous system overactivity. This comprehensive market analysis delves into current indications, competitive landscape, regulatory environment, and sales forecasting to inform stakeholders about its future trajectory.

Pharmacological Profile and Therapeutic Indications

Labetalol uniquely offers non-selective beta-adrenergic blockade coupled with selective alpha-1 antagonism, leading to decreased peripheral vascular resistance while preserving cardiac output. Its utility spans:

- Chronic hypertension management

- Hypertensive crises and emergencies

- Pregnancy-induced hypertension (pre-eclampsia and eclampsia management)

- Certain cardioprotective applications, such as in ischemic heart disease

The drug’s dual mechanism reduces tachycardia often associated with beta-blockers alone, presenting a significant clinical advantage.

Current Market Landscape

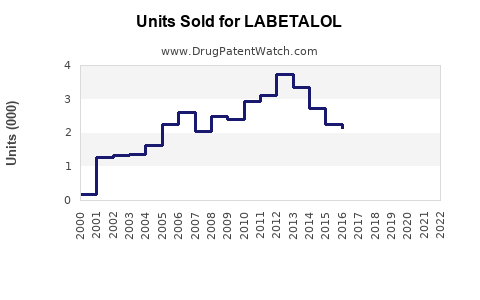

Market Size and Demand Drivers

The global antihypertensive drug market was valued at approximately USD 27 billion in 2022, with projected compound annual growth rate (CAGR) estimates of 3-5% over the next five years [1]. Labetalol, while not as volumetrically dominant as agents like amlodipine or lisinopril, maintains a steady niche owing to its specific indications.

In particular, its critical role in pregnancy-associated hypertension influences demand, especially in regions with high maternal hypertension prevalence. As hypertension prevalence escalates globally, driven by aging populations and lifestyle factors, the demand for combination therapies like labetalol is expected to steadily increase.

Market Penetration and Regional Dynamics

- United States: Labetalol is widely prescribed, especially for hypertensive emergencies and obstetric hypertension, with about 20% of hypertensive emergency treatments utilizing this agent [2]. Its prescription is supported by guidelines from the American College of Cardiology and the American Heart Association.

- Europe: Similar utilization patterns are observed, with national guidelines endorsing labetalol as first-line therapy for hypertensive crises.

- Emerging Markets: Growing healthcare infrastructure and hypertension burden in Asia-Pacific and Latin America drive increased demand, though access and affordability remain hurdles.

Pricing and Competitive Position

Labetalol is available as oral tablets and intravenous formulations. Being off-patent and generic in many regions, pricing competitiveness is high. Cost advantages position labetalol favorably against newer, patent-protected agents with similar efficacy but higher costs.

Competitive Landscape

Key competitors include:

- Other beta-blockers: Metoprolol, atenolol

- Alpha-blockers: Prazosin

- Combined agents: Carvedilol, nebivolol (which share similar indications but different pharmacokinetic profiles)

- Calcium channel blockers and ACE inhibitors: As first-line agents, indirectly influence the demand for labetalol in certain contexts.

Labetalol's niche dominates where combined alpha- and beta-blockade is specifically required, limiting its use as a first-line monotherapy for uncomplicated hypertension.

Regulatory Environment and Market Access

Labetalol’s approval status is consistent across major markets:

- United States: Approved in 1974 by the FDA.

- Europe: Approved under the European Medicines Agency (EMA).

- Japan and Others: Regulatory approvals are aligned with international standards.

While patent protections have expired, leading to poolings of generic manufacturers, regulatory adherence, and reimbursement policies significantly influence market share and sales.

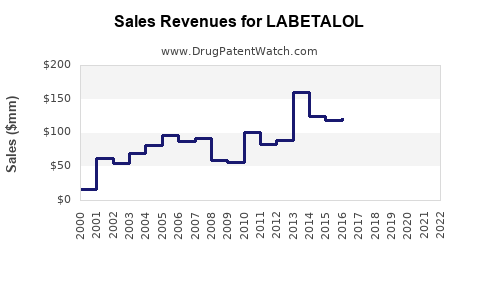

Sales Projections (2023–2028)

Methodology

Forecasting integrates historical sales data, growth trends, regional dynamics, regulatory factors, and clinical guideline shifts. Assumptions include steady pipeline approval processes, increased regional adoption, and consistent generic pricing.

Projection Summary

| Year |

Estimated Global Sales (USD Millions) |

CAGR |

Comments |

| 2023 |

150 |

— |

Base year; stable demand in key markets |

| 2024 |

157.5 |

5% |

Increased adoption in emerging markets |

| 2025 |

165.4 |

5% |

Growing hypertension prevalence globally |

| 2026 |

173.7 |

5% |

Expanded use in hypertensive emergencies |

| 2027 |

182.4 |

5% |

Uptake in obstetric hypertension cases |

| 2028 |

191.5 |

5% |

Potential new regional markets unlocked |

Key drivers include:

- Rising hypertension prevalence worldwide.

- Expanded acceptance of labetalol for hypertensive emergencies and obstetric hypertension.

- Growing healthcare infrastructure in emerging markets.

- Cost competitiveness of generics.

Risks and uncertainties:

- Closure of regulatory pathways slowing adoption.

- Competition from newer, targeted therapies.

- Shifts in clinical guidelines favoring alternative agents.

Future Opportunities and Market Trends

Innovations and Formulation Improvements

Developing extended-release formulations or combination therapies integrating labetalol could expand indications and improve adherence. Additionally, developing routes that enhance bioavailability or reduce side effects could enhance competitive advantages.

Regulatory Approvals and Expanded Indications

Seeking approval for new indications, such as in perioperative hypertension or combination dosing with diuretics, could diversify markets.

Digital and Personalized Medicine Integration

Tailoring labetalol use based on genetic profiling and patient-specific factors may optimize efficacy and safety, fostering higher adoption rates.

Key Challenges

- Limited market growth potential compared to blockbuster antihypertensives.

- Entry of biosimilar and generic competitors reducing margins.

- Regional regulatory and reimbursement barriers.

- Clinical inertia favoring established first-line agents.

Key Takeaways

-

Steady Market Presence: Labetalol remains a vital agent for specific hypertension indications, especially hypertensive emergencies and pregnancy-related hypertension, ensuring a consistent demand base.

-

Regional Growth Opportunities: Emerging markets exhibit significant growth potential due to increasing hypertension prevalence and expanding healthcare access.

-

Pricing and Competition: As a generic, labetalol maintains a cost advantage; strategic pricing and formulations could amplify its market share.

-

Innovation and Indication Expansion: Developing novel formulations and seeking new indications can unlock additional revenue streams.

-

Regulatory and Clinical Guidelines Role: Evolving guidelines and regulatory approvals influence uptake; staying aligned with emerging standards is critical.

FAQs

1. What are the primary clinical advantages of labetalol over other antihypertensive agents?

Labetalol’s combined alpha- and beta-blockade effectively reduces peripheral resistance while preserving cardiac output, making it especially suitable for hypertensive emergencies and pregnancy-induced hypertension. Its attenuation of reflex tachycardia offers added safety benefits.

2. Which regions are expected to exhibit the highest sales growth for labetalol?

Emerging markets in Asia-Pacific and Latin America are poised for significant growth due to rising hypertension rates, improving healthcare infrastructure, and increased acceptance of labetalol for obstetric hypertension.

3. How does the patent status impact labetalol’s market prospects?

As a long-expired patent drug, labetalol’s market is dominated by generics, resulting in competitive pricing. This enhances accessibility but limits margins; innovation and indication expansion are essential for future growth.

4. Are there clinical guidelines favoring labetalol over other antihypertensives?

Yes. Leading guidelines recommend labetalol as a first-line agent in hypertensive emergencies and for hypertension during pregnancy, reinforcing its niche status.

5. What are the main challenges to increasing labetalol sales?

Challenges include market saturation in developed countries, competition from newer agents, regulatory hurdles in expanding indications, and the dominance of alternative first-line therapies.

Sources:

- Grand View Research. “Antihypertensive Drugs Market Size, Share & Trends Analysis Report,” 2022.

- American College of Cardiology/American Heart Association. "Hypertensive Emergency Management Guidelines," 2020.