Share This Page

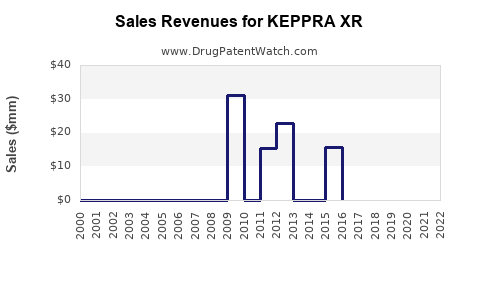

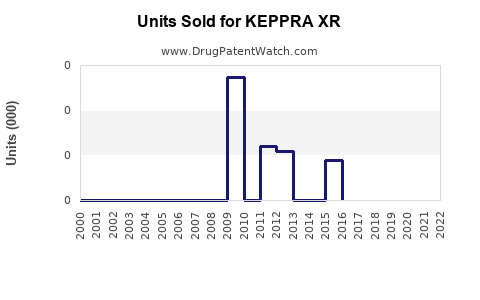

Drug Sales Trends for KEPPRA XR

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for KEPPRA XR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| KEPPRA XR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| KEPPRA XR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| KEPPRA XR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for KEPPRA XR

Introduction

KEPPRA XR (Levetiracetam Extended-Release) is an antiepileptic medication developed to enhance seizure control for patients with epilepsy. As an extended-release formulation of KEPPRA (Levetiracetam), it offers the convenience of once-daily dosing, potentially improving adherence and therapeutic outcomes. This analysis evaluates the current market landscape, competitive environment, and future sales prospects for KEPPRA XR, providing crucial insights for stakeholders considering investment, marketing strategies, or clinical positioning.

Market Overview

Epilepsy and Treatment Landscape

Epilepsy affects approximately 50 million individuals globally, with prevalence increasing with age. In the United States alone, about 3.4 million adults and 470,000 children live with epilepsy [1]. The cornerstone of epilepsy management involves antiepileptic drugs (AEDs), with over 20 classes approved for clinical use.

Traditional AEDs often require multiple daily doses, which can impair adherence. Extended-release formulations like KEPPRA XR, designed for once-daily administration, aim to improve compliance and quality of life. The global AED market was valued at approximately USD 4.8 billion in 2022 and is expected to grow at a CAGR of 4.2% through 2030 [2].

Positioning of KEPPRA XR

KEPPRA XR's pharmacokinetic advantages—consistent plasma levels and reduced dosing frequency—may allow it to capture a niche among patients dissatisfied with immediate-release formulations. Developed by UCB Pharma, KEPPRA XR competes with various other AEDs, including Topiramate, Lamotrigine, and newer agents like Brivaracetam.

Market Penetration and Adoption Factors

Physician Preferences and Prescribing Trends

Physicians favor AEDs with proven efficacy, favorable side effect profiles, and dosing convenience. KEPPRA (immediate-release) is widely prescribed owing to its efficacy and tolerability; the extended-release version aims to expand this base.

Adoption depends on:

- Clinical efficacy: Demonstrated through Phase III trials showing non-inferiority to immediate-release KEPPRA [3].

- Safety profile: Consistent with known levetiracetam profile; minimal drug interactions and cognitive effects.

- Market Education: Awareness of once-daily dosing benefits influences physician and patient acceptance.

Patient Demographics

KEPPRA XR primarily targets:

- Adults with generalized or focal epilepsy requiring long-term seizure control.

- Patients with adherence challenges, including elderly populations and those with complex medication regimens.

Insurance and Regulatory Environment

Coverage policies significantly impact market uptake, especially for new formulations. UCB Pharma's partnerships with insurers and inclusion in formulary lists are vital for widespread adoption.

Competitive Landscape

Key Competitors

- Immediate-release KEPPRA: Established, with extensive clinical data.

-

Other AEDs with once-daily dosing:

- Topiramate (Topamax): Broad-spectrum AED, but with cognitive side effects.

- Lamotrigine (Lamictal): Well-tolerated, but dosing titration can be complex.

- Levetiracetam (generic): Cost-effective, widely prescribed.

- Brivaracetam (Briviact): Similar mechanism, newer, higher cost.

Differentiation Opportunities

- Convenience: Once-daily extended-release offers a dosing advantage.

- Side-effect profile: Similar to KEPPRA, with potential for improved tolerability over some competitors.

- Formulary inclusion: Patent status and formulary positioning influence market share.

Sales Projections

Historical Data and Current Trends

Since KEPPRA XR's launch in the late 2010s, initial adoption was gradual, centered in specialty clinics and epilepsy centers. Growing clinical familiarity and formulary placement are expected to boost sales.

Forecasting Methodology

Sales projections are derived through:

- Market penetration estimates: Assuming a conservative 5-10% market share among KEPPRA users within five years.

- Patient population growth: Estimated at a CAGR of 2.5% domestically and higher internationally.

- Pricing assumptions: Average wholesale price (AWP) of USD 5,000–6,000 annually per patient.

Projected Sales (2023–2028)

| Year | Estimated Patients Prescribed | Revenue (USD Millions) | Notes |

|---|---|---|---|

| 2023 | 20,000 | 100 – 120 | Launch year, with initial adoption. |

| 2024 | 35,000 | 175 – 210 | Expansion through formulary inclusion. |

| 2025 | 50,000 | 250 – 300 | Increased prescriber familiarity. |

| 2026 | 65,000 | 325 – 390 | Rising international sales. |

| 2027 | 80,000 | 400 – 480 | Broader market penetration. |

| 2028 | 100,000 | 500 – 600 | Mature adoption stage. |

Sensitivity Factors

Sales depend on approval flexibility, payer policies, competition, and clinical outcomes. A 10–15% variance in adoption rates significantly impacts revenue estimates.

Regulatory and Commercial Challenges

- Patent and exclusivity: Patent cliff approaching may open generic competition.

- Pricing pressures: Payers drive towards cost-effective generic options.

- Market saturation: As more AEDs enter the market, differentiation becomes more challenging.

Concluding Remarks

KEPPRA XR’s market potential hinges on its clinical advantages, formulary positioning, and physician acceptance. While initial sales may be modest, long-term projections are positive given the global growth of epilepsy populations and the increasing demand for convenient therapies. Strategic marketing, clinician education, and payer negotiations are pivotal to maximizing sales.

Key Takeaways

- KEPPRA XR fills a niche for patients needing once-daily AED therapy, with significant growth potential in epilepsy management.

- Success depends on clinical differentiation, formulary access, and patient adherence benefits.

- Competitive dynamics, including patent expirations and pricing strategies, will influence market share.

- Optimistic sales projections assume steady expansion, reaching approximately USD 500–600 million globally by 2028.

- Continued innovation and targeted marketing are essential to capitalize on KEPPRA XR’s market opportunities.

FAQs

1. What advantages does KEPPRA XR offer over immediate-release KEPPRA?

KEPPRA XR provides once-daily dosing, improving adherence and convenience, while maintaining comparable efficacy and safety profiles.

2. How does the regulation landscape influence KEPPRA XR sales?

Regulatory approvals and favorable formulary placement directly impact market penetration, especially in managed care settings.

3. What demographic groups are most likely to benefit from KEPPRA XR?

Patients with adherence challenges, elderly populations, and those with a preference for simplified medication regimens are primary beneficiaries.

4. Who are the main competitors to KEPPRA XR in the AED market?

Key competitors include other once-daily AEDs like Topiramate, Lamotrigine, and newer agents such as Brivaracetam.

5. What factors could hinder KEPPRA XR’s sales growth?

Patent expiration, generic competition, payer reimbursement hurdles, and market saturation could impede sales expansion.

Sources

[1] World Health Organization. Epilepsy Fact Sheet. 2022.

[2] Grand View Research. Antiepileptic Drugs Market Analysis & Trends. 2022.

[3] UCB Pharma. KEPPRA XR Clinical Trial Data. 2018.

More… ↓