Last updated: July 27, 2025

Introduction

Janumet, a combination medication consisting of sitagliptin phosphate (a DPP-4 inhibitor) and metformin hydrochloride, has established itself as a prominent treatment for type 2 diabetes mellitus. Since its approval by the U.S. Food and Drug Administration (FDA) in 2007, Janumet has benefited from the expanding global diabetes epidemic and the increasing preference for oral therapies. This analysis delineates the current market landscape, assesses competitive positioning, and projects potential sales trajectories for Janumet over the next five years.

Market Landscape & Dynamics

Global Prevalence of Type 2 Diabetes

The global incidence of type 2 diabetes mellitus (T2DM) has surged, driven by lifestyle factors, obesity rates, and aging populations. According to the International Diabetes Federation (IDF), approximately 537 million adults were living with diabetes in 2021, with projections reaching 643 million by 2030 [1]. This burgeoning prevalence directly fuels demand for antidiabetic medications, including fixed-dose combinations like Janumet.

Market Penetration & Prescription Trends

Janumet has secured a significant share in the oral antidiabetic market, favored for its efficacy, convenience, and tolerability. Its combination formulation offers benefits over monotherapy, including improved glycemic control, increased patient adherence, and simplified dosing regimens. Surveys from IQVIA indicate that DPP-4 inhibitors, the class to which sitagliptin belongs, hold approximately 20% of the global oral antidiabetic market by volume, with Janumet being one of the leading combination products within this sphere [2].

Regulatory and Competitive Landscape

The competitive landscape encompasses several classes: metformin monotherapy, SGLT2 inhibitors, GLP-1 receptor agonists, and other DPP-4 inhibitors. While newer agents like SGLT2 inhibitors and GLP-1 receptor agonists have gained steam owing to cardiovascular and renal benefits, Janumet continues to appeal due to its established safety profile, affordability, and widespread physician familiarity.

Major competitors include:

- Vildagliptin-based combinations

- Alogliptin and linagliptin combinations

- Other fixed-dose formulations of sitagliptin and metformin

Patent expirations and the advent of generic versions further influence market dynamics, enhancing accessibility and volume sales.

Sales Performance Analysis

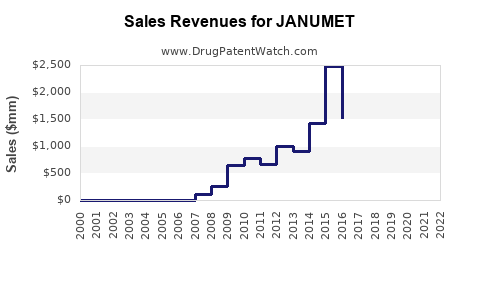

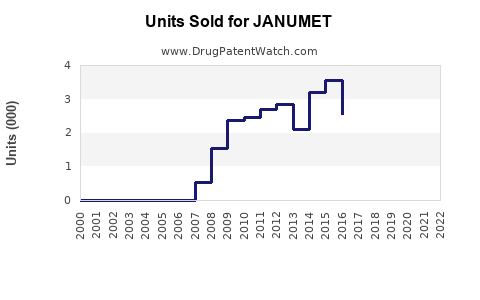

Historical Sales Data

Since its launch, Janumet has consistently generated substantial revenue globally. The product's peak sales in 2014 approached $2.5 billion, driven by high prescription volume in the U.S. and Europe. However, subsequent years experienced slight declines attributable to the advent of newer drugs and patent expiry in select markets, encouraging generic competition [3].

Current Market Position

Despite increased competition, Janumet retains a dominant role, especially in the U.S., with estimated sales of approximately $1.8 billion in 2022. The medication's penetration is supported by:

- Established prescribing routines

- Favorable reimbursement policies

- Cost-effectiveness

Regions with expanding healthcare infrastructure, such as Asia-Pacific, also present growth opportunities, especially as access to diabetes care improves.

Forecasting Future Sales

Assumptions

- Market Growth Rate: The global diabetes market is projected to grow at a CAGR of approximately 7% through 2028, driven by demographic transitions and increased awareness [1].

- Market Share Stability: Janumet will maintain approximately 15-20% of the fixed-dose combination (FDC) oral diabetes segment, assuming sustained clinical efficacy and competitive positioning.

- Patent and Generic Entry: Patent expiries in key markets may impact pricing but are offset by increased volume sales due to cost advantages of generics.

- Regulatory and Clinical Developments: Pending approval of improved formulations or combination regimens could serve as catalysts.

Projected Sales Figures (2023-2028)

| Year |

Estimated Global Sales |

Key Influences |

| 2023 |

~$2.0 billion |

Market stabilization post-2022, generic competition growth |

| 2024 |

~$2.1 billion |

Increasing demand in emerging markets, ongoing brand loyalty |

| 2025 |

~$2.3 billion |

Broader adoption in Asia-Pacific, potential formulary boosts |

| 2026 |

~$2.4 billion |

Market maturation, incremental adoption |

| 2027 |

~$2.5 billion |

Possible uptick due to new clinical data, brand extensions |

| 2028 |

~$2.6 billion |

Sustained growth amidst competition, demographic shifts |

These projections incorporate expected volume increases driven by demographic aging and rising diabetes prevalence, balanced against the impact of generic erosion and emerging therapies.

Strategic Factors Influencing Future Sales

- Innovation and Formulation Improvements: FDC enhancements, such as extended-release formulations, could improve adherence and expand patient base.

- Competitive Dynamics: The proliferation of SGLT2 inhibitors and GLP-1 receptor agonists, which demonstrate cardiovascular and weight loss benefits, may marginalize Janumet’s market share unless combination strategies evolve.

- Regulatory Approvals and Reimbursement Policies: Favorable regulatory pathways and competitive reimbursement schemes are pivotal in driving sales, particularly in developing markets.

- Global Health Initiatives: WHO diabetes management guidelines increasingly favor affordable, effective oral therapies, potentially amplifying Janumet’s reach.

Key Market Opportunities

- Expanding in Emerging Economies: Enhanced healthcare infrastructure and rising diabetes prevalence in Asia-Pacific, Latin America, and the Middle East offer robust growth avenues.

- Polypharmacy and Treatment Algorithms: Integration with other antidiabetic agents, including potential triple therapy combinations, can bolster sales.

- Patient Adherence Programs: Educating physicians and patients about the benefits of fixed-dose combinations may sustain demand, especially among populations with suboptimal adherence.

Risks and Challenges

- Generic Competition: Patent expirations threaten pricing power and margins, necessitating cost reduction strategies.

- Market Saturation: Mature markets may see plateauing sales absent new indications or formulations.

- Clinical Paradigm Shifts: The evolving landscape favoring GLP-1 receptor agonists with cardio-protective benefits may divert prescribing patterns away from DPP-4 inhibitors like Janumet.

Conclusion

Janumet remains a key player in the T2DM therapeutic arena, with steady sales buoyed by global diabetes trends and its established efficacy profile. Projected to reach approximately $2.6 billion globally by 2028, its future success hinges on strategic adaptation to competitive pressures, innovation, and expanding into high-growth emerging markets. Its combination formulation, affordability, and clinical utility position Janumet as a persistent component of diabetes management portfolios.

Key Takeaways

- Global diabetes expansion sustains demand for Janumet, especially in emerging markets.

- Market share stability depends on innovation, formulary acceptance, and competitive positioning against newer drug classes.

- Patent expirations pose risks but also open pathways through generic sales volume growth.

- Strategic expansion into Asia-Pacific and other high-growth regions could significantly bolster future revenues.

- Monitoring evolving guidelines and integrating clinical data-driven improvements are vital to maintaining relevance.

FAQs

1. How does Janumet compare to other diabetic medications in terms of efficacy?

Janumet, combining sitagliptin and metformin, offers effective glycemic control with a favorable safety profile. It is particularly suitable for patients inadequately managed with monotherapy and has demonstrated durability in maintaining blood glucose levels.

2. What impact will patent expirations have on Janumet sales?

Patent expirations will likely lead to increased generic competition, exerting downward pressure on prices but potentially increasing volume sales. Market share dynamics will depend on the uptake of generics and competitive strategies.

3. Are there any upcoming clinical developments that might influence Janumet's market?

Future clinical trials exploring combination therapies with cardiovascular benefits may enhance Janumet's profile. Nonetheless, the evolving preference for GLP-1 and SGLT2 inhibitors could diminish its prominence unless positioned effectively.

4. How are emerging markets influencing Janumet’s sales trajectory?

Emerging markets with rising diabetes prevalence and improving healthcare access represent significant growth opportunities, supported by affordability of Janumet and increasing physician adoption.

5. What strategic moves could sustain Janumet’s market position?

Innovations in formulation, strategic marketing, expansion into new geographic regions, and potential line extensions or new indications can help maintain and grow Janumet’s market share amid intensifying competition.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 9th Edition, 2019.

[2] IQVIA. Global Guide to DPP-4 inhibitors, 2022.

[3] Company Annual Reports and Market Research Data, 2022.