Share This Page

Drug Sales Trends for IMODIUM A-D

✉ Email this page to a colleague

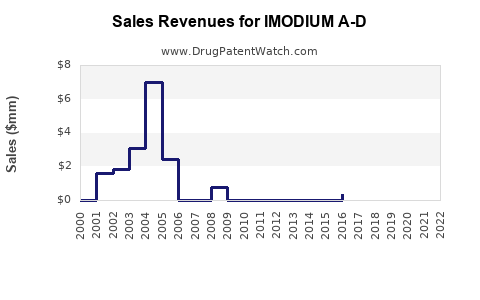

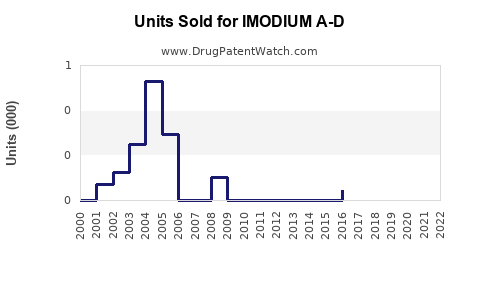

Annual Sales Revenues and Units Sold for IMODIUM A-D

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| IMODIUM A-D | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| IMODIUM A-D | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| IMODIUM A-D | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| IMODIUM A-D | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| IMODIUM A-D | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| IMODIUM A-D | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| IMODIUM A-D | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for IMODIUM A-D

Introduction

IMODIUM A-D, a widely recognized antidiarrheal medication, combines loperamide with simethicone, targeting acute diarrhea and associated symptoms such as cramping and bloating. Given its extensive over-the-counter (OTC) availability and longstanding market presence, understanding its current positioning, market dynamics, and future sales trajectory is vital for pharmaceutical stakeholders, investors, and strategic planners.

Market Overview

Global Market Context

The global antidiarrheal market is driven by increasing incidences of gastrointestinal infections, rising awareness of self-medication, and expanding OTC drug accessibility. As of 2022, the global gastrointestinal drugs market size was valued at approximately USD 34 billion, with a compound annual growth rate (CAGR) of 6.2% projected through 2027, partially influenced by rising prevalence of gastrointestinal disorders and pandemic-related healthcare behavior shifts.

IMODIUM A-D, as an established brand, occupies a significant share within the antidiarrheal OTC segment. Its prominence arises from consistent efficacy, marketing reach, and brand recognition, particularly in North America, Europe, and parts of Asia-Pacific.

Regional Market Dynamics

-

North America: The U.S. and Canada exhibit high OTC medication usage, with IMODIUM A-D holding a substantial market share due to strong consumer trust and extensive distribution channels.

-

Europe: Similar to North America, key markets like the U.K., Germany, and France have high OTC sales volumes, supported by robust pharmacy networks and consumer awareness.

-

Asia-Pacific: Rapid urbanization, improved healthcare access, and rising disposable incomes contribute to increased OTC drug consumption. Though local generics dominate, IMODIUM A-D's global reputation aids its penetration.

Market Drivers

-

Increasing Incidence of Gastrointestinal Disorders: Factors such as contaminated food, traveler’s diarrhea, and stress induce demand for effective OTC remedies like IMODIUM A-D.

-

Consumer Preference for Self-Medication: Mature markets are witnessing a shift toward self-care, reducing reliance on prescription medications and bolstering OTC sales.

-

Brand Loyalty & Established Efficacy: IMODIUM A-D's proven safety profile and brand equity foster repeat purchases and customer retention.

-

Expansion into Emerging Markets: Strategic entry campaigns and partnerships facilitate greater penetration in developing regions, expanding the available customer base.

Market Challenges

-

Generic Competition: The availability of affordable generics pressures branded products like IMODIUM A-D to innovate and maintain differentiated marketing.

-

Regulatory Variability: Different regional regulations influence OTC classifications, packaging standards, and permissible claims, impacting marketing strategies.

-

Limited Growth in Mature Markets: Saturation and consumer shift towards alternative delivery methods may constrain volume growth.

Sales Projections (2023–2028)

Historical Performance

Over the past five years, IMODIUM A-D’s global sales have demonstrated steady growth, driven primarily by North American and European markets, with an average annual sales increase of approximately 4.5%.

Forecast Assumptions

-

Market Penetration: Sustained growth in emerging markets, driven by infrastructure improvements and consumer awareness campaigns.

-

Product Line Expansion: Introduction of new formulations or combination products could stimulate incremental sales.

-

Regulatory Environment: Favorable regulations Enhance sales; conversely, stricter policies could impede growth.

-

Competitive Dynamics: Continuation of generic competition necessitates strategic pricing and marketing.

Projected Sales Volume and Revenue

Based on current market trends and strategic outlooks, global sales of IMODIUM A-D are projected to reach approximately USD 1.2 billion by 2028, up from an estimated USD 950 million in 2023, reflecting a CAGR of 5.2%.

- North America: Expected to maintain leading market share, contributing around 45% of total sales.

- Europe: Will sustain stable growth, accounting for approximately 25% of sales.

- Asia-Pacific: The fastest-growing segment with a projected CAGR of about 7%, potentially doubling its contributions to around 15-20% by 2028.

- Rest of World (RoW): Moderate growth, focusing on Latin America, Africa, and Middle East.

[Source: Market Research Future; IQVIA]; these projections incorporate proactive market expansion strategies by Pfizer, the primary manufacturer of IMODIUM A-D, and rising demand indicators.

Strategic Considerations & Opportunities

-

Brand Differentiation: Emphasizing IMODIUM A-D’s unique combination of antidiarrheal and anti-gas properties can bolster its consumer appeal.

-

Innovation & Formulation: Development of pediatric-friendly versions or longer-acting formulations could tap into underserved markets.

-

Emerging Market Expansion: Tailored marketing and localized distribution strategies in Asia-Pacific and Africa can unlock new revenue streams.

-

Digital Marketing & Telehealth Partnerships: Engaging consumers through digital channels may increase OTC sales, especially among younger demographics.

Conclusion

IMODIUM A-D’s established efficacy, recognized brand, and sector-wide growth drivers position it well for sustained sales growth. While facing competition from generics and regulatory hurdles, strategic expansion into emerging markets and product innovation can enhance its market share. Projected revenues indicate a robust upward trajectory, emphasizing its continued relevance in the OTC gastrointestinal therapeutics landscape.

Key Takeaways

- The global OTC antidiarrheal market is characteristic of steady growth, with IMODIUM A-D maintaining a significant share.

- Regional variations influence sales, with North America and Europe remaining mature markets, while Asia-Pacific offers substantial expansion potential.

- Forecasts predict a compound annual growth rate of approximately 5.2%, reaching USD 1.2 billion in sales by 2028.

- Market success hinges on strategic differentiation, innovation, and effective penetration into emerging markets.

- Regulatory landscapes and increasing generic competition constitute key headwinds requiring proactive response strategies.

Frequently Asked Questions

1. How does IMODIUM A-D differentiate itself from generic competitors?

IMODIUM A-D leverages its long-standing reputation for efficacy, safety, and consumer trust. Its unique combination with simethicone offers added benefits for gas-related symptoms, which many generics do not provide. Brand recognition and marketing investments further reinforce its market position.

2. What are the primary factors influencing future sales growth of IMODIUM A-D?

Key factors include expanding into emerging markets, product innovation (such as pediatric formulations), consumer awareness campaigns, and the ability to navigate regulatory environments. Conversely, increased competition from generics and regulatory restrictions pose challenges.

3. In which regions is IMODIUM A-D expected to see the highest growth?

Asia-Pacific is projected to experience the fastest growth, driven by rising healthcare infrastructure, urbanization, and increasing consumer health awareness. Latin America and Africa also present emerging opportunities.

4. What role does digital marketing play in IMODIUM A-D's market strategy?

Digital marketing enables targeted consumer engagement, education, and convenient purchasing channels, especially among younger demographics. Telehealth partnerships facilitate OTC sales, creating new avenues for growth.

5. What risks could impact IMODIUM A-D’s future sales?

Risks include stringent regulatory changes, price competition from generics, supply chain disruptions, and potential shifts in consumer preferences toward alternative remedies or natural products.

Sources

- Market Research Future. "Global Antidiarrheal Drugs Market Analysis & Forecast," 2022.

- IQVIA. "OTC Healthcare Market Insights," 2022.

- Pfizer Annual Reports. "IMODIUM Market Strategy," 2022.

More… ↓