Share This Page

Drug Sales Trends for HYDROXYCHLOROQUINE SULFATE

✉ Email this page to a colleague

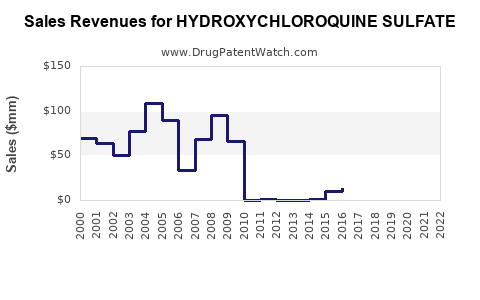

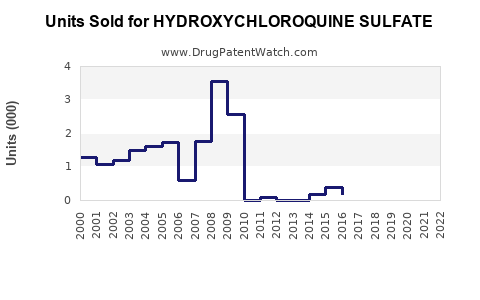

Annual Sales Revenues and Units Sold for HYDROXYCHLOROQUINE SULFATE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| HYDROXYCHLOROQUINE SULFATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| HYDROXYCHLOROQUINE SULFATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| HYDROXYCHLOROQUINE SULFATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| HYDROXYCHLOROQUINE SULFATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| HYDROXYCHLOROQUINE SULFATE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Hydroxychloroquine Sulfate

Introduction

Hydroxychloroquine sulfate, an antimalarial drug with immunomodulatory properties, gained significant global attention during the COVID-19 pandemic as a potential therapeutic option. Although initial enthusiasm waned due to mixed clinical trial outcomes, the drug maintains a substantial role within the treatment paradigms for autoimmune diseases such as rheumatoid arthritis and lupus erythematosus. This analysis explores the current market landscape, competitive dynamics, regulatory outlook, and future sales projections for hydroxychloroquine sulfate, offering strategic insights for pharmaceutical stakeholders.

Market Overview

Historical Context and Market Drivers

Hydroxychloroquine sulfate has been on the market for decades, primarily branded as Plaquenil by Sanofi. Its core markets include autoimmune disease treatment, with an emerging segment in infectious diseases and investigational uses related to viral illnesses.

Despite its long-standing presence, the COVID-19 pandemic significantly amplified demand initially, driven by hypotheses of antiviral efficacy. This surge was transient; global regulatory authorities, including the FDA, subsequently revoked emergency use authorizations due to inconsistent efficacy results and safety concerns [1].

Key market drivers now include:

- Chronic autoimmune disease management: Established as a first-line or adjunct therapy for rheumatoid arthritis and lupus.

- Regulatory stability and safety profile: Recognized safety approvals foster ongoing clinical use.

- Emerging research: Ongoing studies exploring additional therapeutic indications.

Market Size and Segments

Pre-pandemic, the global hydroxychloroquine sulfate market was valued approximately at USD 300 million in 2019, with expectations of steady CAGR (Compound Annual Growth Rate). The autoimmune segment dominates, comprising over 80% of sales, with regional variations influenced by healthcare infrastructure, prescribing practices, and regulatory approvals.

Pandemic-related demand in 2020-2021 temporarily inflated market size, with some estimates suggesting a market spike to USD 600-800 million, but this was largely a behavioral anomaly driven by controversy rather than sustained demand. The market is now stabilizing, with a focus on core indications.

Competitive Landscape

Key Players

- Sanofi: Manufacturer of Plaquenil, dominates the market with a well-established brand.

- Teva Pharmaceuticals: Offers generic formulations, widening access due to cost competitiveness.

- Mylan/Natco: Active in Asian and North American markets, providing generic options.

- Others: Several regional players and emerging manufacturers expanding manufacturing capacities.

Pricing Dynamics

Generic competition has driven prices downward, with significant price elasticity observed, especially in markets with high generic penetration. The branded drug commands premium pricing where brand loyalty persists or regulatory restrictions limit generics.

Regulatory Environment

Safety warnings concerning retinopathy, cardiac arrhythmias, and off-label misuse have led to tighter regulatory oversight, impacting prescribing and distribution channels. The drug’s approval status varies across countries, influencing geographic market potential.

Regulatory and Ethical Considerations

In the wake of initial COVID-19 advocacy, regulatory agencies globally have issued warnings over unapproved use. However, regulatory approval remains intact for primary indications. Ethical concerns surrounding off-label use and safety profiles shape market access and prescribing practices.

Sales Projections

Near-Term Outlook (2023–2025)

The immediate future of hydroxychloroquine sulfate hinges on several factors:

- Autoimmune Disease Market Stability: Continued adherence to established treatment protocols forecasts stable demand.

- Regulatory Clarity: Regulatory agencies’ positions on off-label COVID-19 use are unlikely to support resurgence in demand.

- Pricing Trends: Generic proliferation will sustain low prices, supporting accessibility but capping revenue growth.

- Research Initiatives: Ongoing clinical trials exploring novel indications may open new avenues, though these are at preliminary stages.

Based on current data, the global sales are projected to hover around USD 300 million annually, with slight fluctuations depending on regional dynamics and patent expiration schedules.

Long-Term Outlook (2026–2030)

A sustained, stable market for autoimmune diseases is expected, with incremental growth driven by:

- Expanding indications: Investigational use in viral, oncological, and dermatological conditions may mitigate patent expiration impacts.

- Market expansion in emerging markets: Growing healthcare infrastructure and disease awareness support increased prescribing.

- Patent expirations and generics: While generics dominate, insights into manufacturing efficiencies could slightly improve profit margins.

With these considerations, sales are projected to grow modestly at a CAGR of 3–4%, reaching approximately USD 400–500 million by 2030.

Potential Disruptors

- Newer therapeutic agents: Biologic and small-molecule drugs with superior efficacy may displace hydroxychloroquine in certain indications.

- Regulatory bans or safety recalls: Increased safety concerns could lead to market restrictions, affecting sales.

- Emerging evidence: Positive trial results in new indications could stimulate demand, while adverse findings could erode market confidence.

Strategic Opportunities

- Invest in clinical research: Supporting trials in novel indications can diversify the revenue base.

- Market expansion in developing countries: Leveraging price competitiveness can improve market penetration.

- Regulatory navigation: Proactively engaging with health authorities can facilitate smoother approval pathways.

- Lifecycle management: Developing combination therapies or new formulations may extend product relevance.

Risks and Challenges

- Safety concerns and alerts: Heightened scrutiny and potential adverse event reports could impair demand.

- Market saturation: High penetration in autoimmune markets limits growth opportunities.

- Pricing pressures: Intense generic competition constrains profit margins.

- Innovation gap: Lagging behind newer drugs could diminish market share over time.

Key Takeaways

- Hydroxychloroquine sulfate remains a stable, albeit mature, market primarily driven by autoimmune disease management.

- The post-pandemic demand landscape is characterized by normalization, with sales stabilized around USD 300 million annually.

- Future growth hinges on expanding therapeutic indications, emerging markets, and ongoing clinical research.

- Competition from generics ensures affordable pricing but caps profit margins.

- Regulatory oversight and safety profiles will continue to influence market access and prescribing behavior.

Conclusion

While hydroxychloroquine sulfate’s market prospects are primarily anchored in its established indications, strategic positioning in emerging therapeutic areas and markets offers incremental growth opportunities. Navigating regulatory frameworks and safety considerations remains critical. Providers and investors should focus on innovation, regional expansion, and clinical evidence to sustain competitiveness in this mature landscape.

FAQs

1. Is hydroxychloroquine sulfate still a viable treatment for autoimmune diseases?

Yes. It remains a first-line therapy for conditions like rheumatoid arthritis and lupus, with stable demand driven by its established efficacy and safety profile.

2. How did COVID-19 impact the hydroxychloroquine sulfate market?

The pandemic caused a temporary surge in demand, peaking in 2020-2021, followed by a rapid decline after clinical trials questioned its efficacy and safety for COVID-19.

3. What are the main regulatory challenges facing hydroxychloroquine manufacturers?

Regulatory concerns focus on safety warnings regarding retinal toxicity and cardiac arrhythmias, as well as restrictions on off-label COVID-19 use, impacting distribution and prescribing patterns.

4. What future therapeutic indications could drive growth for hydroxychloroquine?

Research into its potential benefits in viral infections, dermatological conditions, and certain cancers could open new markets, though these are still in investigational phases.

5. How does generic competition influence the market?

The widespread availability of generics has driven prices down, limiting revenue growth but ensuring broad healthcare access.

Sources:

[1] U.S. Food and Drug Administration. "FDA Revises Emergency Use Authorization for Hydroxychloroquine and Chloroquine," 2020.

More… ↓