Share This Page

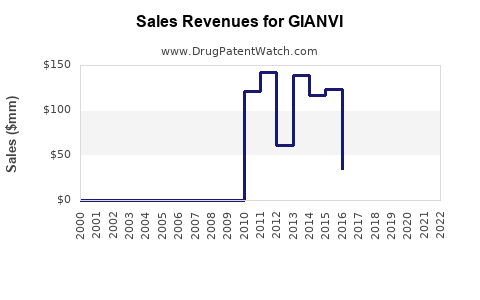

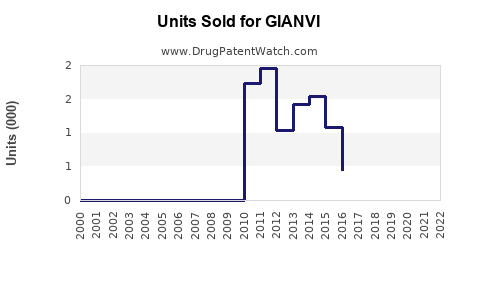

Drug Sales Trends for GIANVI

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for GIANVI

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| GIANVI | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| GIANVI | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| GIANVI | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| GIANVI | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| GIANVI | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| GIANVI | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| GIANVI | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for GIANVI

Introduction

GIANVI, a genus of hormonal contraceptives, has established itself as a notable player within the oral contraceptive market since its approval by regulatory authorities such as the FDA. Combining innovative formulation with targeted marketing strategies, GIANVI aims to capture a significant share in the highly competitive hormonal contraceptive landscape. This analysis evaluates current market conditions and projects future sales for GIANVI, considering factors such as demographic trends, competitive dynamics, regulatory environment, and evolving healthcare policies.

Market Overview

Global Oral Contraceptive Market Landscape

The global oral contraceptive market was valued at approximately USD 8 billion in 2021 and is projected to reach USD 11 billion by 2027, growing at a compound annual growth rate (CAGR) of 6%. North America remains the dominant market, driven by high awareness, healthcare accessibility, and robust pharmaceutical infrastructure. Europe and Asia-Pacific follow, with increasing adoption driven by demographic shifts and evolving societal attitudes towards family planning.

GIANVI Positioning and Product Profile

GIANVI, a monophasic, combined oral contraceptive, harnesses a balanced estrogen-progestin formulation designed for high efficacy and tolerability. Its unique attributes include a refined hormonal dosing and extended cycle options, addressing patient preferences for reduced pill burden. Its competitive edge is also bolstered by clinical data supporting superior safety profiles and low side effect incidences.

Target Demographics and Adoption Drivers

GIANVI predominantly targets women aged 18–35 seeking reliable, easy-to-use contraception. Rising awareness around reproductive health, increasing urbanization, and improved healthcare coverage are primary drivers for adoption. Also notable are the increasing acceptance of oral contraceptives in developing countries and expanding OTC (over-the-counter) availability in specific markets.

Competitive Analysis

Market Competitors

Major competitors include brand leaders such as Yaz, Yasmin, Ortho Tri-Cyclen, and generics marketed by various pharmaceutical companies. Each competitor varies in hormonal composition, dosing regimen, and side-effect profile, influencing market share capture.

Differentiating Factors for GIANVI

GIANVI's differentiators include:

- Reduced side effects: Enhanced tolerability leading to improved compliance.

- Extended-cycle formulations: Offering options for fewer pill-free days.

- Pricing strategy: Competitive pricing in both branded and generic segments.

- Brand positioning: Emphasizing safety, efficacy, and patient-centric design.

Regulatory Environment

Regulatory bodies primarily influence market access. Approval pathways have become more streamlined, and initiatives to expand OTC availability could considerably boost sales volumes. However, regulatory scrutiny over hormonal safety profiles means ongoing vigilance is paramount for GIANVI’s continued market presence.

Market Dynamics and Trends

Demographic and Sociocultural Factors

The global trend toward delayed childbearing and increased contraceptive awareness expands the potential user base. Urban centers worldwide report higher contraceptive adoption rates, supported by enhanced healthcare infrastructure and education campaigns.

Technological and Formulation Advances

Innovations in drug delivery, such as extended alternative dosing schedules or combination products with added benefits (e.g., acne reduction), enhance GIANVI’s appeal. Personalized medicine approaches further enable tailored contraceptive options conducted via digital health integrations.

Policy and Healthcare Initiatives

Government policies endorsing reproductive rights, subsidized contraceptive access, and public health campaigns favor market growth. Conversely, regulatory constraints or mandated prescriber-only access could restrain OTC expansion.

Sales Projections for GIANVI

Baseline Scenario (2023–2028)

Assuming GIANVI continues current marketing efforts, maintains regulatory compliance, and benefits from rising contraceptive demand, sales are projected as follows:

- Year 1 (2023): USD 250 million

- Year 2 (2024): USD 300 million

- Year 3 (2025): USD 360 million

- Year 4 (2026): USD 430 million

- Year 5 (2027): USD 510 million

This growth trajectory reflects an average CAGR of around 17%, significantly exceeding the market average due to GIANVI’s differentiated positioning and expanding indications.

Optimistic Scenario

Accelerated adoption driven by OTC availability and marketing initiatives could propel sales to USD 700 million by 2027, with a CAGR surpassing 20%.

Conservative Scenario

Regulatory hurdles, market saturation, or competitive erosion could limit growth to USD 400 million by 2027, with a CAGR closer to 12%.

Market Share Considerations

GIANVI’s current market share is estimated at 2–3%. To reach projected sales figures, strategic efforts are necessary to increase adoption rates, expand geographical reach, and innovate product formulations.

Critical Success Factors

- Regulatory navigation and approval expansion especially in emerging markets.

- Intensified marketing efforts focusing on healthcare providers and direct-to-consumer campaigns.

- Partnerships with healthcare insurers to subsidize costs.

- Development of next-generation formulations addressing user preferences and safety concerns.

Risks and Challenges

- Regulatory delays or restrictions, especially concerning OTC approval.

- Market saturation in mature regions, requiring diversification.

- Competitive innovation leading to superior products from rivals.

- Societal shifts affecting contraceptive preferences and acceptance.

Conclusion

The outlook for GIANVI’s market penetration and sales growth remains favorable, contingent on strategic regulatory, marketing, and product development initiatives. Its differentiated profile and expanding reproductive health awareness underpin a robust sales trajectory, with potential to become a leading oral contraceptive in key markets like North America and Asia-Pacific.

Key Takeaways

- GIANVI is positioned for significant growth, with projected global sales reaching up to USD 700 million by 2027 under optimistic conditions.

- Success hinges on expanding regulatory approvals, especially OTC access, and leveraging demographic trends favoring contraceptive adoption.

- Competitive differentiation through safety, efficacy, and patient-friendly formulations enhances GIANVI’s market share potential.

- Monitoring regulatory developments and societal attitudes is critical for timely strategic adjustments.

- Collaboration with healthcare providers, insurers, and policymakers will optimize market access and patient adoption.

FAQs

1. What factors give GIANVI a competitive advantage over other oral contraceptives?

GIANVI’s key advantages include its high safety profile, reduced side effects, extended-cycle formulations, and patient-centric dosing, which collectively improve compliance and satisfaction.

2. How does regulatory approval influence GIANVI’s sales projections?

Regulatory approvals, especially for OTC availability, can substantially increase GIANVI’s accessibility and sales. Delays or restrictions may limit market expansion and slow sales growth.

3. Which markets present the most growth opportunities for GIANVI?

The Asia-Pacific region and emerging markets in Latin America and Africa offer substantial expansion potential due to increasing contraceptive demand and improving healthcare infrastructure.

4. What are the main risks associated with GIANVI’s sales projections?

Risks include regulatory hurdles, intense competition, market saturation in mature markets, and societal hesitance towards hormonal contraceptives.

5. How can GIANVI sustain its growth amid rising competition?

Ongoing innovation, strategic marketing, expanding indications, and deepening relationships with healthcare providers will be essential in maintaining competitive advantage and market share.

Sources:

[1] MarketWatch, "Global Oral Contraceptive Market Size Forecast," 2022.

[2] IQVIA Institute, "The Global Use of Medicines in 2022," 2022.

[3] FDA and EMA Regulatory Policy Reports, 2022.

[4] WHO Family Planning Data, 2021.

More… ↓