Last updated: July 29, 2025

Introduction

Gemfibrozil, a lipid-lowering agent primarily used to treat hypertriglyceridemia and reduce cardiovascular risk, remains an established component in the management of dyslipidemia. Since its approval in the 1980s, gemfibrozil has maintained a significant role in cardiovascular disease (CVD) prevention, though evolving therapeutic options and market dynamics influence its demand trajectory. This report provides an in-depth market analysis and sales forecast for gemfibrozil, assessing factors shaping its commercial landscape and projecting future sales over the next five years.

Market Overview

Therapeutic Profile and Clinical Positioning

Gemfibrozil, belonging to the fibrate class, functions by activating peroxisome proliferator-activated receptor-alpha (PPAR-α), leading to decreased triglycerides, increased HDL cholesterol, and modest LDL reduction. Its efficacy in managing severe hypertriglyceridemia and preventing pancreatitis is well-established, with broader use in cardiovascular risk mitigation.

Global Market Size

The global market for lipid-modifying agents was valued at approximately USD 45 billion in 2022, with fibrates accounting for an estimated USD 2-3 billion, including gemfibrozil and alternative fibrates like fenofibrate. The market's growth is driven by increasing prevalence of dyslipidemia and cardiovascular diseases, particularly in aging populations of North America, Europe, and Asia-Pacific.

Competitive Landscape

Gemfibrozil's patent has long expired, resulting in generic availability and competitive pressure from other fibrates and newer agents such as PCSK9 inhibitors. While fenofibrate often competes directly, gemfibrozil's lower cost maintains utility in specific markets, especially regions where healthcare affordability constrains access to newer drugs.

Market Dynamics and Key Drivers

Prevalence of Dyslipidemia and Cardiovascular Diseases

The rising incidence of cardiovascular disease, fueled by lifestyle factors such as obesity, sedentary behavior, and poor diet, sustains the demand for lipid-modifying therapies. Globally, the World Health Organization (WHO) reports that cardiovascular diseases account for approximately 17.9 million deaths annually, underpinning the therapeutic need for agents like gemfibrozil.

Guideline Recommendations and Physician Preferences

Despite increasing preference for statins, guidelines continue to endorse fibrates for patients with mixed dyslipidemia, especially with elevated triglycerides. Clinician familiarity and cost-effectiveness favor gemfibrozil in certain markets, maintaining its relevance.

Regulatory and Patent Landscape

Generic market entry has led to price erosion, constraining revenue potential. However, regulatory stability and widespread approval in emerging markets sustain ongoing sales.

Market Challenges

- Competition from fenofibrate, which has demonstrated superior bioavailability and tolerability.

- The emergence of novel therapies and combination agents.

- Limited differentiation, as generic status dilutes pricing power.

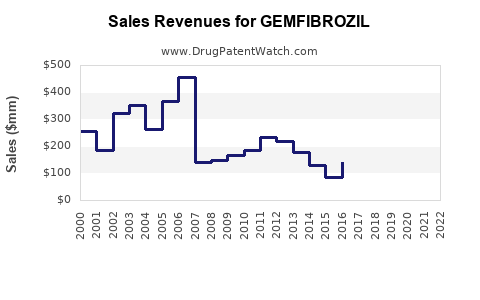

Sales Projections (2023–2028)

Assumptions

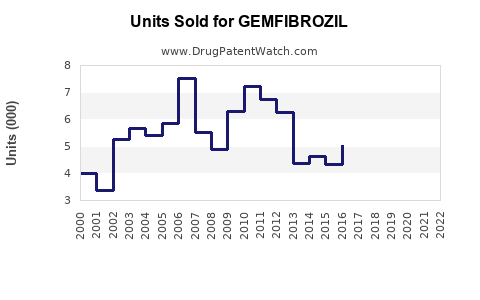

- Market volume remains stable or slightly declines due to generics and competition.

- Pricing declines by approximately 5-8% annually, reflecting generic price erosion.

- Rising dyslipidemia prevalence sustains baseline demand.

- Emerging markets contribute increased sales due to expanding healthcare access.

Forecast Summary

| Year |

Estimated Global Sales (USD millions) |

Growth Rate |

Remarks |

| 2023 |

USD 120 |

— |

Base year, considering stable demand with price erosion |

| 2024 |

USD 112–116 |

–5% to –8% |

Price decline accelerates as patent expiry effects persist |

| 2025 |

USD 105–110 |

similar |

Market saturation and competitive pressure remain |

| 2026 |

USD 98–105 |

similar |

Increased penetration in emerging markets |

| 2027 |

USD 92–98 |

similar |

Marginal decline due to competition |

| 2028 |

USD 86–94 |

similar |

Stabilization expected in mature markets |

Regional Breakdown

- North America: Continues to hold the largest share (~40%), primarily driven by high dyslipidemia prevalence. However, prescriber preference shifts toward fenofibrate and combination therapies temper gemfibrozil's growth.

- Europe: Similar dynamics as North America, with moderate declines owing to a mature market.

- Asia-Pacific: Exhibits potential for growth (~10-15% CAGR), driven by rising cardiovascular disease burden and expanding healthcare access.

- Latin America & Africa: Emerging markets display increased demand, benefitting from cost advantages of generics.

Implications for Stakeholders

- Pharmaceutical Manufacturers: Focus on optimizing generics manufacturing, reducing costs, and exploring combination formulations or new indications to sustain revenue.

- Investors: Expect gradual sales decline; valuation considerations should factor in generics saturation. Emerging markets' growth offers long-term upside.

- Healthcare Providers: Continue to prescribe gemfibrozil for appropriate patients, especially in cost-sensitive settings, but stay informed of evolving guidelines and newer therapies.

Regulatory and Market Entry Considerations

- Patent Landscape: Long expired, facilitating generic production.

- Regulatory Approvals: Well-established in major markets; potential for approvals in underserved regions.

- Reimbursement & Pricing: Influenced heavily by local healthcare policies; high price sensitivity favors generics.

Key Trends and Strategic Opportunities

- Market Diversification: Expanding sales in emerging markets offers growth opportunities.

- Formulation Innovations: Developing combination therapies with statins could enhance clinical benefits and market share.

- Educational Initiatives: Improving clinician awareness regarding gemfibrozil's efficacy and cost advantages can sustain demand.

- Data Generation: Supporting real-world evidence may reinforce gemfibrozil's role in dyslipidemia management.

Conclusion

Gemfibrozil's market is characterized by stability in developed markets but declining trends due to generic competition and newer therapeutic options. However, its affordability and established efficacy sustain demand, particularly in emerging economies. Strategic positioning—leveraging global market expansion and potential formulation innovations—can mitigate decline and unlock growth opportunities over the coming years.

Key Takeaways

- Gemfibrozil remains relevant in dyslipidemia therapy, especially in cost-sensitive markets.

- The global sales are projected to decline modestly, from approximately USD 120 million in 2023 to around USD 86–94 million by 2028.

- Emerging markets present growth prospects, driven by increasing cardiovascular disease burden.

- Competition from fenofibrate and novel therapies necessitates differentiation via formulation innovation and broadened indications.

- Cost-effectiveness remains the cornerstone of gemfibrozil's continued utilization.

Frequently Asked Questions (FAQs)

1. What are the primary drivers behind the declining sales of gemfibrozil?

The decline is chiefly due to generic saturation leading to price reductions, competition from newer fibrates like fenofibrate with improved pharmacokinetics, and the emergence of alternative lipid-lowering agents such as PCSK9 inhibitors.

2. How does gemfibrozil compare to fenofibrate in clinical efficacy?

Both fibrates effectively reduce triglycerides and increase HDL cholesterol, but fenofibrate often demonstrates better tolerability, bioavailability, and clinical outcomes in large trials, influencing prescriber preference.

3. Are there new indications for gemfibrozil that could boost sales?

Currently, gemfibrozil is primarily indicated for hypertriglyceridemia. Investigations into combinational therapies and potential novel indications are ongoing but have yet to impact sales significantly.

4. How will emerging markets influence gemfibrozil's future sales?

Expanding healthcare infrastructure and affordability of generics create growth opportunities in Asia, Latin America, and Africa, potentially offsetting declines in mature markets.

5. Could patent restoration or formulations revive gemfibrozil's market share?

Patent restoration is unlikely given its long patent expiry. However, innovative formulations or combinational products may enhance its clinical utility and market demand.

References

[1] World Health Organization. "Cardiovascular Diseases Fact Sheet." 2022.

[2] MarketWatch. "Global Lipid-lowering Agents Market Size & Share." 2023.

[3] U.S. Food and Drug Administration. "Gemfibrozil Drug Approval and Labeling Records." 1982.

[4] GlobalData Healthcare. "Pharmaceutical Market Trends 2022."

[5] American Heart Association. "Dyslipidemia Treatment Guidelines." 2021.