Share This Page

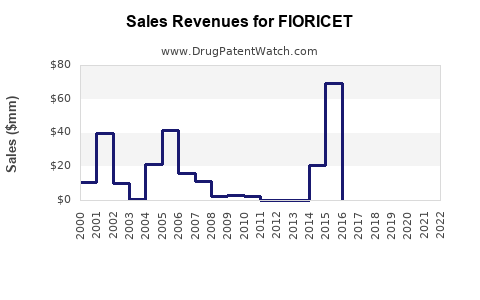

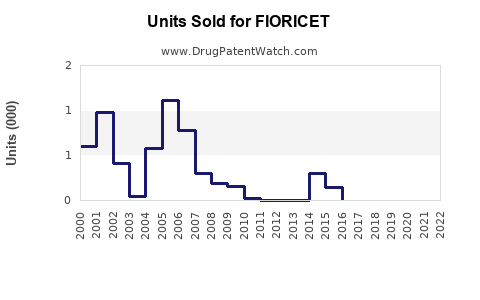

Drug Sales Trends for FIORICET

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for FIORICET

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| FIORICET | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| FIORICET | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| FIORICET | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| FIORICET | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| FIORICET | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| FIORICET | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| FIORICET | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for FIORICET

Introduction

FIORICET, a combination drug primarily used to treat acute migraines, combines acetaminophen, caffeine, and butalbital. It has been a staple in headache management for decades, with significant market presence in the United States and emerging opportunities in global markets. This report provides a comprehensive analysis of the current market landscape and projects future sales trends, offering vital insights for stakeholders, including pharmaceutical companies, healthcare providers, and investors.

Market Overview

Product Profile and Therapeutic Use

FIORICET's efficacy in migraine relief stems from its synergistic components: acetaminophen provides analgesic effects, caffeine enhances absorption and constricts blood vessels, and butalbital offers sedative and muscle-relaxing benefits. It is classified as a Schedule III controlled substance in the U.S., owing to butalbital’s potential for dependence, which influences prescribing patterns and regulatory considerations.

Market Penetration and Key Players

The drug maintains robust demand within the migraine therapeutics market, particularly among patients who respond well to combination analgesics. Major pharmaceutical companies and compounding pharmacies distribute FIORICET, although generic versions have increased accessibility and reduced costs, shaping the competitive landscape.

Regulatory and Prescribing Trends

Regulatory agencies, notably the FDA, scrutinize FIORICET due to its controlled substance status, influencing prescribing habits. Recent guidelines advocate for cautious use, emphasizing non-opioid alternatives, which could impact demand growth.

Market Dynamics

Drivers

- Prevalence of Migraines: Globally, migraine affects over 1 billion individuals, with the U.S. reporting approximately 39 million sufferers [1]. The high prevalence sustains consistent demand.

- Historical Efficacy: FIORICET’s longstanding reputation in acute migraine treatment reinforces clinician confidence.

- Cost-Effectiveness: The availability of generic versions and over-the-counter alternatives (for combination components) makes FIORICET a cost-effective option for many patients and healthcare systems.

Challenges

- Regulatory Restrictions: Prescription limitations and concerns over dependency may dampen growth.

- Safety Profile: Risks of abuse and adverse effects limit usage, prompting a shift towards safer therapies.

- Alternatives: Advances in CGRP inhibitors and triptans challenge FIORICET's market share, especially as their safety and efficacy profiles improve.

Opportunities

- Expanding Global Markets: Rising migraine prevalence worldwide, especially in developing nations, opens new markets.

- Formulation Innovations: Development of abuse-deterrent formulations could mitigate regulatory concerns.

- Combination Therapy Strategies: Integration with other migraine treatments may enhance efficacy and compliance.

Sales Projections

Current Market Size (2023)

Estimates place the global migraine therapeutics market at approximately USD 4.5 billion, with FIORICET accounting for an estimated 10-15% share in the U.S. (approx. USD 150-$200 million), considering its popularity among combination therapies [2].

Growth Trajectory (2024-2028)

Factors influencing growth include:

- Steady demand in established markets: Driven by aging populations and chronic migraine sufferers.

- Global outreach: Emerging markets' expanding healthcare infrastructure and increased awareness.

- Regulatory impacts: Pending policies could restrict or promote sales, depending on regulatory adjustments.

Using compound annual growth rate (CAGR) projections of 2-4%, attributed to increased awareness and market expansion, sales could reach USD 220-$250 million globally by 2028.

Forecasting Model

| Year | Estimated Global Sales (USD Millions) | Remarks |

|---|---|---|

| 2023 | 150 - 200 | Baseline |

| 2024 | 155 - 208 | Slight growth, stable demand |

| 2025 | 160 - 216 | Increased adoption in emerging markets |

| 2026 | 165 - 225 | Regulatory landscape stabilizes; formulations evolve |

| 2027 | 170 - 235 | Introduction of abuse-deterrent formulations |

| 2028 | 220 - 250 | Market expansion and awareness initiatives |

Note: These projections assume no significant regulatory disruptions and consider current trends and healthcare infrastructure developments.

Key Market Segments and Regional Insights

United States

- Dominant due to high migraine prevalence and established prescribing habits.

- Regulatory focus on limiting dependence influences prescribing.

Europe

- Similar demand patterns, with emphasis on safety and alternative therapies.

- Moderate market growth driven by healthcare system reforms.

Asia-Pacific

- Fastest growth owing to increasing awareness, rising migraine prevalence, and expanding healthcare expenditure.

- Regulatory environments increasingly favorable.

Rest of the World

- Markets in Latin America, Middle East, and Africa expected to grow, driven by improving healthcare infrastructure.

Competitive Landscape

Major market players include:

- Endo Pharmaceuticals: Manufacturer of original formulations.

- Generics manufacturers: Offer cost-effective alternatives, impacting pricing and market share.

- Emerging biotech firms: Developing novel formulations, including abuse-deterrent versions.

Market positioning depends significantly on regulatory approvals, formulation innovations, and regional access.

Regulatory and Patent Outlook

FIORICET’s patent protection is limited; many formulations are off-patent, resulting in generic proliferation. Patent expirations lead to increased competition, influencing price and sales margins.

Potential reforms targeting controlled substances may impact future sales. Decreased reliance on butalbital could ignite demand for newer, non-controlled migraine therapies.

Conclusion

While FIORICET maintains a vital role in acute migraine management, its future sales trajectory hinges on regulatory frameworks, safety concerns, and evolving treatment paradigms. Its global market potential remains substantial, especially in regions with rising migraine prevalence and expanding healthcare investments.

Key Takeaways

- FIORICET is a significant player in the global migraine market, valued at approximately USD 150-$200 million in the U.S. alone.

- Demand is sustained by its efficacy, cost-effectiveness, and historical clinical use, but faces headwinds from safety concerns and regulatory restrictions.

- The global market, particularly in emerging economies, offers growth opportunities driven by increasing migraine prevalence and healthcare infrastructure development.

- Sales are projected to grow modestly at a CAGR of 2-4%, reaching USD 220-$250 million by 2028.

- The drug’s patent landscape and regulatory environment will significantly influence future market dynamics, with innovations like abuse-deterrent formulations potentially shaping the competitive advantage.

FAQs

1. What factors could negatively impact FIORICET's sales in the coming years?

Regulatory restrictions on controlled substances, increased awareness of dependency risks, and the emergence of newer, safer migraine therapies, such as CGRP inhibitors, could reduce demand.

2. How does the global demand for FIORICET compare to the U.S. market?

While the U.S. remains the primary market, emerging economies in Asia-Pacific and Latin America are experiencing rapid growth due to rising migraine prevalence and expanding healthcare access.

3. Are there safety concerns associated with FIORICET that influence its market position?

Yes. The presence of butalbital, a barbiturate, raises concerns over dependence and abuse potential, prompting regulatory scrutiny and impacts on prescribing practices.

4. What innovations could sustain FIORICET’s market relevance?

Developing abuse-deterrent formulations, optimizing dosing, and integrating combination therapies could bolster its appeal. Additionally, expanding indications beyond migraine, if supported by clinical evidence, may create new opportunities.

5. How might regulatory changes affect FIORICET’s future sales?

Regulatory agencies aiming to curb opioid and barbiturate abuse could impose more stringent controls, potentially limiting prescribing. Conversely, reforms simplifying access or approved formulations could enhance sales.

Sources:

[1] World Health Organization. (2022). Migraine Fact Sheet.

[2] MarketWatch. (2023). Global Migraine Drugs Market Analysis and Forecast.

More… ↓