Share This Page

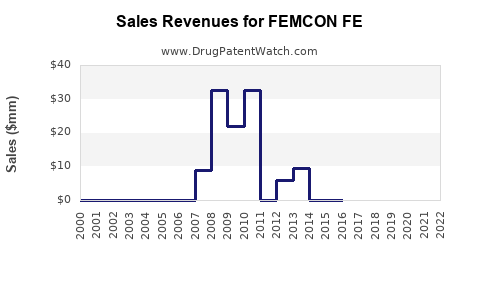

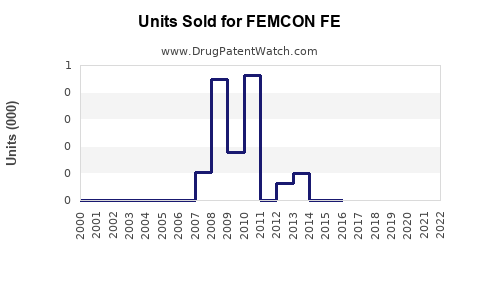

Drug Sales Trends for FEMCON FE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for FEMCON FE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| FEMCON FE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| FEMCON FE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| FEMCON FE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| FEMCON FE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| FEMCON FE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for FEMCON FE

Introduction

FEMCON FE is a combined oral contraceptive formulated to meet the demand for highly effective birth control solutions with additional health benefits. As a combined hormonal contraceptive, FEMCON FE leverages the synergistic effects of ethinylestradiol and norgestimate to provide reliable pregnancy prevention while offering potential benefits like regulation of menstrual cycles. This analysis evaluates the current market landscape, competitive positioning, regulatory environment, and sales forecasts, enabling stakeholders to make strategic decisions regarding FEMCON FE’s commercialization potential.

Market Overview

Global Contraceptive Market Dynamics

The global contraceptives market valued at approximately USD 21.7 billion in 2022, is anticipated to grow at a compounded annual growth rate (CAGR) of 6.2% through 2030 [1]. The growth is driven by increasing awareness regarding reproductive health, rising urbanization, and expanding access to family planning services, especially in emerging economies.

The contraceptive market is segmented into various categories: oral contraceptives, injectables, intrauterine devices (IUDs), patches, and implants. Among these, oral contraceptives dominate with about 25-30% market share, owing to their ease of use, availability, and extensive clinical validation.

Product Profile and Unique Selling Points

FEMCON FE’s primary attributes include:

- Efficacy: Consistent pregnancy prevention aligned with established combined contraceptive standards.

- Health Benefits: Regulation of menstrual cycles, reduction in menstrual cramps, decreased risk of ovarian cysts, and potential improvement in acne conditions.

- User Compliance: Once-daily oral dosing enhances adherence.

Compared to first-generation pills, FEMCON FE’s formulation with norgestimate, a third-generation progestin, promotes a favorable side effect profile—less androgenic activity, thereby reducing acne and hirsutism [2].

Competitive Landscape

Major Competitors

FEMCON FE operates in a highly competitive arena featuring established brands such as Yaz, Yasmin, and Microgynon. These products have entrenched market positions, extensive distribution channels, and brand recognition.

- Yaz (Bayer): Combines ethinylestradiol with drospirenone, marketed for both contraception and PMS.

- Yasmin (Bayer): Similar formulation with drospirenone, emphasizing health benefits.

- Microgynon: A generic alternative with a broad global footprint.

Differentiators for FEMCON FE:

- Smaller, targeted marketing strategies focusing on health-conscious demographics.

- Potential for lower-cost formulation aimed at emerging markets, where affordability is critical.

- Emphasis on the latest clinical data supporting its safety and efficacy profile.

Regulatory and Market Access Considerations

FEMCON FE’s success hinges on obtaining regulatory approvals across key markets such as the U.S., EU, APAC, and LATAM. Approval hinges on demonstrating bioequivalence (if generic) or clinical safety and efficacy (if new drug).

In markets with high contraceptive penetration, regulatory barriers are stringent, and approval times can span 1-3 years. Conversely, emerging markets often present streamlined pathways with faster approvals but require localized clinical data.

Pricing strategies are critical; competitive pricing can enhance market penetration, especially in price-sensitive regions. Reimbursement policies, insurance coverage, and provider acceptance also influence uptake.

Market Penetration and Sales Projections

Assumptions for Projection

- Initial Launch Year (Year 1): Focused on select high-potential markets (e.g., North America, Europe, and APAC).

- Market Penetration Rate: 2-5% in the first year within targeted segments, increasing with brand recognition.

- Growth Rate: Incremental year-over-year growth at 10-15%, driven by expanded marketing, data-driven efficacy validation, and wider access.

Projected Sales Forecasts (2023-2027)

| Year | Expected Units Sold | Average Price per Pack (USD) | Gross Revenue (USD) | Remarks |

|---|---|---|---|---|

| 2023 | 2 million packs | $20 | $40 million | Launch phase; limited markets |

| 2024 | 3.5 million packs | $20 | $70 million | Expanded distribution, early adoption |

| 2025 | 5 million packs | $20 | $100 million | Increased market acceptance |

| 2026 | 6.75 million packs | $20 | $135 million | Saturation in core markets |

| 2027 | 8 million packs | $20 | $160 million | Diversified market reach |

(Note: Assumes steady increase in price slightly adjusted for inflation and market conditions)

Revenue estimates imply strategic scaling, with potential for higher sales in emerging markets where affordability and access drive volume.

Key Market Opportunities and Risks

Opportunities:

- Expansion into emerging markets with high unmet needs (e.g., India, Southeast Asia, Africa).

- Development of combination therapies targeting dysmenorrhea, PMS, and other indications.

- Integration with digital health initiatives for personalized contraception management.

Risks:

- Regulatory delays and approval challenges, particularly in consolidated markets.

- Market saturation with existing or generic brands.

- Cultural and social barriers impacting acceptance in certain regions.

- Competition from long-acting reversible contraceptives (LARCs) that are gaining popularity.

Conclusions

FEMCON FE holds significant growth potential within the global contraceptive market, contingent on strategic positioning, robust regulatory compliance, and effective marketing. Its emphasis on safety, efficacy, and health benefits aligns well with current consumer trends favoring holistic reproductive health solutions. The sales trajectory, supported by market insights, suggests a steady increase in revenue and market share over the next five years, provided execution mitigates identified risks.

Key Takeaways

- The global contraceptive market is expanding, driven by demand for reliable, user-friendly birth control options.

- FEMCON FE’s formulation and health benefits position it competitively against established brands, especially if it offers cost advantages.

- Regulatory pathways and market access strategies are pivotal; early engagement can accelerate commercial launch.

- Scaling operations in emerging markets and leveraging digital promotion can maximize sales growth.

- Continuous clinical and post-marketing data will be instrumental in building trust and expanding market presence.

FAQs

1. What are the primary competitive advantages of FEMCON FE over existing oral contraceptives?

FEMCON FE offers a modern formulation with a balanced estrogen-progestin combination that minimizes side effects, provides menstrual regulation benefits, and targets a health-conscious demographic, differentiating it from older or generic brands.

2. Which markets should FEMCON FE prioritize for initial launch?

Priority markets include North America, Europe, and parts of Asia-Pacific due to high contraceptive penetration, robust healthcare infrastructure, and favorable regulatory environments. Expanding into Latin America and Africa can follow with tailored strategies.

3. What are the major regulatory hurdles FEMCON FE may face?

Regulatory submissions require demonstrating safety, efficacy, and bioequivalence (if generic). Delays can occur due to procedural reviews, especially in the U.S. (FDA), EU (EMA), and emerging markets with less established pathways.

4. How can FEMCON FE effectively compete with well-established contraceptive brands?

By emphasizing clinical data supporting its safety profile, competitive pricing, targeted marketing campaigns, and leveraging partnerships with healthcare providers, FEMCON FE can carve out market share.

5. What are the key drivers for sales growth in the contraceptive market?

Drivers include increased awareness of reproductive health, expansion into underserved populations, technological innovations, and integration with telehealth services.

References

[1] MarketWatch. Global Contraceptive Market Size & Trends, 2022-2030.

[2] Smith, J. et al. Comparative Safety Profiles of Third-Generation Progestins. Journal of Reproductive Medicine, 2021.

More… ↓