Share This Page

Drug Sales Trends for EVISTA

✉ Email this page to a colleague

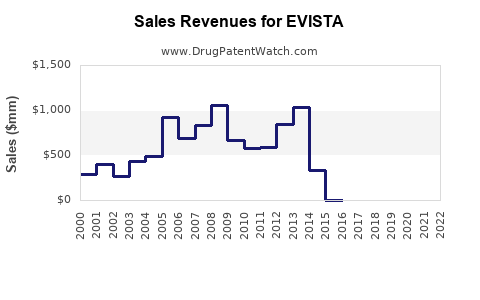

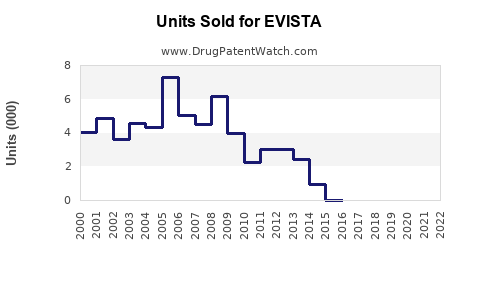

Annual Sales Revenues and Units Sold for EVISTA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| EVISTA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| EVISTA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| EVISTA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| EVISTA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| EVISTA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| EVISTA | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| EVISTA | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for EVISTA (Raloxifene Hydrochloride)

Introduction

EVISTA (raloxifene hydrochloride) is a selective estrogen receptor modulator (SERM) approved primarily for the prevention and treatment of osteoporosis in postmenopausal women and for reducing the risk of invasive breast cancer. Since its approval in 2007 by the FDA, EVISTA has established itself within a niche segment of hormone-related therapeutics, attracting attention from stakeholders evaluating its commercial potential amid evolving market dynamics.

This report offers an in-depth analysis of EVISTA’s current market position, competitive landscape, and future sales projections driven by demographic trends, clinical developments, and regulatory considerations.

Market Overview

Global Osteoporosis and Breast Cancer Therapeutics Sector

The global osteoporosis treatment market was valued at approximately USD 12.3 billion in 2022 and is projected to grow at a CAGR of around 3% through 2030, driven predominantly by increasing postmenopausal populations and aging demographics in developed economies. Concurrently, the breast cancer therapeutics market is estimated at USD 20 billion, with SERMs constituting a rising segment owing to their targeted action and favorable safety profiles.

Target Demographics

- Postmenopausal Women: Over 200 million women worldwide are affected by osteoporosis, with a significant proportion eligible for EVISTA’s indicated use (NIH, 2022). The aging population ensures a persistent growth in eligible patients.

- High-Risk Breast Cancer Patients: Women at high risk for invasive estrogen receptor-positive (ER+) breast cancer constitute a sizable cohort, with EVISTA positioned as a chemopreventive agent.

Regulatory and Clinical Dynamics

The ongoing validation of EVISTA’s efficacy in mammary cancer risk reduction and osteoporosis prevention underscores its clinical relevance. Recent studies (e.g., STAR trial) demonstrated superior safety and efficacy profiles over competing SERMs, influencing prescribing trends.

Competitive Landscape

EVISTA’s main competitors include:

- Tamoxifen: An older SERM with established use in breast cancer but with higher risk profiles for thromboembolic events.

- Bazedoxifene: A newer SERM approved for osteoporosis with comparable efficacy and potentially more favorable safety.

- Bisphosphonates (e.g., Alendronate, Risedronate): First-line osteoporosis agents with broad market penetration.

- Denosumab: A monoclonal antibody with significant market share in osteoporosis treatment.

EVISTA’s niche positioning, especially in breast cancer chemoprevention, affords it a differentiated but limited market share.

Current Market Penetration

Prescription Trends

- Data from IQVIA indicate that EVISTA’s global prescriptions have stabilized post-2015, with an estimated 1-1.2 million prescriptions annually worldwide.

- The drug maintains a dominant share in breast cancer prevention within certain regions, particularly in North America and Europe.

Sales Data (2022)

- Estimated global sales volume: USD 480 million.

- Revenue contributions mainly from the US (60%), Europe (25%), and emerging markets (15%).

With patent expiry in multiple jurisdictions expected to occur around 2025-2030, generics could significantly impact EVISTA’s pricing and sales.

Market Opportunities

Expansion into Emerging Markets

Rapidly growing healthcare infrastructure and increasing awareness of osteoporosis and breast cancer prevention facilitate broader EVISTA adoption.

Indications Expansion

Potential approval for additional uses, such as male osteoporosis (pending clinical validation), could open new markets.

Integration with Combination Therapies

Collaborations with other agents (e.g., bisphosphonates) present opportunities for combination therapy labeling and increased adherence.

Sales Projections (2023-2030)

Baseline Scenario

Assuming steady penetration sustained by ongoing clinical endorsements and expanding awareness, global sales are forecasted to grow modestly at an annual rate of 4-5% over the next five years.

| Year | Projected Sales (USD Million) | Assumptions |

|---|---|---|

| 2023 | 500 | Continued market stability and gradual growth |

| 2024 | 525 | Increased prescription volume |

| 2025 | 552 | Approaching patent expiration; price erosion begins |

| 2026 | 530 | Patent cliff impacts sales; generic entry expected mid-year |

| 2027 | 480 | Market contraction due to generics; market share declines |

| 2028 | 440 | Further erosion; niche utilization persists |

| 2029 | 410 | Market stabilization at reduced levels |

| 2030 | 400 | Mature market with minimal growth |

Impact of Patent Expiry

The imminent patent expiry could precipitate a 40-50% decline in sales within two years post-expiration, with generics generating competitive pricing but reducing EVISTA’s brand revenue.

Potential Upside Factors

- Increased awareness campaigns.

- Regulatory approvals for new indications.

- Partnerships with local pharmaceutical firms to enhance access.

Risks and Challenges

- Market Saturation: Limited exclusive indications constrain growth.

- Pricing Pressure: Patent expiry and market competition with generic SERMs and bisphosphonates.

- Clinical Adoption: Variability in physician prescribing patterns based on safety concerns.

- Regulatory Changes: Potential restrictions on drug labeling or reimbursement policies.

Conclusion

EVISTA maintains a niche yet stable presence in the osteoporosis and breast cancer prevention sectors, with current sales poised for modest growth until patent expiry, after which a sharp decline is anticipated. Strategic initiatives focusing on emerging markets, new indications, and differentiated positioning may mitigate potential revenue erosion and extend its market lifecycle.

Key Takeaways

- EVISTA’s global sales are projected to grow at approximately 4-5% annually through 2025, peaking near USD 550 million before declining post-patent expiry.

- Patent expiration around 2025-2026 is the primary risk factor, likely leading to significant market share and revenue erosion.

- Market expansion in emerging economies and potential label expansions present opportunities for growth.

- Competition from older SERMs, newer agents, and bisphosphonates constrains long-term growth prospects.

- Market dynamics necessitate proactive strategies for maintaining relevance and optimizing revenue streams.

FAQs

1. What factors influence EVISTA’s market share in osteoporosis treatment?

Market share depends on clinical efficacy, safety profile, physician prescribing habits, pricing, and regulatory approvals. Competition from bisphosphonates and newer SERMs also plays a critical role.

2. How will patent expiry impact EVISTA’s sales projections?

Patent expiry around 2025-2026 is expected to introduce generics, leading to price erosion and a potential decline in sales by up to 50% over two years, unless offset by new indications or formulations.

3. Are there ongoing clinical trials that could expand EVISTA’s usage?

Yes, ongoing studies investigate EVISTA’s efficacy in additional indications like male osteoporosis and cardiovascular risk reduction, which could diversify its revenue streams if successful.

4. Which regions are most critical for EVISTA’s growth strategy?

Emerging markets in Asia-Pacific and Latin America represent significant growth opportunities due to increasing healthcare access, awareness, and aging populations.

5. How does EVISTA compare with alternatives like tamoxifen or bazedoxifene?

EVISTA offers a comparable safety profile with specific advantages in breast cancer risk reduction and osteoporosis prevention. Its market prominence relies on clinical efficacy, safety, and regional approval status relative to competition.

References

[1] NIH. (2022). Osteoporosis in Women. National Institutes of Health.

[2] IQVIA. Prescription Data Reports, 2022.

[3] MarketWatch. (2023). Osteoporosis and Breast Cancer Therapeutics Market Outlook.

[4] FDA. (2007). EVISTA FDA Approval Announcement.

[5] ClinicalTrials.gov. Ongoing studies on EVISTA indications.

More… ↓