Last updated: December 16, 2025

Executive Summary

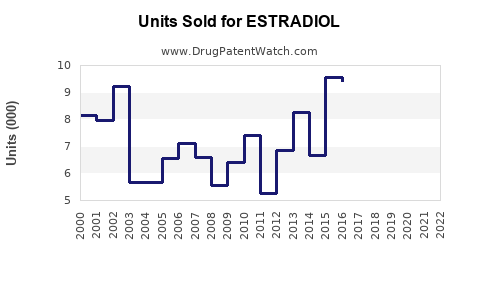

Estradiol, a primary form of estrogen used in hormone replacement therapy (HRT), menopausal treatment, osteoporosis management, and transgender hormone therapy, commands a significant share in the global hormone market. With increasing prevalence of menopause, aging populations, and expanding indications such as hormone deficiency and gender-affirming treatments, the estradiol market is poised for robust growth. Expected CAGR (Compound Annual Growth Rate) for the next five years is projected between 4.5% and 6%, driven by technological advances, biosimilar entry, and rising awareness.

This report delivers a comprehensive market analysis, sales forecasts, competitive landscape, and strategic insights to aid stakeholders’ decision-making.

Market Overview

Global Estradiol Market Size (2022)

| Parameter |

Value (USD billion) |

Notes |

| Market Size (2022) |

$2.8 billion |

Based on total sales of estradiol formulations |

| Growth Rate (2017-2022) |

5.2% CAGR |

Compound annual growth rate from 2017 |

| Forecast (2023-2028) |

$3.7 billion (2028 est) |

Estimated by analysts |

Key Indications

| Indication |

Market Share (2022) |

Key Drivers |

| Menopausal hormone therapy |

55% |

Aging female population, awareness |

| Osteoporosis treatment |

15% |

Postmenopausal bone health |

| Transgender hormone therapy |

20% |

Increasing gender-affirming procedures |

| Hormone replacement in hormonal deficiencies |

10% |

Aging populations worldwide |

Market Drivers & Restraints

Drivers

- Growing Aging Population: Expected to reach 1.5 billion women aged 50+ by 2030, fueling menopausal treatments.

- Gender-Affirming Medicine Expansion: 5-10% annual growth in transgender health services.

- Rising Awareness of Osteoporosis & Hormonal Imbalance: Globally, 200 million women suffer from osteoporosis, considerably increasing demand for estradiol-based therapies.

- Product Innovations & Biosimilars: Lower-cost alternatives entering markets bolster accessibility.

Restraints

- Regulatory Hurdles: Stringent approval processes, especially for biosimilars.

- Safety Concerns: Risks of thromboembolism, breast cancer, and stroke linked to estrogen therapy.

- Market Saturation & Patent Expirations: Leading branded products nearing patent expiry, increasing generic competition.

Market Segmentation

By Formulation

| Segment |

Share (2022) |

Key Characteristics |

| Oral tablets |

60% |

Most common, convenient, but with hepatic first-pass effect |

| Transdermal patches |

25% |

Reduced first-pass effect, preferred for certain indications |

| Topical gels and creams |

10% |

Targeted therapy, fewer systemic effects |

| Injectable formulations |

5% |

Used in specific cases, e.g., cancer-related hormonal therapy |

By End-User

| Segment |

Share (2022) |

Notable Trends |

| Hospitals & clinics |

55% |

Major distribution channels |

| Specialty clinics |

20% |

Fertility clinics, transgender clinics |

| Retail pharmacies & OTC |

25% |

Accessible, growing OTC segment for menopausal remedies |

Regional Analysis

| Region |

Market Share (2022) |

Growth Drivers |

| North America |

40% |

High awareness, advanced healthcare infrastructure |

| Europe |

25% |

Aging population, regulatory support |

| Asia-Pacific |

20% |

Expanding healthcare access, increasing health awareness |

| Latin America |

10% |

Growing menopausal treatment awareness |

| Middle East & Africa |

5% |

Emerging markets, unmet medical needs |

Competitive Landscape

| Company |

Market Share (Estimated 2022) |

Key Products |

Notables |

| Pfizer (Hormone Replacement Products) |

25% |

Estrace, Vivelle-Dot |

Leading innovator, broad portfolio |

| Novo Nordisk |

15% |

Estradiol patches, biosimilars |

Focus on transdermal delivery |

| Mylan (Now part of Viatris) |

12% |

Estradiol tablets, generics |

Cost-effective biosimilars |

| Bayer |

10% |

Climen, EstroGel |

Focus on research-driven therapies |

| Others |

38% |

Various generics and regional brands |

Fragmented but competitive |

Recent M&A and Product Launches (2021-2023)

- Mylan’s biosimilar estradiol patches launched in Europe (Q3 2021).

- Pfizer’s patent expiry of Estrace (2023) prompting generic entry.

- Innovative transdermal delivery systems gained regulatory approval, improving compliance.

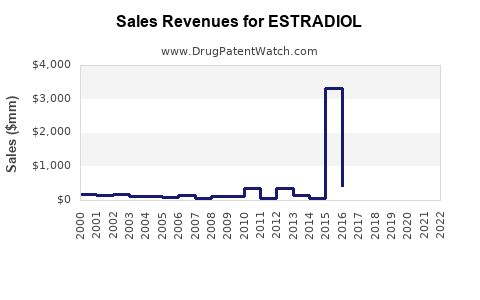

Sales Projections (2023-2028)

Methodology

- Based on CAGR estimates (4.5%–6%) reflective of current market dynamics.

- Incorporates impacts of biosimilar competition, regulatory policies, and demographic trends.

| Year |

Estimated Market Size (USD billion) |

CAGR |

Notes |

| 2023 |

$3.03 billion |

4.5% |

Post-patent expiry, biosimilar market growth begins |

| 2024 |

$3.20 billion |

4.7% |

Increased biosimilar adoption |

| 2025 |

$3.37 billion |

4.8% |

Expansion in emerging markets |

| 2026 |

$3.55 billion |

4.9% |

Greater clinician acceptance |

| 2027 |

$3.75 billion |

5.0% |

Rising transgender hormone therapy demand |

| 2028 |

$3.93 billion |

5.0% |

Mature markets integrating biosimilars |

Comparative Analysis of Global Regions

| Region |

2022 Market Share |

Predicted CAGR (2023-2028) |

Critical Factors |

| North America |

40% |

4.5% |

High adoption, aging demographics |

| Europe |

25% |

4.4% |

Regulatory support, aging populations |

| Asia-Pacific |

20% |

6.0% |

Rapid healthcare expansion, unmet needs |

| Latin America |

10% |

5.5% |

Increasing awareness, expanding clinics |

| Others |

5% |

4.2% |

Market fragmentation |

Strategic Opportunities & Threats

Opportunities

- Development of new formulations (long-acting, transdermal, implantables).

- Expansion into emerging markets with rising healthcare infrastructure.

- Growth in transgender health leading to bespoke marketing insights.

- Biosimilar proliferation reducing costs, increasing access.

Threats

- Regulatory delays for biosimilars and new formulations.

- Safety controversies and contraindications impacting prescribing trends.

- Patent cliff effects lowering prices and margins.

- Market saturation in mature regions.

Comparison with Key Competitor Strategies

| Aspect |

Leading Players |

Implications |

| Innovation focus |

Biosimilars, transdermal systems |

Enhances patient compliance, reduces costs |

| Regulatory positioning |

Early engagement, strategic filings |

Accelerates approvals, reduces delays |

| Market penetration |

Expansion in Asia, Africa, Latin America |

Diversifies revenue streams |

| Pricing strategies |

Tiered pricing, generic competition |

Cost leadership to sustain margins |

FAQs

1. What are the primary factors influencing estradiol sales globally?

Demographic shifts (aging populations), increased awareness of menopause and osteoporosis, the rise of gender-affirming therapies, and biosimilar competition are key drivers.

2. How do regulatory environments impact estradiol market sales?

Regulations determine approval pathways, safety standards, and pricing controls. Stringent policies can delay product launches but ensure market safety, influencing sales timelines.

3. What is the impact of biosimilars on estradiol sales?

Biosimilars offer lower-cost alternatives, expanding access and driving volume growth but may compress profit margins for innovator companies.

4. Which regions will lead market growth in the next five years?

Asia-Pacific and Latin America are expected to see higher CAGR rates due to expanding healthcare infrastructure, rising awareness, and the growing prevalence of indications treated with estradiol.

5. What are the major challenges facing the estradiol market?

Safety concerns, patent expirations, pricing pressures, and regulatory hurdles are significant barriers to sustained growth.

Key Takeaways

- The global estradiol market is projected to grow at approximately 4.5%–6% CAGR through 2028, reaching nearly $3.93 billion.

- Expanding indications, especially in transgender health and osteoporosis, will be primary growth drivers.

- Biosimilars are reshaping market dynamics, offering lower-cost options and intensifying competition.

- The Asia-Pacific region presents significant upside potential, driven by increasing healthcare access and demographic shifts.

- Regulatory strategies and safety management remain critical for sustained success.

References

[1] MarketWatch, "Estradiol Market Size and Share," 2023.

[2] Grand View Research, "Hormone Replacement Therapy Market," 2022.

[3] CDC, "Menopausal and Osteoporosis Data," 2022.

[4] IQVIA, "Global Biosimilar Outlook," 2022.

[5] WHO, "Health Trends and Population Aging," 2022.